Net Income Revenue COGS Labour GA Expenses. What are the 2 ways to calculate NOPAT.

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

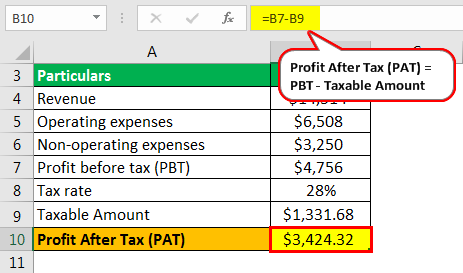

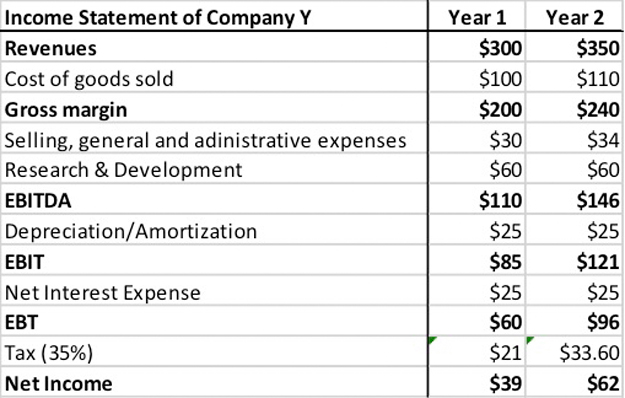

Further We need to Calculate Tax Expenses which is calculated on the Profit Before Tax.

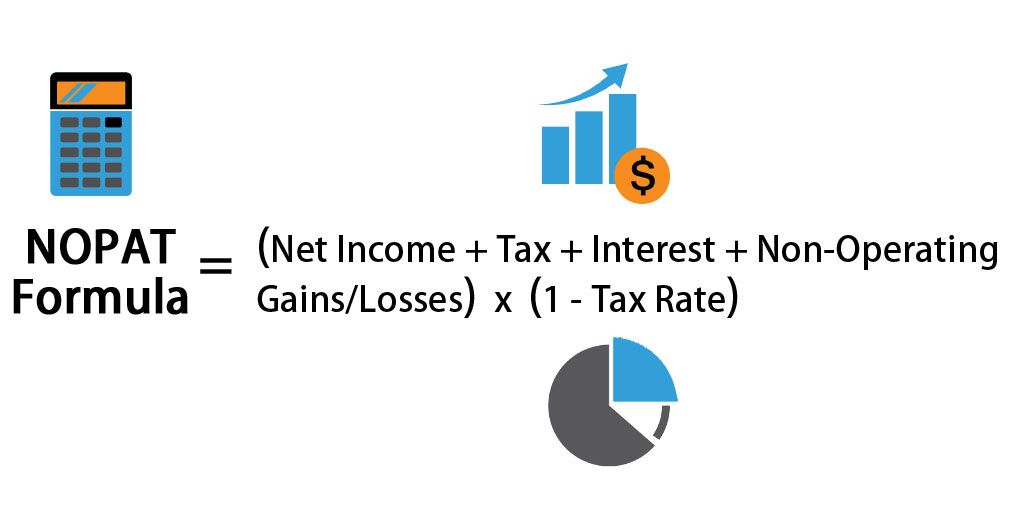

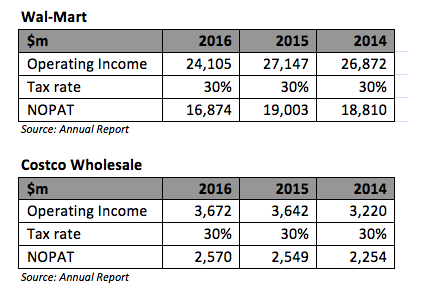

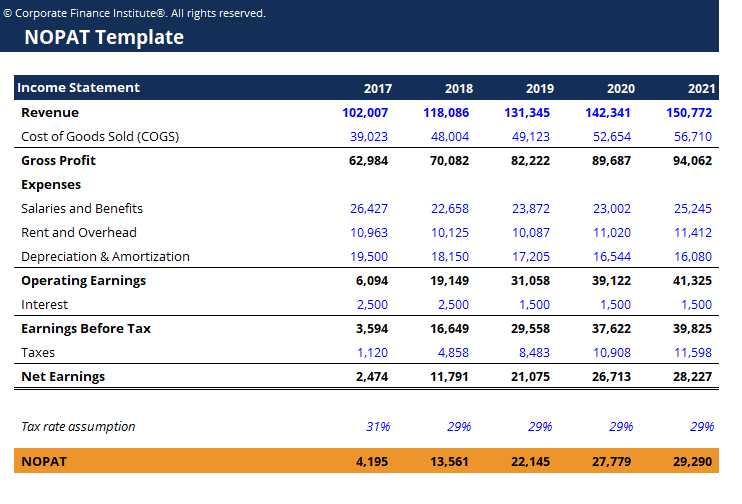

Npat finance formula. NOPAT operating income x 1 - Tax Rate. What does NPAT stand for. Specialised Sector Specific Scorecards.

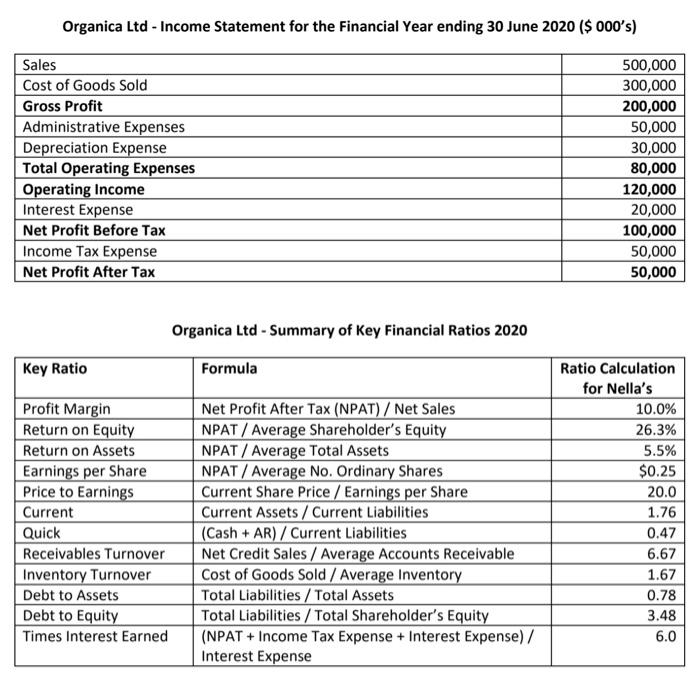

25000 NPAT Dividend payout ration of 95 of all NPAT Current Share price of 230 Calculate EPS 142 cents per share PE 164 DPS 135 cents per share Div Yield 58 If both companies were within the same industry and very similar in business 1. Companies report net income in a variety of ways. NOPAT Formula EBIT 1 Tax rate Net Operating Profit After Tax Formula is also known as Net Operating Profit less adjusted Taxes NOPLAT.

Download CFIs free earnings per share formula template to fill in your own numbers and calculate the EPS formula on your own. The effective tax rate is the percentage amount needed for taxes so the remainder 1 - the effective tax rate is the portion left after allowing for taxes. For the purpose of this ratio net profit is equal to gross profit minus operating expenses and income tax.

Different businesses have different strategies on paying tax which effects the NPAT figure. Calculating NOPAT or Net Operating Profit After Taxes is done primarily to compare operating revenues before debt. The NOPAT formula is calculated by multiplying a companys operating income by 1 minus the corporate tax rate.

Net profit ratio NP ratio is a popular profitability ratio that shows relationship between net profit after tax and net sales. The simplest calculation is. Annual value of all Socio-Economic Development Contributions made by the Measured Entity as a percentage of the target equates to a 1 contribution of Net Profit after Tax NPAT.

To allow for the different tax strategies NPBT is considered. Net Income 300000 100000 80000 20000 Net Income 100000. The average NPAT calculation works as follows.

How Return on Invested Capital ROIC Is Used. If the industry norm was 4 then NPAT over Turnover must be greater than or equal to 1 calculated as 025 x 4 1. Profit Before Tax Revenue Expenses Exclusive of the Tax Expense Profit Before Tax 2000000 1750000 250000.

For example if EBIT is 10000 and the tax rate is 30 the net operating profit after tax is 07 which equals 7000 calculation. 1 definitions of NPAT. It is to be noted that the formula for NOPAT doesnt include the one-time losses or charges.

This is an approximation of after-tax. Profit Before Tax is calculated using the formula given below. As you can see in the Excel screenshot below if ABC Ltd has a net income of 1 million dividends of 025 million and shares outstanding of 11 million the earnings per share formula is 1 025 11 007.

The return on assets formula sometimes abbreviated as ROA is a companys net income divided by its average of total assets. One business owner has a company paying tax at 30 the other business owner is a sole trader and paying tax at 45. Net income in the numerator of the return on assets formula can be found on a companys income statement.

Definition of NPAT in Business Finance. The formula for ROIC is net income - dividend debt equity. The return on assets formula looks at the ability of a company to utilize its assets to gain a net profit.

In the same way the average Revenue is calculated by adding the current Revenue to the Revenue figures of the 4 previous financial periods and dividing this amount by 5. As such it is a good representation of the operating profitability of a company. NOPAT Operating profit X 1 Tax rate If a detailed income statement isnt available and you cant figure out the operating in come of the company you can always calculate the net operating profit after tax equation using net income by backing out the interest payments like this.

It is computed by dividing the net profit after tax by net sales. The ROIC formula is calculated by assessing the value in the denominator total. The concept of profit before tax is demonstrated in the example below.

Say that a business effective tax rate is 20. Indicative profit margin is the profit margin in the last year where the companys profit margin is at least one quarter of the industry norm. We add the current NPAT to the NPAT of the 4 previous financial periods and divided this amount by 5.

For example think of two identical business with a net profit of 500000. 10000 x 1 - 03. The Simple NOPAT Formula In this formula an investor would determine the NOPAT by reviewing a companys income statement.

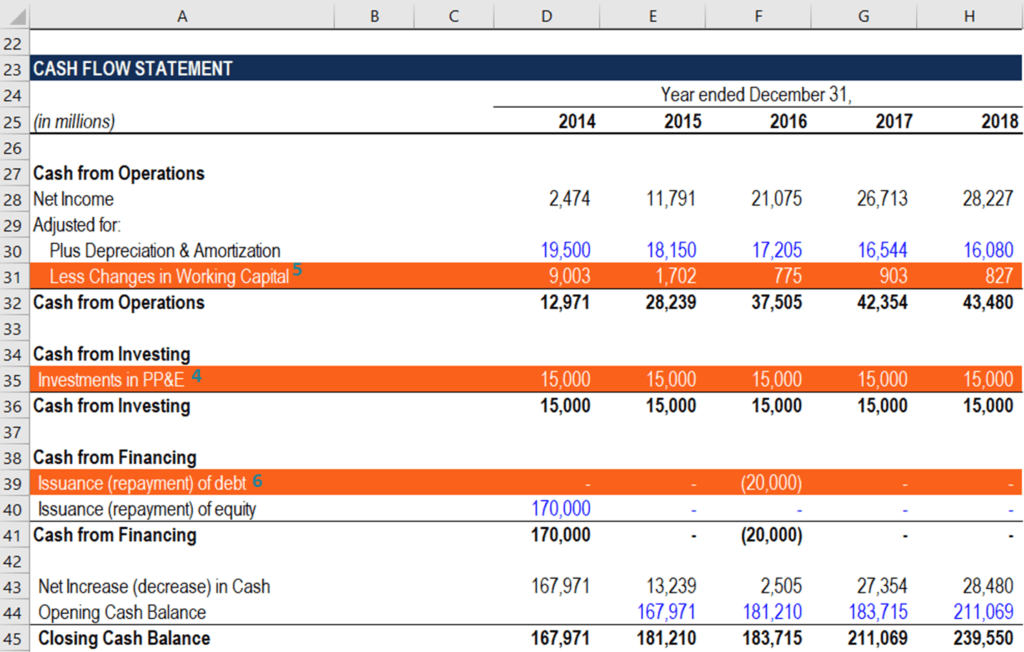

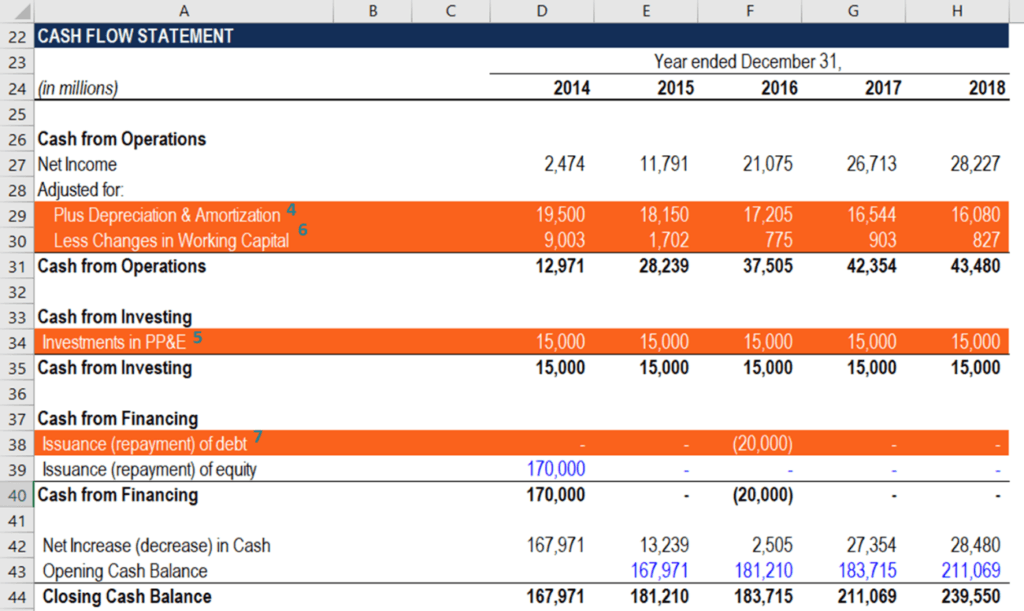

Free Cash Flow To Firm Fcff Formulas Definition Example

Free Cash Flow To Firm Fcff Formulas Definition Example

Earnings Before Tax Ebt What This Accounting Figure Really Means

Earnings Before Tax Ebt What This Accounting Figure Really Means

Nopat Formula How To Calculate Nopat Excel Template

Nopat Formula How To Calculate Nopat Excel Template

Net Operating Profit After Tax Nopat Formula Example Calculation

Net Operating Profit After Tax Nopat Formula Example Calculation

Training Financial Modeling Annual Forecast Model Revenue Expenses Operating Expenditure Modano

Training Financial Modeling Annual Forecast Model Revenue Expenses Operating Expenditure Modano

Nopat Net Operating Profit After Tax What You Need To Know

Nopat Net Operating Profit After Tax What You Need To Know

How To Calculate Fcfe From Ebitda Overview Formula Example

How To Calculate Fcfe From Ebitda Overview Formula Example

Unlevered Free Cash Flow Definition Examples Formula

Unlevered Free Cash Flow Definition Examples Formula

What Is Net Operating Profit After Taxes Nopat Definition Meaning Example

What Is Net Operating Profit After Taxes Nopat Definition Meaning Example

How To Calculate Fcfe From Ebit Overview Formula Example

How To Calculate Fcfe From Ebit Overview Formula Example

0 comments:

Post a Comment