The days payable outstanding formula is calculated by dividing the accounts payable by the derivation of cost of sales and the average number of days outstanding. Days Payable Outstanding Accounts Payable Cost of Sales Number of days The DPO calculation consists of two three different terms.

Short Term Financial Management Ppt Video Online Download

Short Term Financial Management Ppt Video Online Download

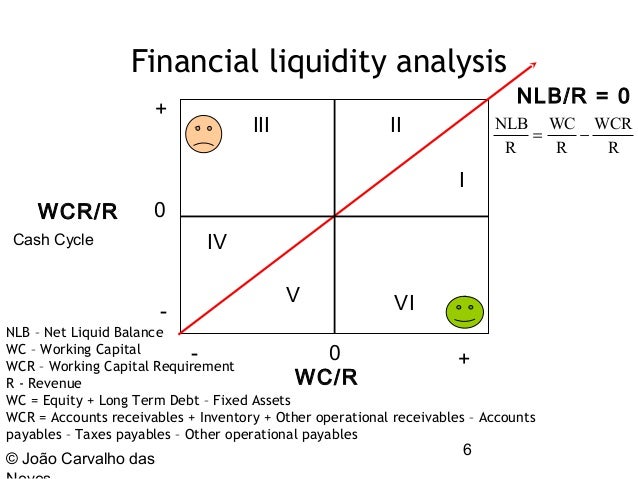

Liquidity Current Ratio Current Assets Current Liabilities.

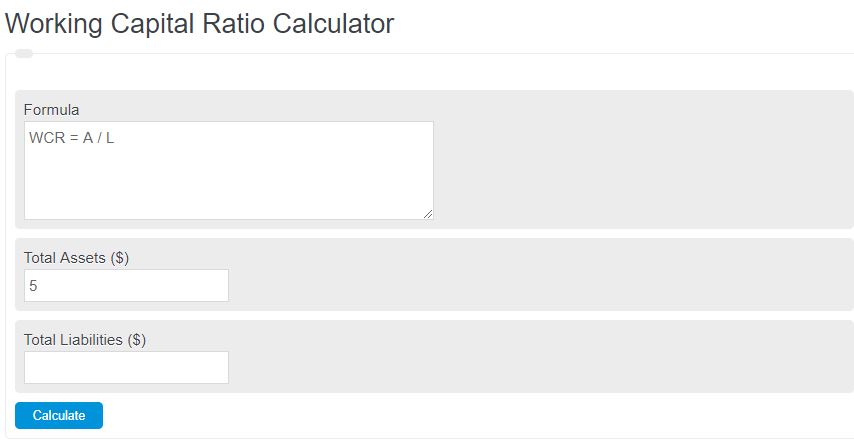

Wcr finance formula. When used in this manner working capital ratio is not really a ratio. The following formula is used to calculate a working capital ratio. A potential acquirer is interested in the current financial health of the Beemer Designs retail chain which sells add-on products for BMW automobiles.

Analysis and Interpretation of Working Capital Ratio. WCR A L. Accounts receivable Days credit x Daily revenue Accounts receivable 45 x 182500 365 Accounts receivable 22500 Accounts receivable 22500 182500 123.

In the complete calculation formula the WCR is constituted by the amount of the receivables increased by the amount of the stocks and reduced by the amount of the debt supplier. A WCR of 1 represents the current assets equal to current liabilities. Heres what the equation looks like.

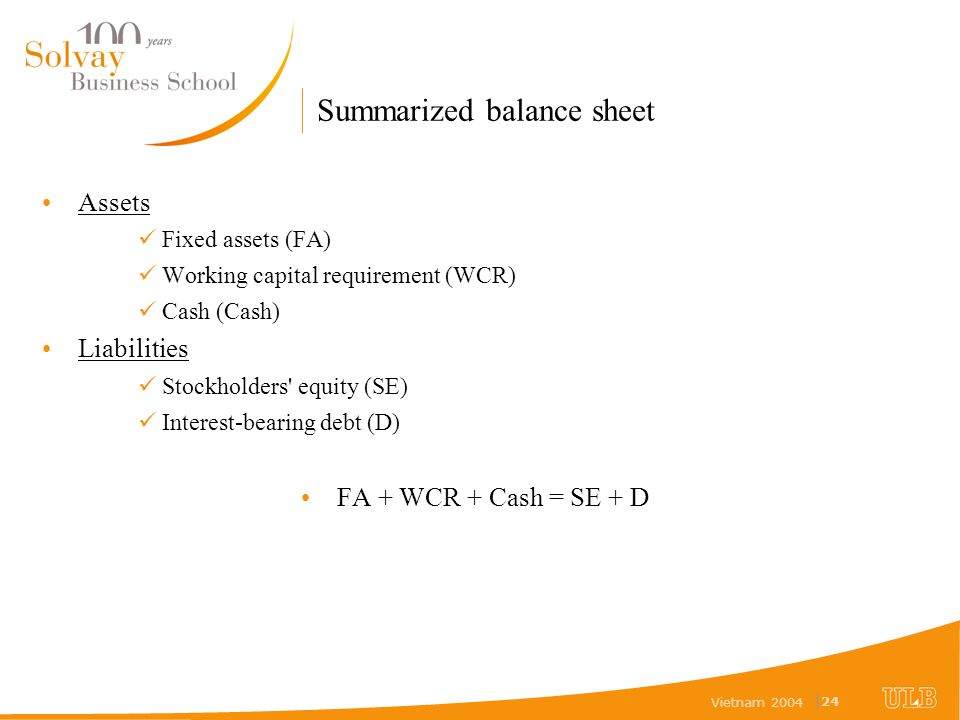

The working capital requirement WCR is calculated from the balance sheet. A is the total assets L is the total liabilities Working Capital Ratio Definition. She obtains the following information about the company for the past three years.

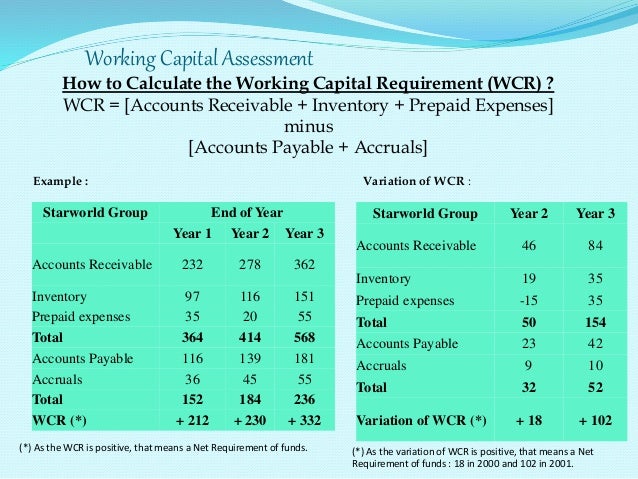

A working capital ratio is a ratio of the value of all assets to all liabilities of a business. WCR Accnts Receivable Inventoryes WCR Accounts Receivable Inventory Prepaid expenses minus Accounts payable Accruals. It is important to note that the current assets and current liabilities are placed firstly which is then followed by long term assets and liabilities.

Example of the Working Capital Ratio. A ratio of 1 is sometimes considered the center-groundIts not risky but it is also not very safe. WCR inventories receivables non-financial liabilities.

How to Calculate the Working Capital Requirement WCR. The working capital formula is. It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling.

Most receivables are trade receivables. The simplest formula for calculating working capital requirements is. Working capital that is in line with or higher than the industry average for a company of comparable size is.

The Working Capital Requirement expressed as the number of days of sales is also called the WCR turnover ratio highlighting the number of days of revenue needed to finance the companys business. There are two calculation formulas a simplified formula and a longer one. The days working capital is calculated by 200000 or working capital x 365 10000000.

Rather it is simply a dollar amount. Days working capital 73 days. On average at any one time the working capital requirement resulting from offering credit to customers will be 22500 or 123 of revenue.

For example if a company h. Working capital Current Assets Current Liabilities The working capital formula tells us the short-term liquid assets remaining after short-term liabilities have been paid off. Both of these current accounts are stated separately from their respective long-term accounts on the balance sheet.

Working capital is defined as current assets minus current liabilities. The standard formula for working capital is current assets minus current liabilities. Formula The working capital ratio is calculated by dividing current assets by current liabilities.

Here is how to calculate the WCR. Since the capital ratio measures current assets as a percentage of current liabilities it might only add up that a better ratio is more favorable. In this video on Working Capital formula we will look at how you can find out the Working Capital formula of a company𝐖𝐨𝐫𝐤𝐢𝐧𝐠 𝐂𝐚𝐩𝐢𝐭𝐚𝐥 𝐟𝐨𝐫.

Some use the term working capital ratio to mean working capital or net working capital. Purchasing - wip storage - production - finished goods storage - sales - collection It represents the funds necessary to run the daily operations. Where WCR is the working capital ratio.

Current assets Current liabilities Working capital ratio. The Working capital ratio can be defined by comparing current assets and current liabilities and the formula for the same is as below. WCR is the balance between the portion of current assets and the portion of current liabilities which are directly and exclusively associated with the operating cycle.

It is necessary to control and anticipate changes in working capital in value and in proportion with the turnover. However if the company made 12 million in sales and working. WCR Average Outstanding Trade Receivables Average Stocks Average Outstanding Trade Payables.

Working Capital Ratio Formula.

Http Www Quaestus Ro Wp Content Uploads 2012 03 Cr C4 83ciun Sab C4 82u Cristina Mihaela Nagy Pdf

Discover The Mysterious Working Capital Requirement My Campus Finance

Working Capital Ratio Financial Kpis Profit Co

Working Capital Ratio Financial Kpis Profit Co

Short Term Financial Management Ppt Download

Short Term Financial Management Ppt Download

The Working Capital Requirement Wcr B Accounting

The Working Capital Requirement Wcr B Accounting

Working Capital Ratio Calculator Calculator Academy

Working Capital Ratio Calculator Calculator Academy

Vietnam Capital Budeting With The Net Present Value Rule Professor Andre Farber Solvay Business School Universite Libre De Bruxelles Ppt Download

Vietnam Capital Budeting With The Net Present Value Rule Professor Andre Farber Solvay Business School Universite Libre De Bruxelles Ppt Download

Chapter 19 Evaluating Liquidity Ppt Download

Chapter 19 Evaluating Liquidity Ppt Download

Https Www Mdpi Com 2305 6290 5 1 8 Pdf

Key Ratios For Financial Analysis

Key Ratios For Financial Analysis

0 comments:

Post a Comment