How To Calculate Ke Finance

Most common representation of a dividend discount model is P 0 D 1 Ke-g. The US treasury bill T-bill is generally used as the risk free rate for calculations in the US however in finance theory the risk free rate is any investment that involves no risk.

Let S Do It In Atmospheres The Total Pressure Includes The Partial Pressure Contributions From Hydrogen Gas And From Water In 2020 Hydrogen Gas Gas Constant Pressure

Let S Do It In Atmospheres The Total Pressure Includes The Partial Pressure Contributions From Hydrogen Gas And From Water In 2020 Hydrogen Gas Gas Constant Pressure

To calculate a companys PE ratio we use the following formula.

How to calculate ke finance. How Return on Invested Capital ROIC Is Used. G future dividend growth. Assumes dividends are paid and the company has a share price.

Ke D0 1gP0 g. The value of a long forward contract with no known income and where the risk free rate is compounded on a continuous basis is given by the following equation. Ke the cost of equity shareholders required rate of return D1 dividend to be paid at the end of year 1.

Valuation of firm. Ke 00525 005. To find a financial advisor near you try our free online matching tool or call 1-888-217-4199.

Ke Equity Capitalisation Rate. 644 This Best Practice includes 1 Video File. The ROIC formula is calculated by assessing the value in the denominator total.

Ke cost of equity Kd cost of debt E market value of the firms equity D market value of the firms debt VED E-V percentage of financing that is equity D-V percentage of financing that is debt T corporate tax rate Video length. Ke 020 1005200m50m 005. Ke EBIT-I x 100 V-B.

R f Risk-free rate of return. Market Value of Debt Fair Value of Debt 3814 million. B Total debt.

The lack of debt means that there is less risk in Kuno debt holders with priority claims on the companyproject so Ku will be lower than the levered cost. S V B V EBIT Ke. Cost of Equity 750.

We have collected all the information that is needed to calculate the Weighted Average Cost of Capital. B Value of debt. F S 0 Ke -rT.

A financial advisor can help you manage your investment portfolio. ER m Expected market return. Ke 020 1054 005.

Calculate ke where the domestic and world weights wD wW respectively can be ad-hoc or represent some measure of integration say based on international trade or international investments of a country as a proportion of GDP. Use the CAPM formula to calculate the cost of equity. WACC Formula EV Ke DV Kd 1 Tax Rate.

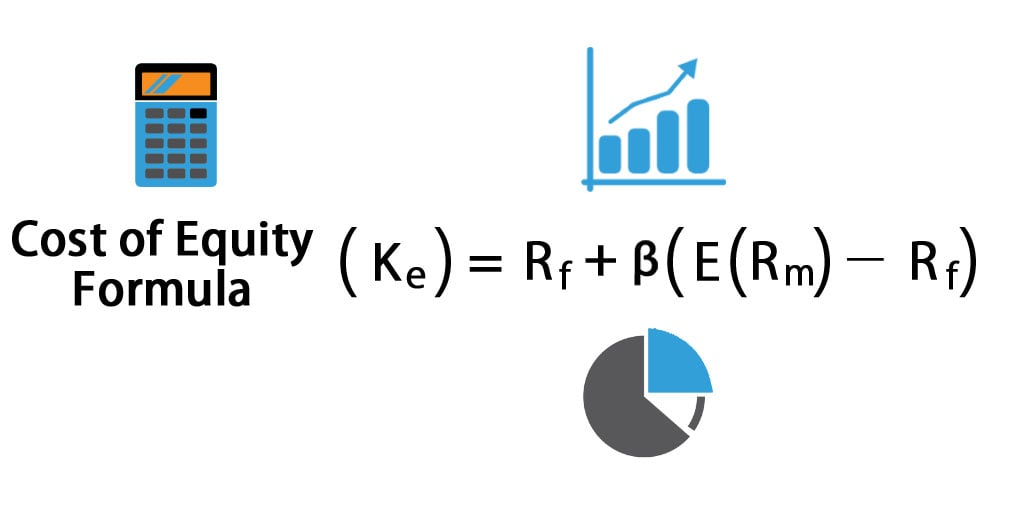

The formula for ROIC is net income - dividend debt equity. Cost of Equity is calculated using below formula Cost of Equity ke Rf β E Rm Rf Cost of Equity 267 063 596 Cost of Equity 267 37548. β i Beta of asset i.

V Value of firm. R f Risk free rate of return. Step 2 work out the value of equity Ve Ve number of shares x current share price.

D0 dividend paid. The unlevered cost of equity Ku is the cost of equity without any consideration for debt. WACC Cost of Equity of Equity Cost of Debt 1-t of Debt Cost of Preferred Stock of Preferred Stock Breaking down the Formula To appreciate the WACC calculation in its entirety it helps to understand the derivation and rationale behind its components.

D 1 Dividend for the Next Year It can also be represented as D 0 1g where D 0 is Current Year Dividend. - Partially Integrated CAPM. Cost of Debt 272.

PE Ratio Price per Share Earnings per Share textPE RatiofractextPrice per SharetextEarnings per Share PE. Or the extended formula looks like this. Ke D 1 P 0 g.

Step 1 work out the cost of equity Ke Ke d 1gPo g. So we need to calculate Ke in the following manner Cost of Equity Dividends per share for next year Current Market Value of Stock Growth rate of dividends Here it is calculated by taking dividends per share into account. Cost of equity is the rate of return an investor required for investing equity into business.

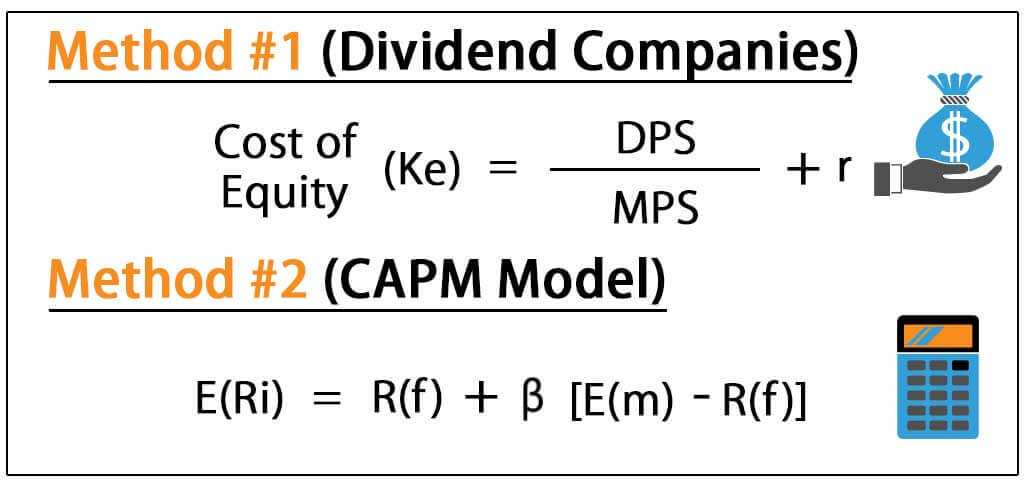

There are multiple types of cost of equity and model to calculate same they are as follows-. This formula is meant for calculating the present value of the stock when the cost of equity is known. P 0 present value of a stock.

Market Value of Equity 863198 million. ER i Expected return on asset i. Ke 0214 005.

Ke Cost of Equity. V Total value of the firm. ERP Equity Risk Premium ER m R f.

Ke wD keD 1- wD keW. WACC E-V x Ke D-V x Kd x1-T Where. S Market value of Equity.

P0 share price. Ke Cost of Equity Capital. Risk Premium of the Market.

S Value of equity. K kd BV KE SV Kd Cost of Debt. K Overall cost of capital.

Cost of Preferred Stocks kp Dividend Do Current Market Price P0 Cost of Equity. The risk premium of the market is the average return on the market minus the risk free rate. Calculate the ERP Equity Risk Premium ERP ER m R f.

Investing lets you take money youre not spending and put it to work for you. ER i R f β i ERP. Tax rate 329.

Heat Exchanger Calculation Spreadsheet Excel Format Heat Exchanger Business Template Spreadsheet

Heat Exchanger Calculation Spreadsheet Excel Format Heat Exchanger Business Template Spreadsheet

Cost Of Equity Formula How To Calculate Cost Of Equity Ke

Cost Of Equity Formula How To Calculate Cost Of Equity Ke

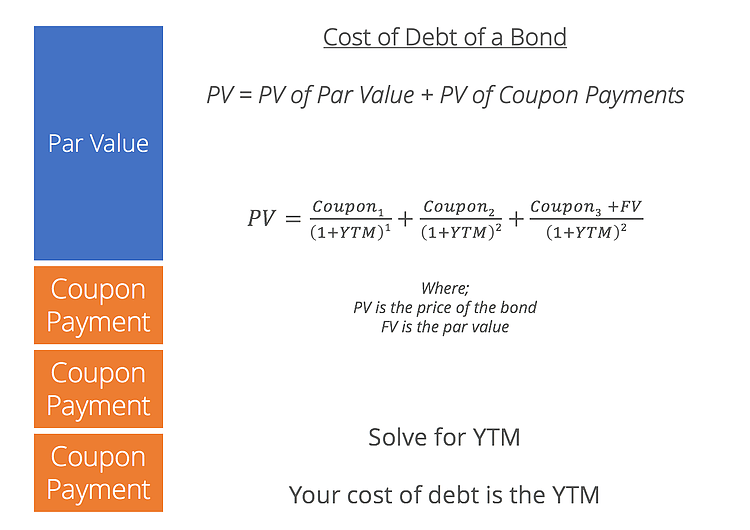

Cost Of Debt How To Calculate The Cost Of Debt For A Company

Cost Of Debt How To Calculate The Cost Of Debt For A Company

Expanding Compound Interest Equation To Find R Excel Formula Intrest Rate Compound Interest

Expanding Compound Interest Equation To Find R Excel Formula Intrest Rate Compound Interest

Effective Interest Rate Effective Yield Interest Rates Intrest Rate Rate

Effective Interest Rate Effective Yield Interest Rates Intrest Rate Rate

Cost Of Equity Formula Calculator Excel Template

Cost Of Equity Formula Calculator Excel Template

How To Calculate Your Net Salary Using Excel Salary Ads Excel

How To Calculate Your Net Salary Using Excel Salary Ads Excel

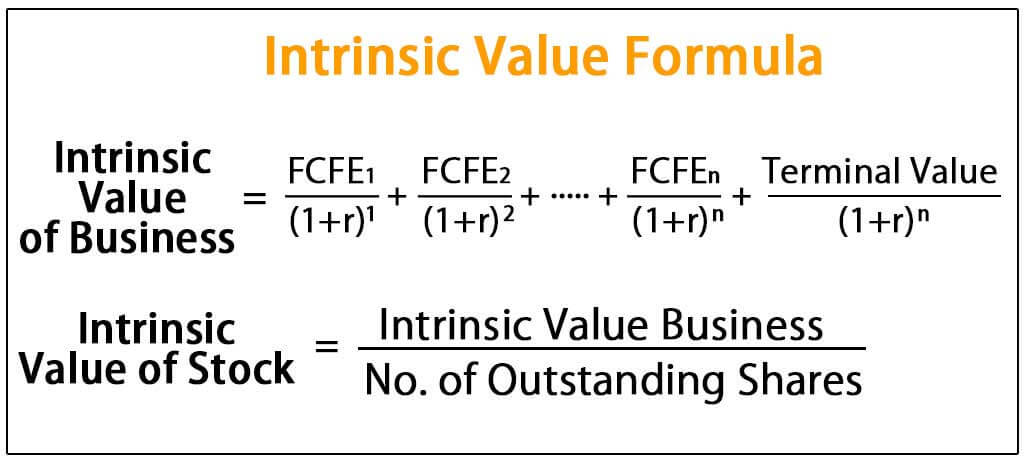

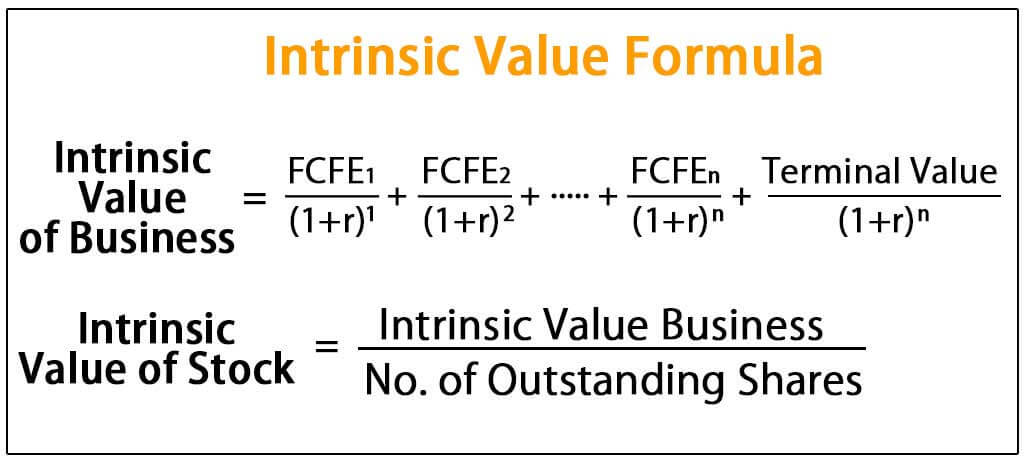

Intrinsic Value Formula Example How To Calculate Intrinsic Value

Intrinsic Value Formula Example How To Calculate Intrinsic Value

How To Calculate Kinetic Energy Kinetic Energy Kinetic 6th Grade Science

How To Calculate Kinetic Energy Kinetic Energy Kinetic 6th Grade Science

Normal Distribution Calculating Probabilities Areas Z Table Youtube Normal Distribution Probability Statistics Math

Normal Distribution Calculating Probabilities Areas Z Table Youtube Normal Distribution Probability Statistics Math

Pin Di Basic Concepts In Economic Business And Finance

Pin Di Basic Concepts In Economic Business And Finance

Post a Comment for "How To Calculate Ke Finance"