How to abbreviate Cost of Debt. Formula for same is below-Effective Interest Rate Interest Expenses Annual Interest Total Debt Obligation 100.

Cost of Debt Pre-tax Formula Total Interest Cost Incurred Total Debt 100.

Kd finance formula. One of the definitions of KD is Cost of Debt. E market value of equity 100m. Finally Kps reflects its intermediate standing in terms of risk between debt and equity.

Here credit spread depends on the credit rating. The effective tax rate is the weighted average interest rate of a companys debt. Ke cost of equity 10.

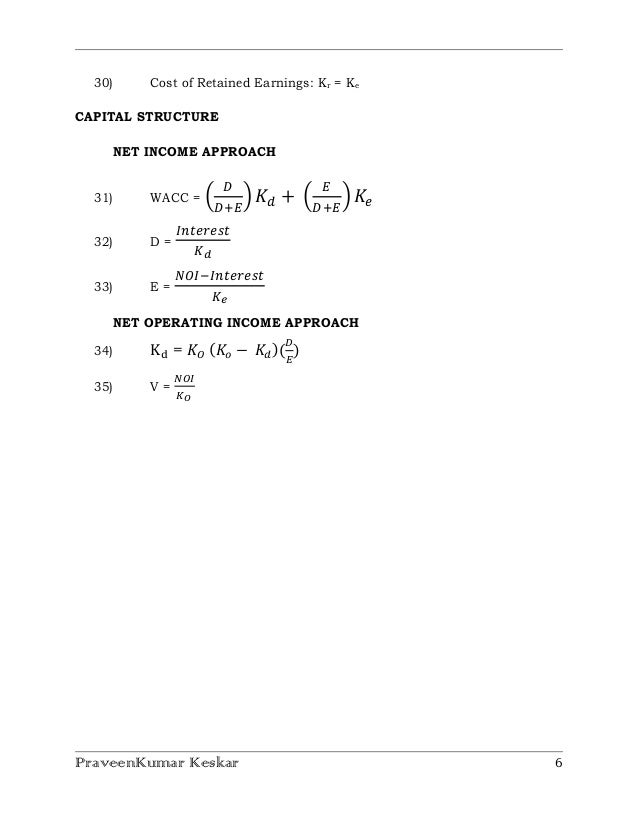

Kd cost of debt Kps cost of preferred stock E market value of equity D market value of debt PS market value of preferred stock T tax rate. Kd cost of debt required rate of return i annual interest paid. And A is assists.

WACC Ke x E D E Kd 1 - t x D D E 10 x 100 100 100 36 x 100 100 100 10 x 100200 36 x 100200. Then Kd reflects the default risk of the company. Kings Domnion amusement park.

D market value of debt 100m. Kd 1-t after-tax cost of debt 36. 5 18.

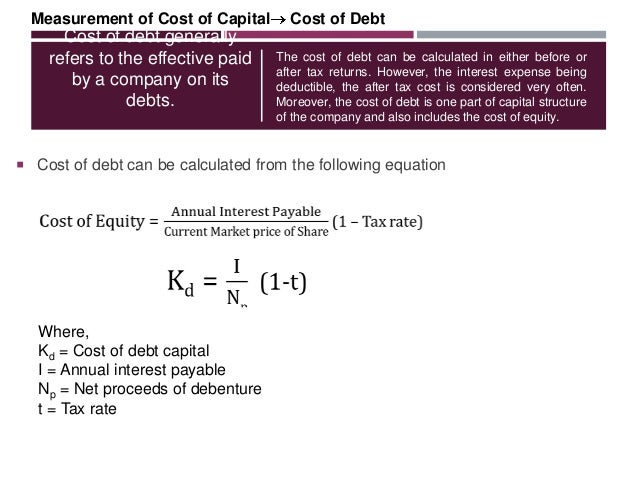

The cost of debt formula is the effective interest rate multiplied by 1 - tax rate. 8 divided by 10 equals 80 or 80. The effective interest rate is annual interest upon total debt obligation into 100.

Corporation tax is 30. 10 x 12 36 x 12. What is KD abbreviation.

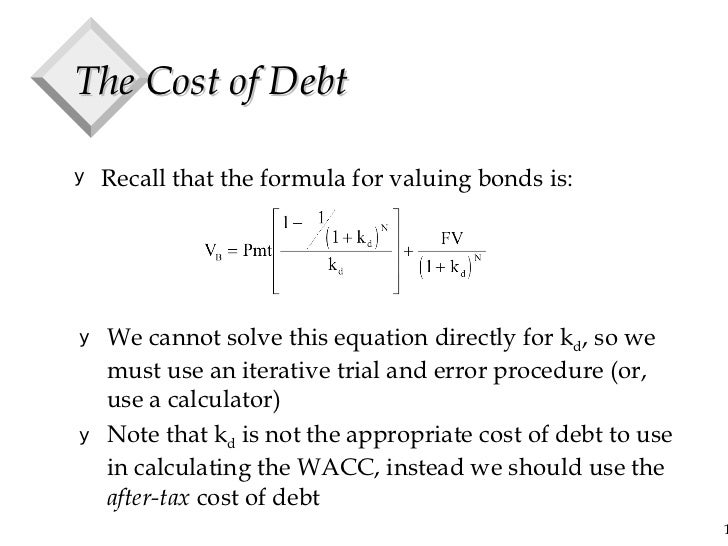

Credit spreads are generally calculated by a credit rating agency and presented in a table like the one below. C1 11 KdtKd FV1 Kdt Where C is the interest expense in dollars Kd is the current cost of Debt in percentages T is the weighted average maturity in years FV represents the total debt. Cost of Debt Formula Kd The formula for determining the Pre-tax Kd is as follows.

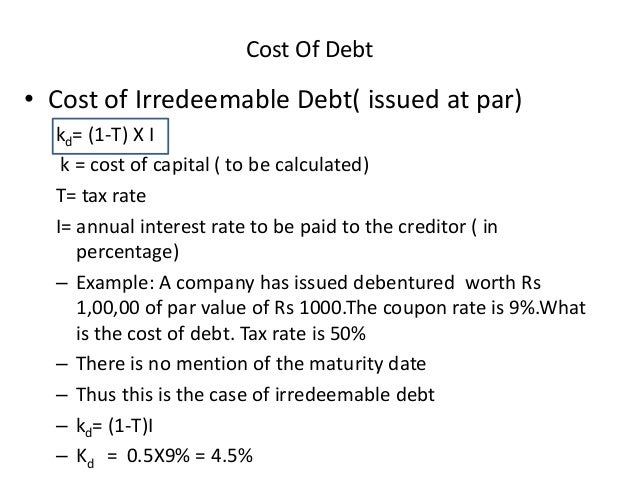

The meaning of KD abbreviation is Cost of Debt. Cost of Debt can be abbreviated as KD. A Plc still has 10 debentures quoted at 80 of par where par is 100.

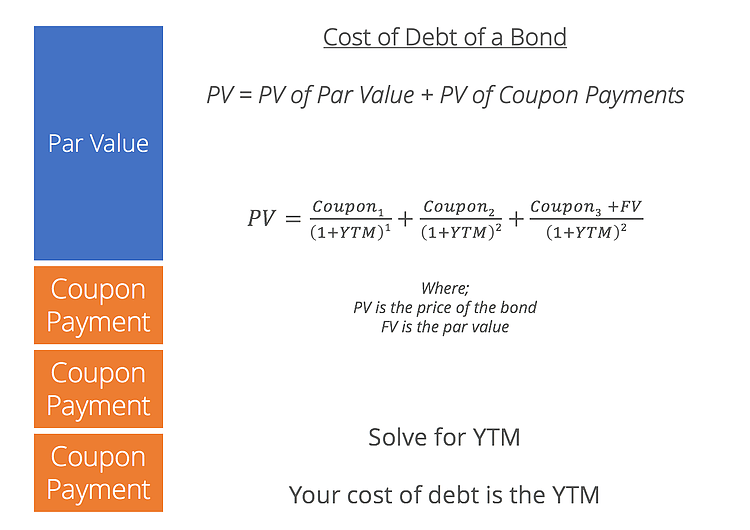

The bond pricing formula to calculate market value of debt is. Keg cost of equity in a geared company. The results of the regression are then used in the K-ratio.

George Lane developed this indicator in the late 1950s. Where K is kills. D Deaths.

Where K Kills. The term stochastic refers to the point of a current price in relation to its price range over a period of time. T corporation tax rate.

Better credit rating will decrease the credit spread and vice versa. Kd cost of debt post tax Ve total market value of issued shares market cap Vd total market value of debt. This method attempts to predict price turning points by comparing the closing price of a.

Ke reflects the riskiness of the equity investment in the company. K d Yield to maturity or internal rate of return or cost of debtdebenture ADVERTISEMENTS. The formula above pulls the entire list of options from the.

KDA is typically used as a measure of skill in a video game. The close less the lowest low equals 8 which is the numerator. The high-low range is 10 which is the denominator in the K formula.

KD K. C1 11 KdtKd FV1. Multiply this number by 100 to find K.

What is a KD Ratio. K would equal 30 if the close was at 103 30 x 100. The value of k d yield to maturity can be found by trial and error method using present value tables.

Ko Keg VeVeVd Kd VdVeVd Ko cost of capital. K d 1-T Risk free rate Credit spread 1-T The credit spread is a measure of the credit risk associated with a company. What is the cost of debt.

KD stands for Cost of Debt. Examples of Cost of Debt Formula With Excel Template Lets see an example to understand the cost of debt formula in a better manner. What is the meaning of KD abbreviation.

We can Calculate the cost of debt using the following formula Cost of Debt Risk-Free Rate Credit Spread 1 Tax Rate As the cost of debt Kd is affected by the rate of tax we consider the After-Tax Cost of Debt. KDA K A D. The higher the KDA Ratio the better the the individual in most cases.

The first step is to get the option chain and find the row with the right expiration date. The calculation involves running a linear regression on the logarithmic cumulative return of a Value-Added Monthly Index VAMI curve. Komatsu Diesel Japan KD.

What does KD mean. KD as abbreviation means Cost of. In technical analysis of securities trading the stochastic oscillator is a momentum indicator that uses support and resistance levels.

K Ke x Ve Kd x VdVe Vd Example 1. D or KD. Kuwaiti Dinar unit of currency KD.

P0 ex interest market value of debt.

Weighted Average Cost Of Capital Wacc Finance Learner Conceptual Clarity

Discount Rate Formula Calculate Discount Rate Dcf Analysis

Discount Rate Formula Calculate Discount Rate Dcf Analysis

Lecture 11 Wacc K P Valuation Methods Investment Analysis Ppt Download

Lecture 11 Wacc K P Valuation Methods Investment Analysis Ppt Download

Cost Of Debt How To Calculate The Cost Of Debt For A Company

Cost Of Debt How To Calculate The Cost Of Debt For A Company

Formulae Of Financial Management

Formulae Of Financial Management

Corporate Finance Formulas Explained Financeviewer

Corporate Finance Formulas Explained Financeviewer

Cost Of Debt Definition Formula Calculate Cost Of Debt For Wacc

Cost Of Debt Definition Formula Calculate Cost Of Debt For Wacc

0 comments:

Post a Comment