Altman was a professor at the Leonard N. 2012 Farlex Inc.

Altman Z Score Formula How To Calculate Youtube

Altman Z Score Formula How To Calculate Youtube

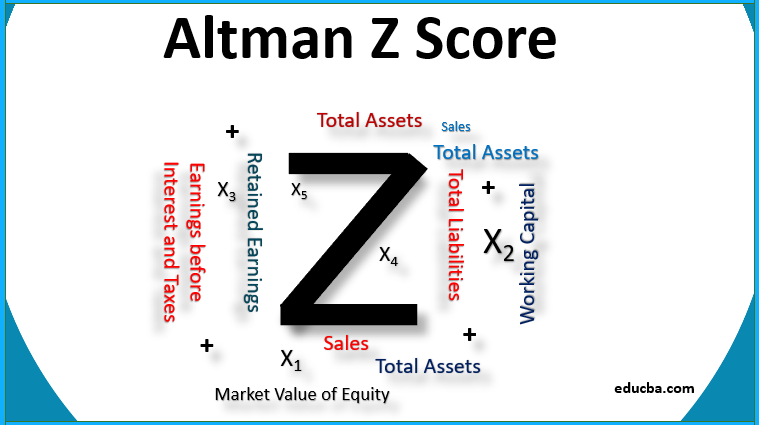

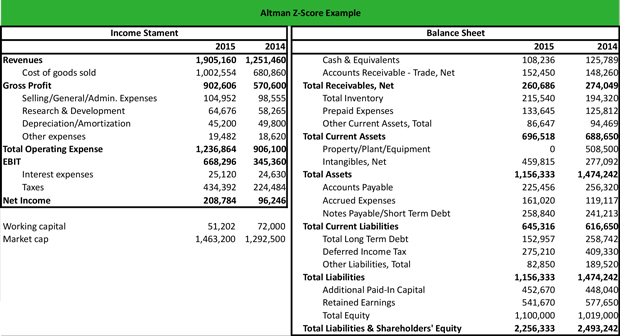

Earnings assets liabilities equity etc.

What is z score in finance. The z-score is positive if the value lies above the mean and negative if it lies below the mean. Altman in 1968 as a Z score formula used to predict the chances of bankruptcy. Altman Z score is a type of Z score which was published by Edward I.

A Z score of greater than 299 means that the entity being measured is safe from bankruptcy. The Altman Z-score is a financial formula used by investors and creditors to to estimate the likelihood of the company going bankrupt by taking into account a firms core activities liquidity solvency profitability and leverage. The Z1 Score is for private manufacturing companies and the Z2 is for general use.

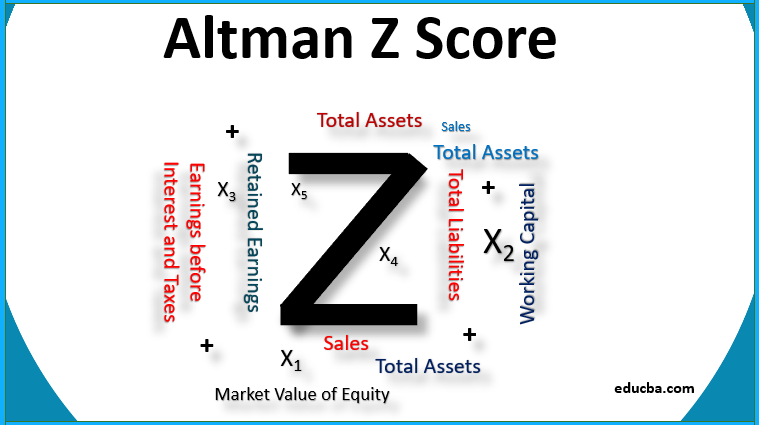

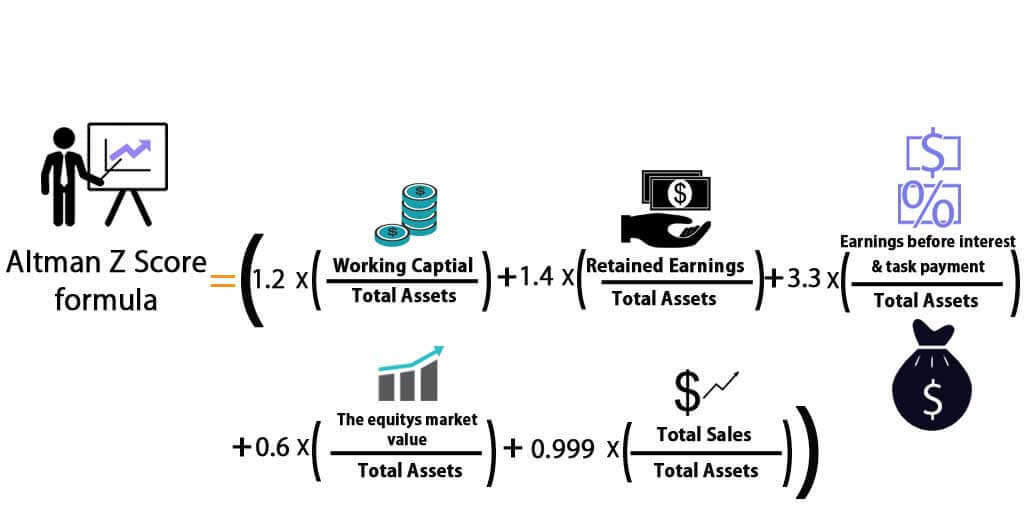

Working Capital Total Assets Retained Earnings Earnings Before Interest and Tax Market Value of Equity Total Liabilities and Sales. In statistics a quantification of the distance of a datapoint from the average of a set of datapoints. The Z score is based on the liquidity profitability solvency sales activity and leverage of the targeted business.

What Does Altman Z Score Mean. Edward Altman who used it predict the likelihood that a company would go bankrupt. If the score is less than 110 its headed for bankruptcy.

Z-score sometimes called standard score is a measurement of how many standard deviations a point is away from the mean of its data set. Therefore according to the table if a companys Z2 score is greater than 260 its currently safe from bankruptcy. This methodology can be used to predict the chance of a business organization to move into bankruptcy within a given time which is mostly about 2 years.

The Altman Z Score model defined as a financial model to predict the likelihood of bankruptcy in a company was created by Edward I. What is the definition of Altman Z score. 2012 Farlex Inc.

Altmans Z-Score model is a numerical measurement that is used to predict the chances of a business going bankrupt in the next two years. The Z-Score is a commonly used metric with wide appeal though it is just one of many credit scoring models in use today that essentially combine quantifiable financial indicators with a small number of variables in an attempt to predict whether a firm will fail. The coefficients were estimated by identifying a set of firms which had declared bankruptcy and then collecting a matched sample of firms which had survived with matching by industry and approximate size assets.

The Z-score is used to predict the likelihood that a company will go bankrupt. The popularity of the z-score stems from the fact that it has a clear negative relationship to the probability of a financial. It is also known as a standard score because it allows comparison of scores on different kinds of variables by standardizing the distribution.

Measuring the Z-score of a company is used to help determine a companys likelihood of bankruptcy. The model was developed by American finance professor Edward Altman in 1968 as a measure of the financial stability of companies. The Z-score is also sometimes known as the Altman Z-score.

Most commonly a lower score reflects higher odds of bankruptcy. Meaning of Altman Z-Score The Altman Z-Score is an analytical representation created by Edward Altman in the 1960s which involves a combination of five distinctive financial ratios used for determining the odds of bankruptcy amongst companies. This formula requires seven variables.

A score of less than 181 means that a business is at considerable risk of going into bankruptcy while scores in between should be considered a red flag for possible problems. How Does the Z-Score Work. A standard normal distribution SND is a normally shaped distribution with a mean of 0 and a standard.

The Z-score is expressed as a numerical value. The Z Score is for public manufacturing companies. In finance Z-scores are measures of an observations variability and can be used by traders to help determine market volatility.

The Z-score is a financial statistic that measures the probability of bankruptcy. Stern School of Business of New York University. The z-score is defined as z kµσ where k is equity capital as percent of assets µ is return as percent of assets and σ is standard deviation of return on assets as a proxy for return volatility.

Given the ease with which the required information can be found the Z Score is a useful metric for an outsider who has access to a companys financial statements. A z-score of zero indicates that that the data point is equal to the mean or average. This concept was adapted to the business and finance world by Dr.

It uses profitability leverage liquidity solvency and activity to. The Z-score is a metric that reveals how likely a company is going to be bankrupt or insolvent. In statistics the number of standard deviations a data point is from the mean value.

The Z-score is a linear combination of four or five common business ratios weighted by coefficients. The Altman Z-score is based on five financial ratios that can calculate from data found on a companys annual 10-K report. A companys Z-score is calculated based on basic indicators found on its financial statements eg.

It is often used to measure a persons or companys likelihood of bankruptcy.

Frm Altman S Z Score For Credit Risk Youtube

Frm Altman S Z Score For Credit Risk Youtube

Altman Z Score Accounting Ratio Gmt Research

Altman Z Score Accounting Ratio Gmt Research

Altman Z Score Formula Step By Step Calcualtion Of Altman Z Score

Altman Z Score Formula Step By Step Calcualtion Of Altman Z Score

Altman Z Score Meaning Formula How It Predicts Bankruptcy

Altman Z Score Meaning Formula How It Predicts Bankruptcy

The Altman Z Score Model In Financial Analysis Magnimetrics

The Altman Z Score Model In Financial Analysis Magnimetrics

Altman Z Score As An Indicator Of Financial Health Altman Z Score As An Indicator Of Financial Health Audit Analyticsaudit Analytics

Altman Z Score As An Indicator Of Financial Health Altman Z Score As An Indicator Of Financial Health Audit Analyticsaudit Analytics

Altman Z Score Model Guide Examples Cleverism

Altman Z Score Model Guide Examples Cleverism

Z Score Formula Value Example Calculation Explanation

Z Score Formula Value Example Calculation Explanation

What Is The Altman Z Score Definition Meaning Example

What Is The Altman Z Score Definition Meaning Example

Altman Z Score Guide And Excel Calculator

Altman Z Score Guide And Excel Calculator

0 comments:

Post a Comment