Finance Formulas Page 3 of 3 Gross Profit EBITDA Gross Margin Sales Operating Income EBIT Operating Margin Sales Net Income Net Profit Margin Sales Debt Preferred Stock 1 Tot Capital Tot Capital Tot CapitalD cP s WACC r T r r 12 12 1. The EAR is more realistic than APR when you want to know how much interest youll pay after adjusting for the compounding of interest.

Effective Interest Rate Formula Calculator With Excel Template

Effective Interest Rate Formula Calculator With Excel Template

If it is continuous compounding formula the EAR is as follows.

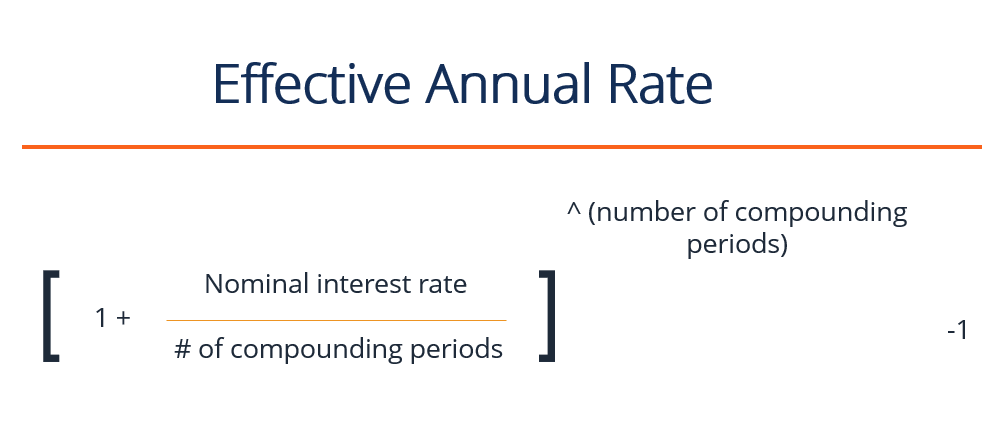

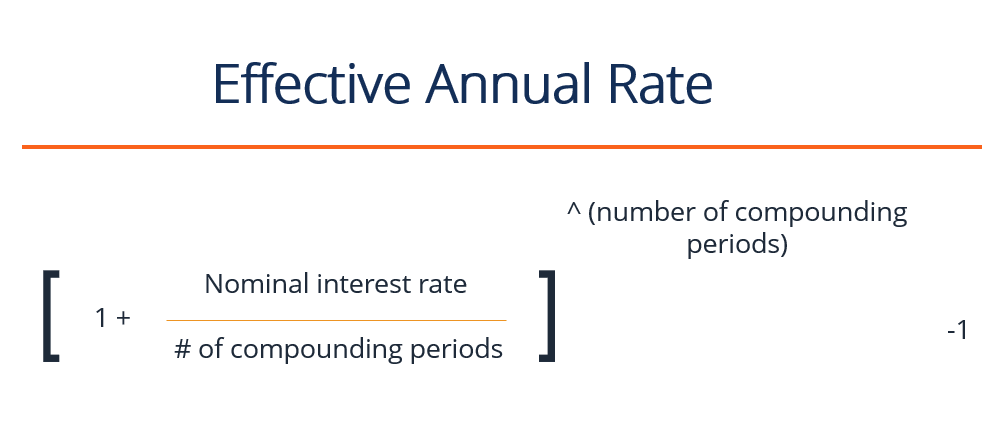

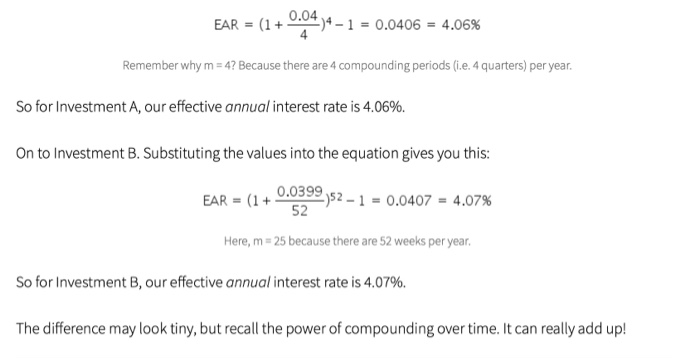

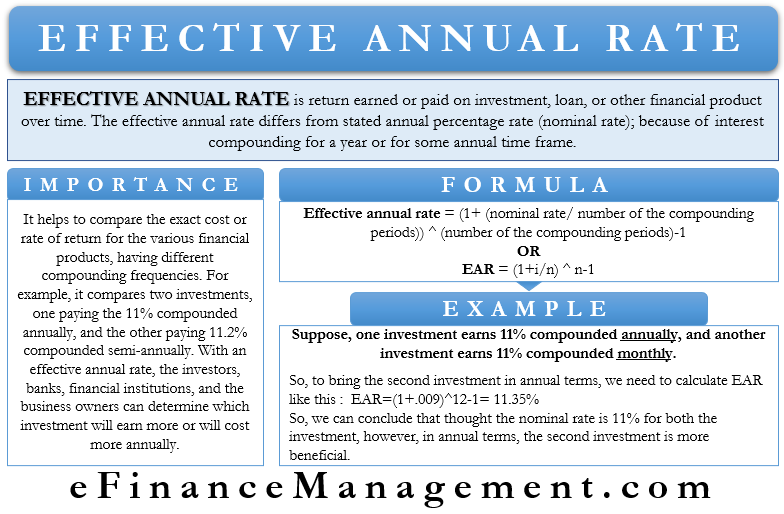

Finance ear formula. Today we will learn to calculate the actual effective annual rate EAR. Divide the quoted or stated interest rate by the number of times the interest is compounded per year n We then add one to this result and raise this result to the power of the number of times the interest is compounded per year. Effective Annual Rate 1 nominal interest rate number of compounding periods number of compounding periods 1 For example.

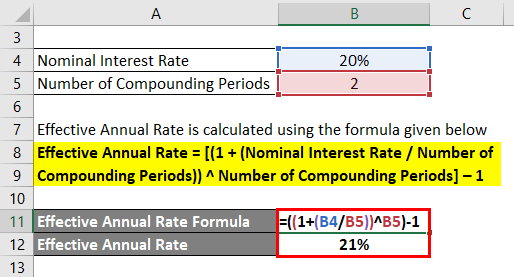

Effective Annual Rate 1 20 2 2 1. Finally we subtract one and are left with the effective annual rate. Effective Annual Rate in case of continuous compounding e i 1.

Number of compounding periods. It is used to compare the interest rates between loans with different compounding. This formula is used to check the results from EFFECT.

The answer is no. The formula for the EAR is. The effective interest rate EIR effective annual interest rate annual equivalent rate AER or simply effective rate is the interest rate on a loan or financial product restated from the nominal interest rate and expressed as the equivalent interest rate if compound interest was payable annually in arrears.

EAR calculation includes balance sheet items that are considered sensitive to changes in interest rates and generate income or expense cash flows. The formula and calculations are as follows. For determining that or for arriving before the conclusion we need to check the EAR that will give us the right indication.

Effective Annual Rate is calculated using the formula given below. In order to be smart and calculative in personal finance matters understanding the time value of money is an essential part of the learning process. EAR 1 in n 1.

Effective Annual Rate Formula i left1dfracrmrightm-1. N Compounding periods. Learn about the PMT PV FV NPER RATE SLN DB EFFECT NOMINAL NPV XNPV and the CUMIPMT functions that can make your financing tasks much.

Effective annual interest rate 1 nominal rate number of compounding periods number of compounding periods - 1 For investment A this. EAR 1 periodic ratem 1 EAR 1 periodic rate m 1 Where periodic rate stated annual rate m periodic rate stated annual rate m And m is the number of compounding periods per year. As the number of compounding periods increase the EAR increases.

The calculation of EAR is done using the above formula as Effective annual rate 1 104 4 1 103813 5 Half-yearly Compounding Since half yearly compounding therefore n 2. The generic formula for calculating EAR in Excel formula syntax is. Effective annual rate EAR is also called the effective annual interest rate or the annual equivalent rate AER.

1 i n n 1 where n stands for periods and i is the stated interest rate. I will be posting a series of computation methods related to time value of money on every Wednesday. EAR 1 periodic ratenumber of compounding periods - 1.

Compound interest or interest on interest is calculated with the compound interest formula. And for the investment compounded monthly EAR1111212-1 1157. I Stated interest rate.

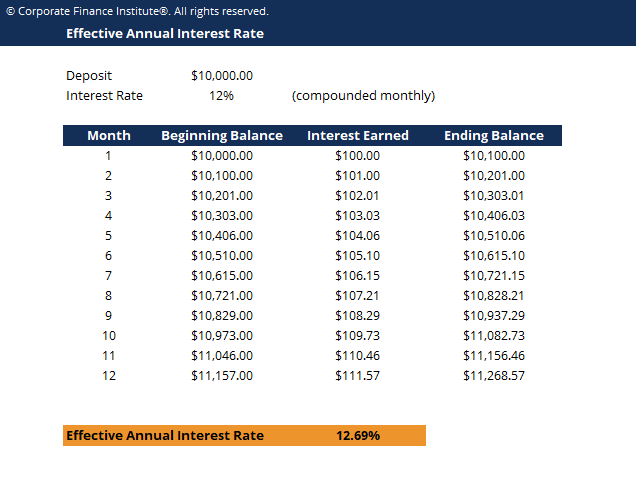

Apply the EAR Formula. The formula for compound interest is P 1 rn nt where P is the initial principal balance r is the interest rate n is the number of times interest is compounded per time period and t is the number of time periods. To calculate the effective annual interest rate of a credit card with an annual rate of 36 and interest charged monthly.

The EAR is equal to the nominal rate only if the compounding is done annually. For example a bank may have 95 confidence that. Therefore EAR 10361212 1 04257 or 4257.

By using the formula of the EAR we calculate the EAR for 11 compounded annually EAR 11111-111. In This Series learn 17 amazing Finance Tricks. Effective Annual Rate 1 Nominal Interest Rate Number of Compounding Periods Number of Compounding Periods 1.

Effective Annual Rate 21.

Effective Annual Rate Ear How To Calculate Effective Interest Rate

Effective Annual Rate Ear How To Calculate Effective Interest Rate

Effective Interest Rate Formula Excel Free Calculator Exceldemy

Effective Interest Rate Formula Excel Free Calculator Exceldemy

Effective Annual Rate Formula Calculator Examples Excel Template

Effective Annual Rate Formula Calculator Examples Excel Template

Effective Annual Rate Ear Definition Examples Interpretation

Effective Annual Rate Ear Definition Examples Interpretation

Ross Chapter 5 Discounted Cash Flow Valuation

Ross Chapter 5 Discounted Cash Flow Valuation

Effective Annual Rate Definition Formula What You Need To Know

Effective Annual Rate Definition Formula What You Need To Know

Effective Annual Rate Formula Calculations Basic Math Class Video Study Com

Effective Annual Rate Formula Calculations Basic Math Class Video Study Com

Solved Formula Effective Interest Rate Eir Effective A Chegg Com

Solved Formula Effective Interest Rate Eir Effective A Chegg Com

Effective Annual Rate Ear Formula Calculation Excel Example Efm

Effective Annual Rate Ear Formula Calculation Excel Example Efm

/Eff-Int-Rate-5c8621da46e0fb00014319d3.jpg)

0 comments:

Post a Comment