Cov xy Σ xi x yi y N 1 Where. 0148 0184.

Covariance P Formula Examples Covariance Excel Function

Covariance P Formula Examples Covariance Excel Function

Let us provide the definition then discuss the properties and applications of covariance.

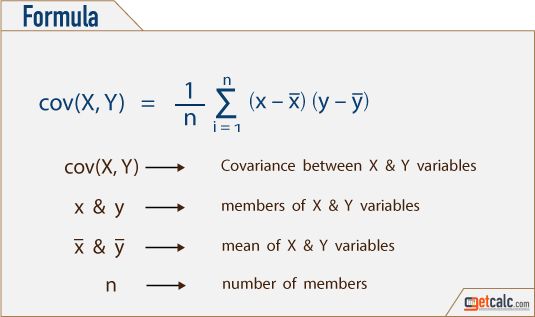

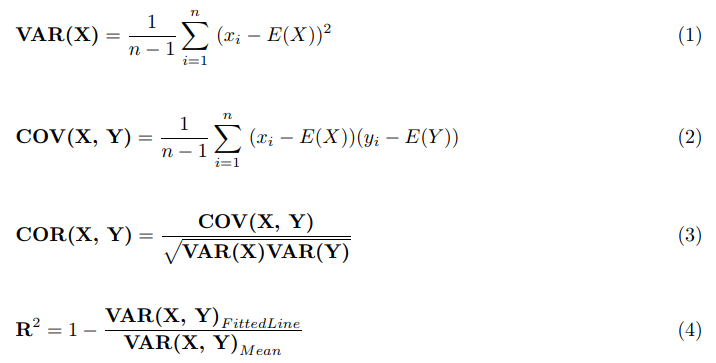

Covariance formula finance with probability. We already have the covariance. Covxy SUM x i - x m y i - y m n - 1. For any random variables X and Y discrete or continuous with means μ X and μ Y the covariance of X and Y can be calculated as.

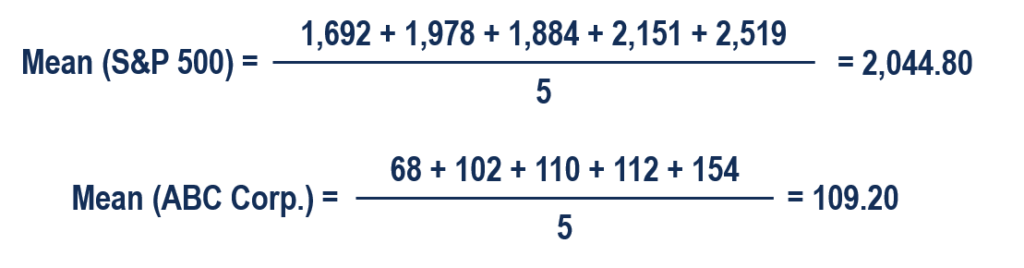

The given table describes the rate of economic growthx i and the rate of returny i on the SP 500. Given this information the formula for covariance is. In probability theory and statistics covariance is a measure of the joint variability of two random variables.

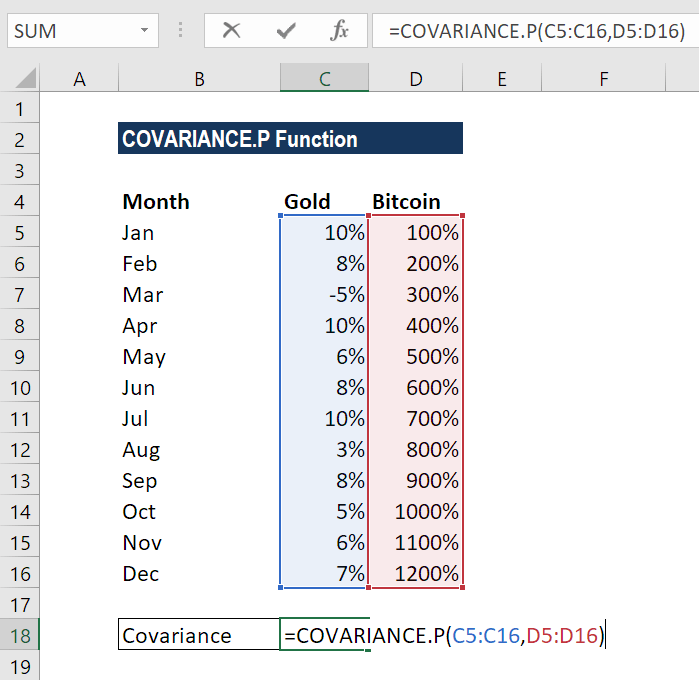

If X Y are random variables and a b are constants then CovXa0 CovaX bYabCovXY CovXaYb CovXY Symmetry. Covariance Formula in Excel COVARIANCEParray1 array2 The COVARIANCEP function uses the following arguments. It is assumed that any rate of return achieved during a specific period eg day week month quarter year has equal probability.

If the greater values of one variable mainly correspond with the greater values of the other variable and the same holds for the lesser values that is the variables tend to show similar behavior the covariance is positive. A nega- tive covariance indicates a negative relationship. Covariance Formula Examples How To Calculate Correlation.

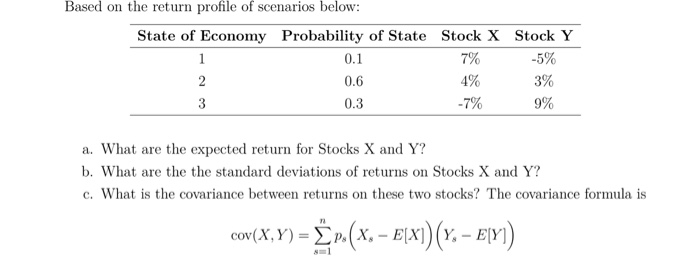

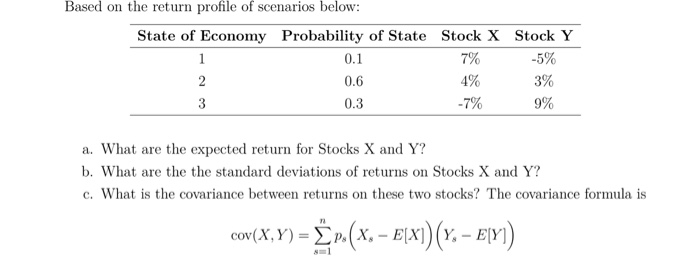

CovX Y CovY X Relation to variance. The covariance of a probability distribution 1S XY2 measures the strength of the relationship between two variables Xand Y. If X and Y are two random variables with means expected values μ X and μ Y and standard deviations σ X and σ Y respectively then their covariance and correlation are as follows.

The standard formula for calculating covariance is. X Mean of x. Cov xy Σ xi x yi y N.

Refer to the spread sheet Covariance-Correlationxlsx for detailed calculations. C o v X Y E X Y μ X μ Y. To see how to apply this formula read some Solved exercises.

The covariance gives some information about how X and Y are statistically related. Σ x i x avg y i y avg n 1 displaystyle Sigma x_ i-x_ text avg y_ i-y_ text avg n-1. Suppose we wish to find the variance of each asset and the covariance between the returns of ABC and XYZ given that the amount invested in each company is 1000.

Consider the following example. Covariance cov X Y σ X Y E X μ X Y μ Y displaystyle textcov_XYsigma _XYEX-mu _XY-mu _Y. Covariance Formula - Example 2.

VarX CovX X VarX Y VarXVarY 2 CovX Y. The standard deviations of the two returns can be calculated using the formulas learned under section Variance and Standard Deviation. The covariance of a random variable with itself own covariance is its own variance.

While the formula for covariance given above is correct we use a slightly modified formula to calculate the covariance of returns from a joint probability model. Variance is a special case of the covariance when the two variables are identical. Std R j 417.

Formula for continuous variables. Std R i 940. 11 - 130 x 3 - 374 17 - 130 x 42 - 374 21 - 130 x 49 - 374.

Correlation 0002694417 066. Yi Data variable of y. Using our example of ABC and XYZ above the covariance is calculated as.

If the probability of each outcome cannot be estimated the historical return is used to compute covariation. The covariance formula is similar to the formula for correlation and deals with the calculation of data points from the average value in a dataset. A positive covariance indicates a positive relationship.

We can calculate the covariance between two asset returns given the joint probability distribution. When the two random variables taken together form a continuous random vector the formula can be expressed as a double integral. In such a scenario we can use the COVARIANCEP function.

With the help of the covariance formula determine whether economic growth and SP 500 returns have a positive or inverse relationship. To use this formula you need to understand the meaning of the variables and symbols. For example the covariance between two random variables X and Y can be calculated using the following formula for population.

Y Mean of y. In the opposite case when the greater values of one. Xi Data variable of x.

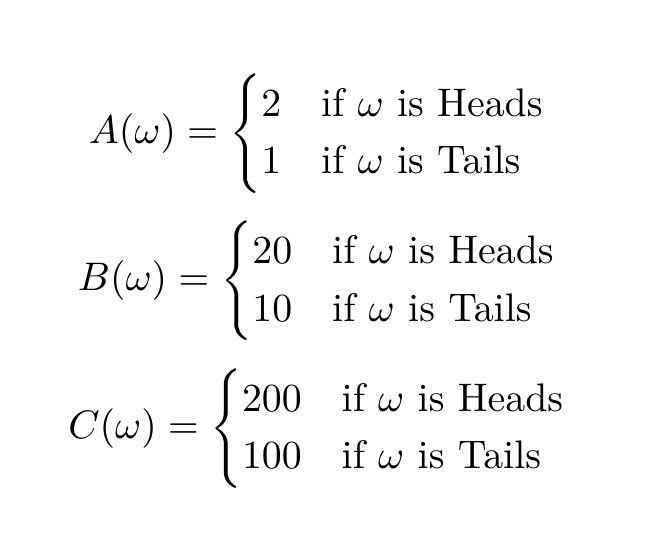

Σ displaystyle Sigma. A simple covariance formula. Example Suppose that the future short-term outlook for the economy is favorable with a probability 06 and unfavorable with a probability of 04.

The covariance between X and Y is defined as CovX Y E X EXY EY EXY EXEY. It is based on the probability-weighted average of the cross-products of the random variables deviations from their expected values for each possible outcome. Array1 required argument This is a range or array of integer values.

For a sample covariance the formula is slightly adjusted. It was introduced in MS Excel 2010 to replace COVAR with improved accuracy over its predecessor. Where is the joint probability density function of and.

If the entire population is used the formula is as follows.

Risk Part 2 Variance Covariance Varsity By Zerodha

Covariance Of Returns Definition Formula Example Covariance In Excel

Probability And Statistics Symbols Poster By Coolmathposters Data Science Learning Statistics Math Math Methods

Probability And Statistics Symbols Poster By Coolmathposters Data Science Learning Statistics Math Math Methods

Chapter 5 Discrete Probability Distributions Ppt Download

Chapter 5 Discrete Probability Distributions Ppt Download

Covariance Cov X Y Calculator Formula Example

Covariance Cov X Y Calculator Formula Example

Covariance Definition Formula And Practical Example

Covariance Definition Formula And Practical Example

Covariance Correlation R Squared By Deepak Khandelwal The Startup Medium

Covariance Correlation R Squared By Deepak Khandelwal The Startup Medium

Cfa Tutorial Quantitative Methods Joint Probability Distribution Youtube

Cfa Tutorial Quantitative Methods Joint Probability Distribution Youtube

Understanding Variance Covariance And Correlation Count Bayesie

Understanding Variance Covariance And Correlation Count Bayesie

0 comments:

Post a Comment