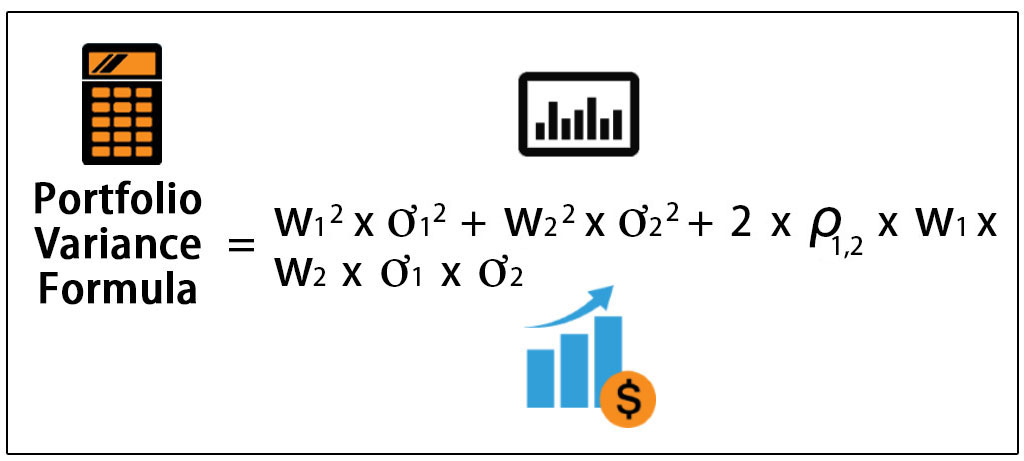

In both of these equations the information provided to an advisor on volatility andor the variability of two-assets can more effectively guide portfolio design. Cov 12 the covariance between assets 1 and 2.

Finc4101 Investment Analysis Ppt Download

Finc4101 Investment Analysis Ppt Download

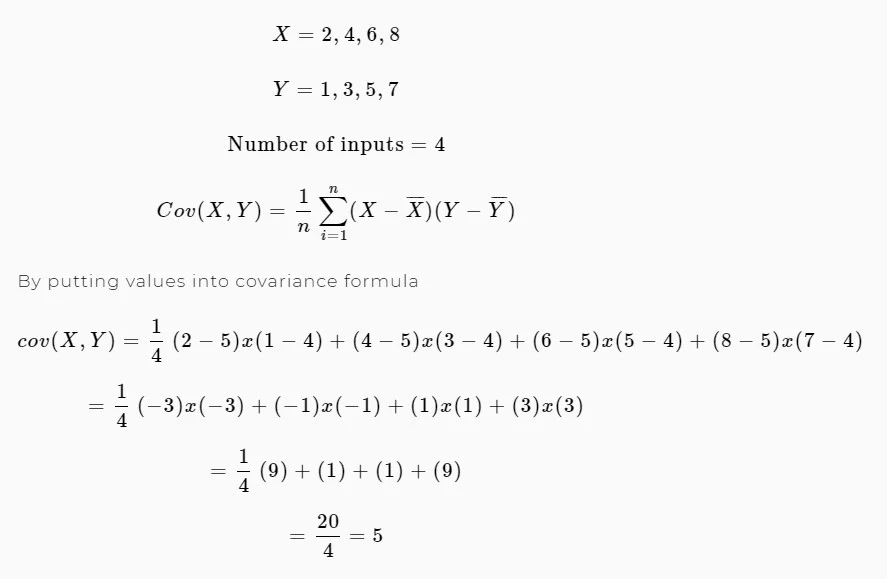

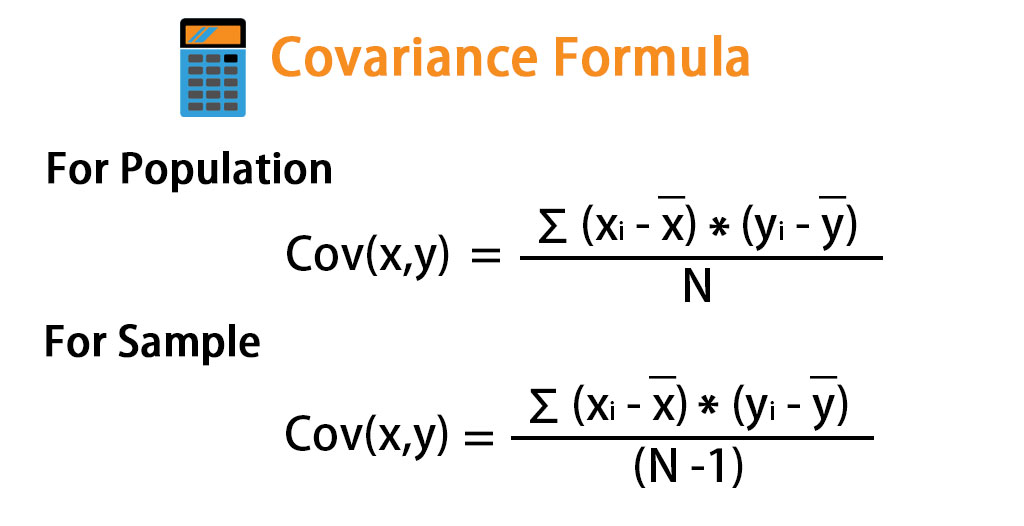

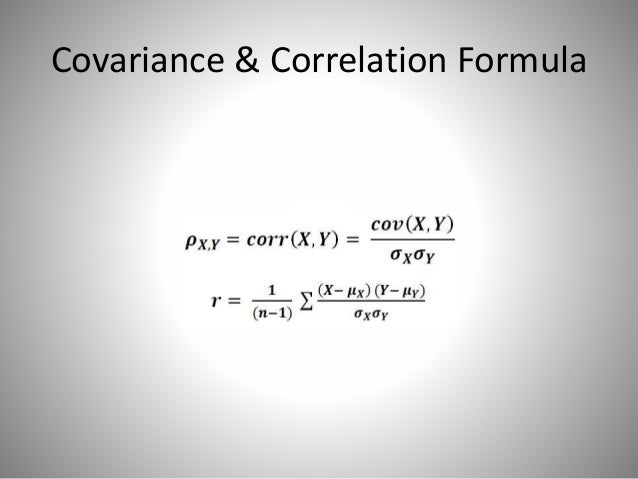

The general formula used to calculate the covariance between two random variables X and Y is.

Finance covariance formula. The numerator for the standard covariance formula is the value that you have just completed calculating. The variance for a portfolio consisting of two assets is calculated using the following formula. σ i 2 the variance of the ith asset.

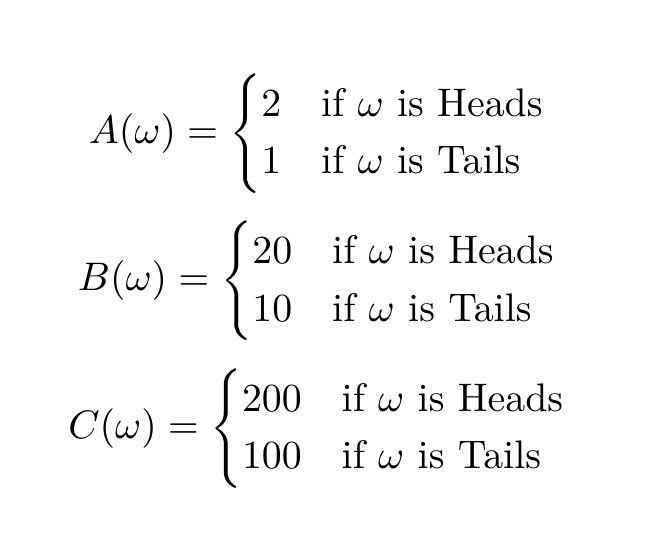

W i the weight of the ith asset. Given this information the formula for covariance is. The positive value of covariance indicates that there is some linear dependence between returns of Security A and Security B and they have positive correlation.

Suppose X and Y are random variables with means µXand µY. CovXY EXEXY EY cov X Y E X E X Y E Y While the formula for covariance given above is correct we use a slightly modified formula to calculate the covariance of returns from a joint probability model. Overview of what is financial modeling how why to build a model.

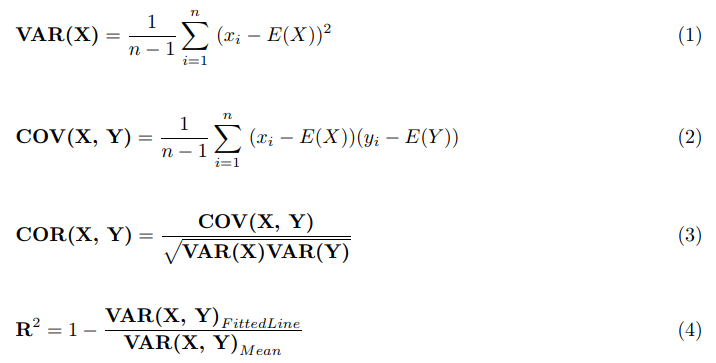

Covariance Formula in Statistics Definition. Alternative formula VX EfX X2g EX2 2 X X 2 EX2 2 XEX 2 EX2 2 2 2 EX2 2 X Observation Variance is always nonnegative. Calculate the denominator for the covariance formula.

Mathematically it is represented as Cov RA RB ρA B ơA ơB. If the greater values of one variable mainly correspond with the greater values of the other variable and the same holds for the lesser values that is the variables tend to show similar behavior the covariance is positive. The calculation of covariance between stock A and stock B can also be derived by multiplying the standard deviation of returns of stock A the standard deviation of returns of stock B and the correlation between returns of stock A and stock B.

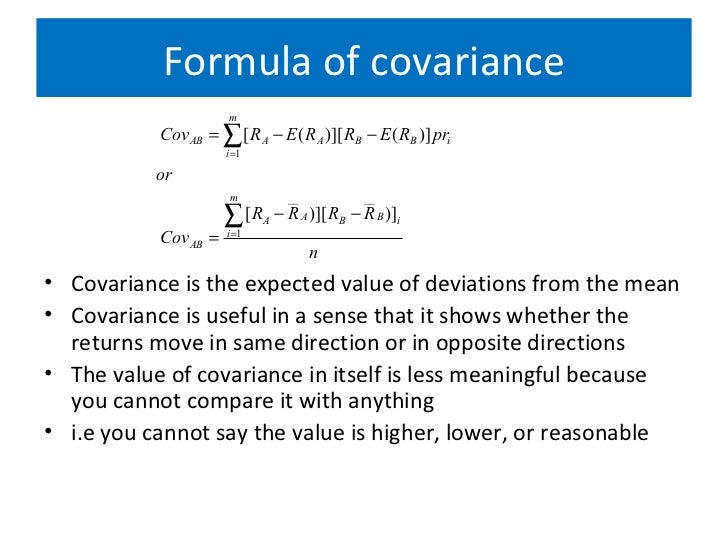

The denominator is represented by n-1 which is just one less than the number of data pairs in your data set. In probability theory and statistics covariance is a measure of the joint variability of two random variables. In the opposite case when the greater values of one.

For this sample problem there are nine data pairs so n is 9. Formula for Portfolio Variance. Similarly if X1Xn are random variables for which covXiXjD0 for each i 6Dj then varX1 CCXnDvarX1CCvarXn for pairwise uncorrelated rvs.

Std R i 940. CovXY fracsum x_i-overlinexy_i-overlineyN-1. Covariance also serves as a variable in the equations to solve for Beta and the standard deviation of a two-asset portfolio.

Cov AB -2816010 -276020 2584040 -936020 -176010 492. Covariance Ri Rm Σ R in R iavg R mn R mavg n-1 Variance Rm Σ R mn R mavg 2 n To calculate the covariance we must know the return of the stock and also the return of the market which is taken as a benchmark value. CovXY fracsum x_i-overlinexy_i-overlineyN Sample Covariance Formula.

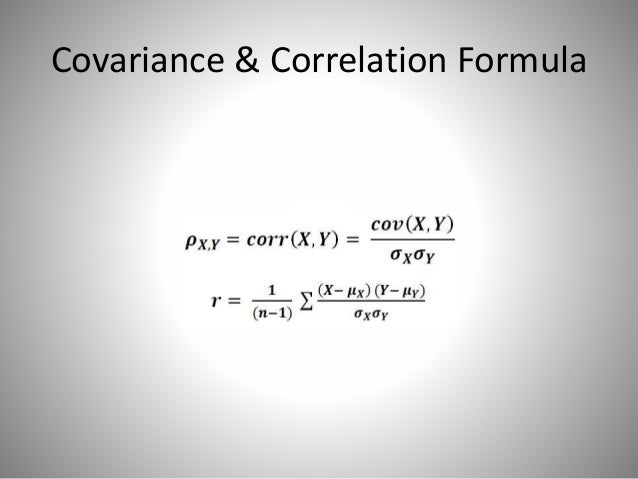

ρxy σxy σxσy ρ x y σ x y σ x σ y Correlation ranges between 1 and -1 and is therefore much easier to interpret than covariance. Once we have the covariance we can calculate the correlation as follows. We must also know the variance of the market return.

If Y and Z are uncorrelated the covariance term drops out from the expression for the variance of their sum leaving varY CZDvarYCvarZ for Y and Z uncorrelated. For example the covariance between two random variables X and Y can be calculated using the following formula for population. Cov XY 2 3 8 975 28 3 11 975 4-3 12 975 32 3 8 975 4.

The covariance of X and Y is defined as Cov xy i 1 n x i x y i y n 1 where xi the values of the X- variable. 11 - 130 x 3 - 374 17 - 130 x 42 - 374 21 - 130 x 49 - 374. We already have the covariance.

Cov xy SUM xi - xm yi - ym n - 1 While the covariance does measure the directional relationship between two assets it does. The standard deviations of the two returns can be calculated using the formulas learned under section Variance and Standard Deviation. Cov XY -1 -175 -02 125 1 225 02 -175 4.

Covariance is calculated using the formula given below. Correlation is a concept that is closely related to covariance in the following way. For a sample covariance the formula is slightly adjusted.

0148 0184. Using our example of ABC and XYZ above the covariance is calculated as. The covariance formula is similar to the formula for correlation and deals with the calculation of data points from the average value in a dataset.

Cov xy Σ xi x yi y N.

Covariance Calculator Find Covariance Definition

Covariance Calculator Find Covariance Definition

Risk Part 2 Variance Covariance Varsity By Zerodha

Covariance Formula Examples How To Calculate Correlation

Covariance Formula Examples How To Calculate Correlation

What Is Beta In Finance Formula For Beta Statistically Beta Shows The Sensitivity Of A Security The Beta Is Financial Analysis Technical Analysis Analysis

What Is Beta In Finance Formula For Beta Statistically Beta Shows The Sensitivity Of A Security The Beta Is Financial Analysis Technical Analysis Analysis

The Risk And Return Relationship Part 1 P4 Advanced Financial Management Acca Qualification Students Acca Global

The Risk And Return Relationship Part 1 P4 Advanced Financial Management Acca Qualification Students Acca Global

Covariance Correlation R Squared By Deepak Khandelwal The Startup Medium

Covariance Correlation R Squared By Deepak Khandelwal The Startup Medium

Security Analysis And Portfolio Management

Security Analysis And Portfolio Management

Understanding Variance Covariance And Correlation Count Bayesie

Understanding Variance Covariance And Correlation Count Bayesie

Covariance Meaning Formula How To Calculate

Covariance Meaning Formula How To Calculate

Portfolio Variance Formula Example How To Calculate Portfolio Variance

Portfolio Variance Formula Example How To Calculate Portfolio Variance

0 comments:

Post a Comment