The valuation of perpetuity is different because it does not include a specified end date. Let us take the example of a financial technology start-up which is contemplating on hiring two new programmers.

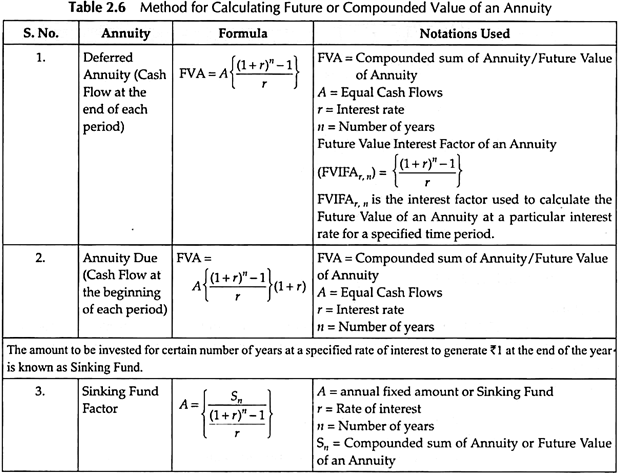

Annuity Contract For Cash Inflows Outflows Example Calculations Annuity Notations Mortgage Loans

Annuity Contract For Cash Inflows Outflows Example Calculations Annuity Notations Mortgage Loans

This is the present value per dollar received per year for 5 years at 5.

Finance formula notations. Actuarial notation is a shorthand method to allow actuaries to record mathematical formulas that deal with interest rates and life tables. The formula developed by three economistsFischer Black Myron Scholes and Robert Mertonis perhaps the worlds most well-known options pricing model. N P V 1 0 0 0 0 0 0 1 2 4 2 3 2 8 2 2 4 2 3 2 2.

Y i data value of y. The following formula to compute the expectation value is applied at each node. ȳ mean of y.

A8 is the range in which you are going to apply your formula. S refers to the spot price. Of years until a further future date n 2 No.

Download the Working File. T is the current time. Where S 1 Spot rate until a further future date S 2 Spot rate until a closer future date n 1 No.

By looking at a present value annuity factor table the annuity factor for 5 years and 5 rate is 43295. Therefore 500 can then be multiplied by 43295 to get a present value of 216475. P Fixed payment.

PV Present value of the annuity. The credit notation is based on behavioral information legal and financial informations. The formula for risk premium sometimes referred to as default risk premium is the return on an investment minus the return that would be earned on a risk free investment.

The promoter expects the programmers to increase the revenue by 25 while incurring an additional cost of 45000 in the next one year. So we translated formula notation into Excel formulas and walked through three main calculations using a simple 2-stock case in Chapter 3. You can use the formula AVERAGEA1.

The general formula for annuity valuation is. Payment behavior Age of the company Legal form of the company Age of the business relationship and evolution of orders Evolution of the turnover EBIT and net income Financial structure with the level of equity in relation to total assets. Time T refers to the time the option will expire.

That formula can be simplified to the following calculation. Financial ratio formulas Prepared by Pamela Peterson Drake 1. Of years until a closer future date.

The numbers are located from A1 to A8. PV P r. Binomial Value p Option up 1 p Option down exp r Δ t displaystyle text Binomial Value ptimes text Option up 1-ptimes text Option down times exp-rtimes Delta t or.

So S0 is the price at time 0. R Interest rate. T 0 is the time to expiry.

V k x 1 e δ k x 1 displaystyle v k_ x1e delta k_ x1 implying double force of interest. N Number of Periods. X mean of x.

Time 0 refers to the time when an options strategy is initiated. You can write it manually in the formula bar or you can select the cells by selecting them together. Finance Pre Algebra Order of Operations Factors Primes Fractions Long Arithmetic Decimals Exponents Radicals Ratios Proportions Percent Modulo Mean Median Mode Scientific Notation Arithmetics.

The risk premium is the amount that an investor would like to earn for the risk involved with a particular investment. The formula for ane can be derived as follows ane 1v vn1 1vn 1v 1vn d. P C 1 1 r-n r Where P Present value of Annuity or the lump sum amount.

Look at the below picture for getting a clear idea. R Interest rate. V k x 1 e δ k x 1 displaystyle v k_ x1e delta k_ x1 implying double force of interest.

If we want to see what is the lump sum amount which we have to pay today so that we can have stable cash flow in the future we use the below formula. C Future cash flow stream. First we calculated Portfolio Return and then Portfolio Risk starting with variance and then used portfolio standard deviation on a chart to create the visual of the Portfolio Possibilities Curve for these two stocks you saw at the outset.

Therefore the value of the perpetuity is found using the following formula. Operating cycle Inventory Inventory Number of days of inventory Average days cost of goods sold Cost of goods sold 365 Accounts receivable Accounts receivable Number of days of receivables Average days sales on credit Sales on credit 365 Accounts payable Accounts payable. N number of data values.

A8 for this calculation. E Z 2 E v k x 1 2 displaystyle E Z 2E v k_ x1 2 but often. ST is the price at time T.

Key Takeaways Covariance in Finance Covariance is known to be a statistical tool that can be used to determine the relationship between the movement of any two asset prices. Actuarial notation is a shorthand method to allow actuaries to record mathematical formulas that deal with interest rates and life. X i data value of x.

Notations in the Formula for Covariance. Cost-Benefit Analysis Formula Example 1. The notation for the formula is typically represented as F 21 which means a one-year rate two years from now.

N Total number of periods of annuity payments. Before we start lets review the key notations used in options formulas.

Solved Sub Managerial Mathematics Please Answer Them And Chegg Com

Solved Sub Managerial Mathematics Please Answer Them And Chegg Com

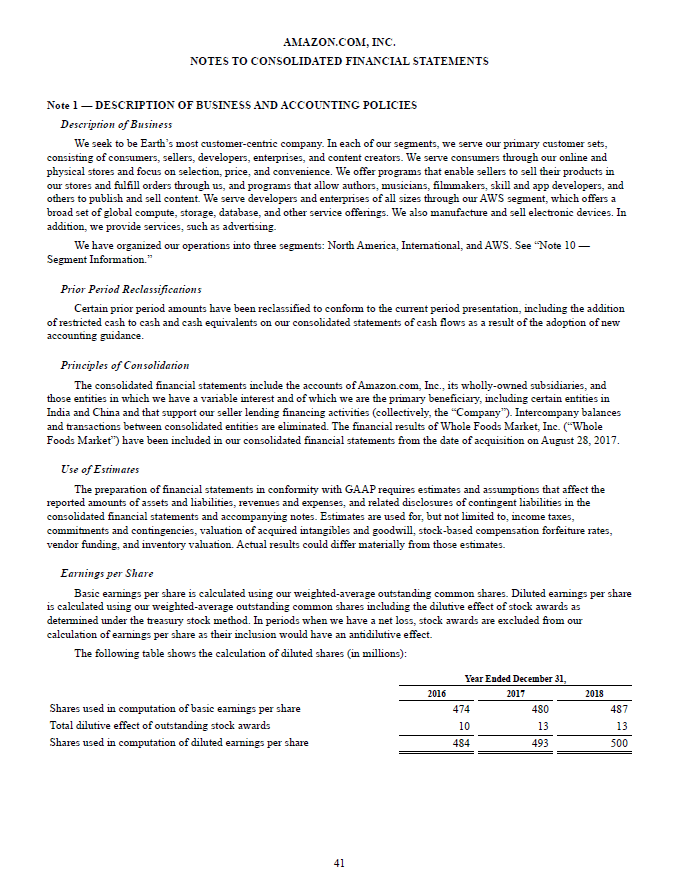

Financial Statement Notes Overview Components

Financial Statement Notes Overview Components

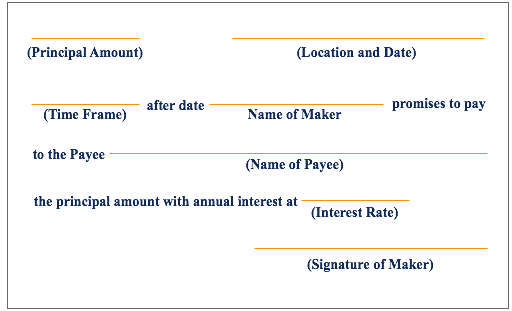

What Are Notes Receivable Examples And Step By Step Guide

What Are Notes Receivable Examples And Step By Step Guide

Reverse Polish Notation Rpn Definition Formula And Application

Reverse Polish Notation Rpn Definition Formula And Application

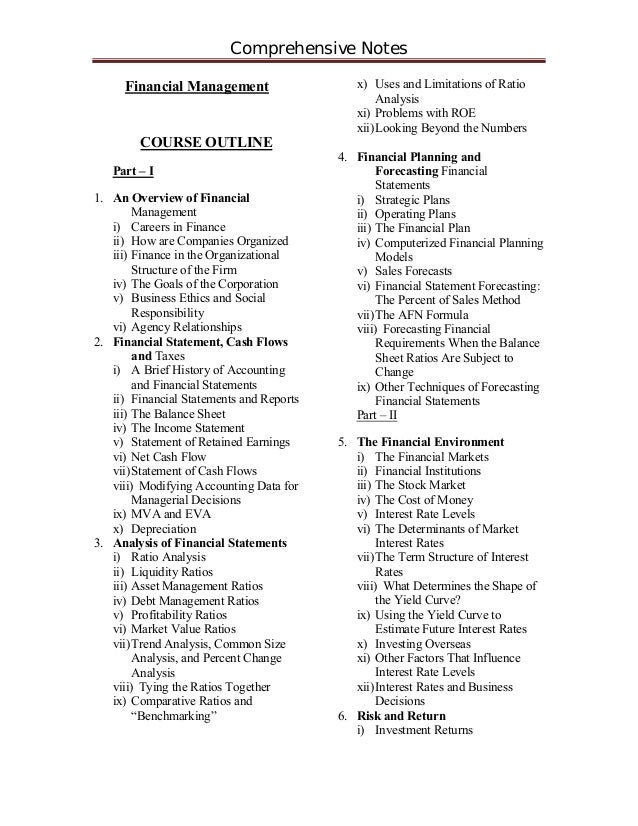

Financial Management Notes By M Riaz Khan 03139533123 1

Financial Management Notes By M Riaz Khan 03139533123 1

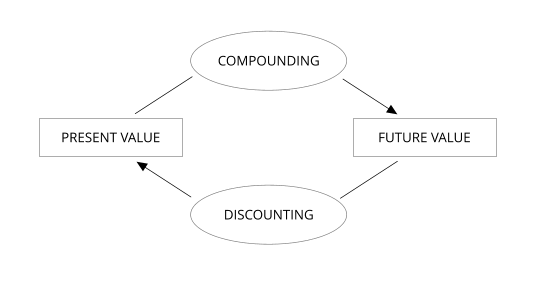

Time Value Of Money Meaning Importance Techniques Formula And Examples

Time Value Of Money Meaning Importance Techniques Formula And Examples

Pin On Business Formulas And Calculations

Pin On Business Formulas And Calculations

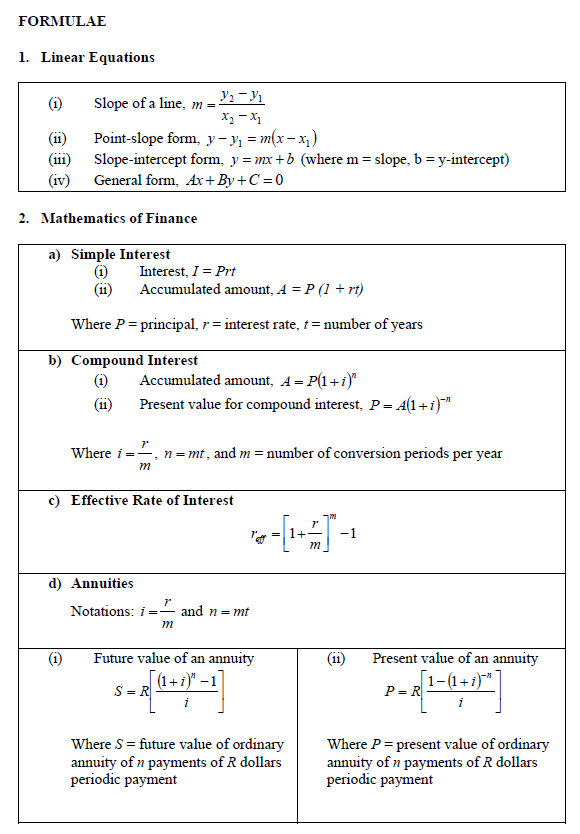

Finance Formulas Owll Massey University

Finance Formulas Owll Massey University

Simple Interest Compound Interest Continuously Compounded Interest Studying Math Math Methods Simple Interest Math

Simple Interest Compound Interest Continuously Compounded Interest Studying Math Math Methods Simple Interest Math

Google Drive Viewer Math Formulas Statistics Math Finance

Google Drive Viewer Math Formulas Statistics Math Finance

0 comments:

Post a Comment