MV of stocks - Book value of stockholders equity. Economic Value Added Formula The formula for calculating EVA is.

Economic Value Added Eva Definition Concept Formula Calculation Examples

Net Operating Profit After Taxes NOPAT - Invested Capital Weighted Average Cost of Capital WACC The equation above shows there are three key components to a companys EVA.

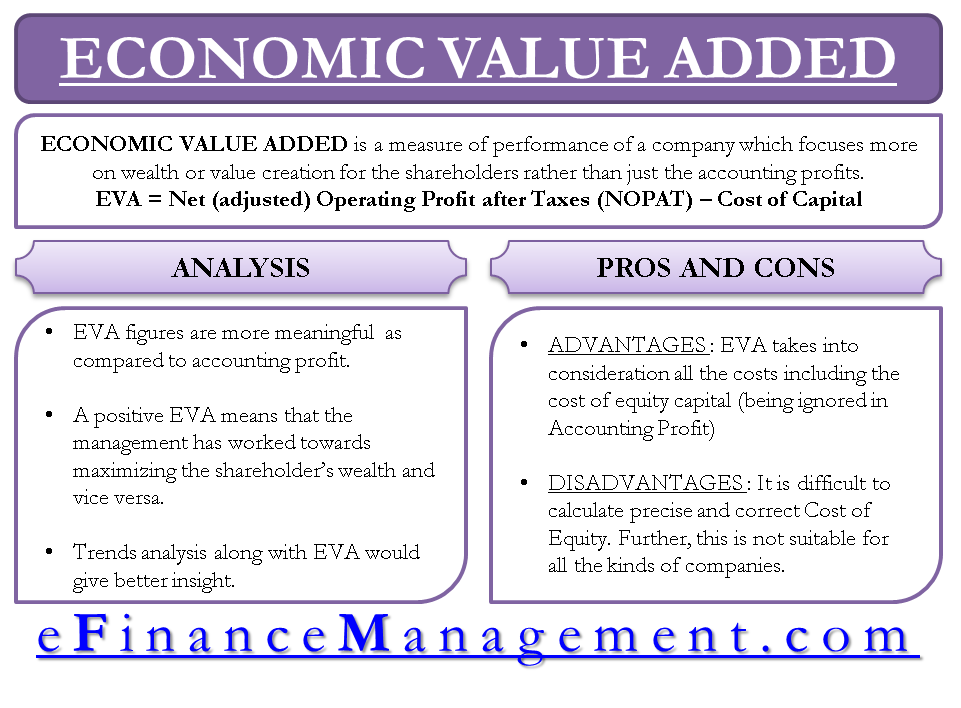

Finance eva formula. The implementation of an EVA profitability measurement system at the business unit or lower level requires methods for three critical tasks. The valuation formula of EVA formula 5 however is always equivalent to Discounted cash flow and Net present value if EVA is calculated as Stewart presents. In corporate finance as part of fundamental analysis economic value added is an estimate of a firms economic profit or the value created in excess of the required return of the companys shareholdersEVA is the net profit less the capital charge for raising the firms capital.

The formula for EVA is. 2 allocation of. The formula for economic value added is.

Economic Value Added EVA formula Net Operating Profit After Tax Capital Invested x WACC. The idea is that value is created when the return on the firms economic capital employed exceeds the cost of. According to the model of EVA a firm should also deduct the cost of equity capital from the accounting profits to arrive at a value which is the actual wealth created for the investors.

NOPAT Operating Income x 1- Tax Rate V E D WACC E V R e D V R d 1 - T EVA NOPAT - Capital Invested x WACC Where EVA Economic Value Added NOPAT Net Operating Profit After Tax WACC Weighted Average Cost of Capital T Tax Rate E Market Value of the Company Equity D Market Value of the Company Debt V Total Market Value of the Company R. Economic Value Added can be calculated with the help of the following formula. Businesses can use economic value added to assess managerial performance as it serves as a measure of value creation for shareholders.

The three main components of Economic Value Added EVA are. Net Operating Profit After Tax. EVA NOPAT WACC capital invested Properties of Economic Value Added.

The formula in computing for the market value added is. Calculate NOPAT Net Operating Profits After Taxes Gross Profits Sales - Cost of Goods Sold of 100000 less Depreciation Amortization of 85000 15000 less income taxes 30 NOPAT of 10500. As a formula EVA is NOPAT or net operating profit after taxes less a capital charge that one computes by multiplying the firms capital base by its cost of capital.

1 transfer pricing of funds. Economic value added EVA is a financial metric based on residual wealth calculated by deducting a firms cost of capital from operating profit. NOPAT the amount of capital invested and the WACC.

Thus given the adjusted taxes we can write the EVA formula as follows. Where NOPAT is net operating profit after taxes and WACC is weighted average cost of capital. EVA NOPAT - Invested Capital WACC.

EVA NOPAT capital x cost of capital. EVA NOPAT A Capital Charge. WACC ie the Weighted Average Cost of Capital.

Economic value added EVA is also referred to as economic profit. This is also known as economic profit or residual profit. EVA Net Operating Profit After Tax - Capital Invested x WACC.

Thus the above valuation formula formula 5 gives always the right estimate of value same as DCF and NPV no matter what the original book value of equity is. Economic value added EVA is a theory developed and trademarked by Stern Steward and Co. Conversely negative economic value added indicates that the value of invested capital is being destroyed.

Thus given the adjusted taxes we can write the economic value-added formula as follows. The basic formula to calculate economic value added is as follows. EVA NOPLAT WACC capital invested The properties of using EVA can be compared with other approaches in the following table.

The following example illustrates a four step approach to calculating EVA. Net investment x Actual return on investment Percentage cost of capital This calculation yields more reliable results when the targeted organization has a large asset base. The market value MV of stocks is computed by multiplying the number of outstanding shares by the market price per share.

Economic value added EVA is a measure of a companys financial performance based on the residual wealth calculated by deducting its cost of capital from its operating profit adjusted for taxes. The EVA formula is calculated using the following equation.

Economic Value Added Versus Profit Based Measures Of Performance Part 1 P5 Advanced Performance Management Acca Qualification Students Acca Global

Economic Value Added Versus Profit Based Measures Of Performance Part 1 P5 Advanced Performance Management Acca Qualification Students Acca Global

Economic Value Added Eva Youtube

Economic Value Added Eva Youtube

Economic Value Added Eva Break Down And Calculation Magnimetrics

Economic Value Added Eva Break Down And Calculation Magnimetrics

Download Contoh Soal Economic Value Added Eva Lengkap Dikdasmen

Download Contoh Soal Economic Value Added Eva Lengkap Dikdasmen

Economic Value Added Eva Case Study Nestle S A Magnimetrics

Economic Value Added Eva Case Study Nestle S A Magnimetrics

Ecofine The Economic Value Added Eva

Ecofine The Economic Value Added Eva

Pdf Economic Value Added Eva Tm A Thematic Bibliography Semantic Scholar

Pdf Economic Value Added Eva Tm A Thematic Bibliography Semantic Scholar

Economic Value Added Eva The Measure Of Real Wealth Creation

Economic Value Added Eva The Measure Of Real Wealth Creation

Diagram Of Calculation Of The Eva Numbers For The Mining Company For Download Scientific Diagram

Diagram Of Calculation Of The Eva Numbers For The Mining Company For Download Scientific Diagram

Economic Value Added Eva Formula Examples And Guide To Eva

Economic Value Added Eva Formula Examples And Guide To Eva

0 comments:

Post a Comment