Pe Ratio Formula Finance

Basic PE formulas and Deriving the Cost of Capital Old fashioned DCF formula where the cost of capital could be estimated using the formula. Market price per share is the price of each share in the open market or how much it would cost to buy a share of stock.

How To Calculate The Intrinsic P E Of A Stock Quora

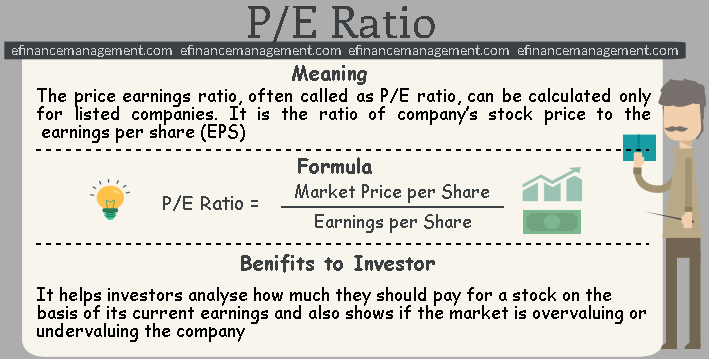

In other words the price earnings ratio shows what the market is willing to pay for a stock based on its.

Pe ratio formula finance. Share To determine the PE ratio one must divide the price per share by the earnings per share. To get a PE ratio for a stock from Google Finance use the following formula. The price earnings ratio often called the PE ratio or price to earnings ratio is a market prospect ratio that calculates the market value of a stock relative to its earnings by comparing the market price per share by the earnings per share.

The formula for the price to earnings ratio also referred to as the PE Ratio is the price per share divided by earnings per share. Relative PE is the companys PE ratio divided by the chosen average. P E Share Price Earnings per Share displaystyle PEfrac textShare PricetextEarnings per Share As an example if share A is trading at 24 and the earnings per share for the most recent 12-month period is 3 then share A has a PE ratio o.

Where P0 is the expected stock price D1 is the expected dividend k is the required rate of return and g is the expected growth rate of dividends. The financial services sectors PE ratio has ranged between 65-10 for the same time frame. GOOGLEFINANCEstock symbolpe In the example below Ill get the PE ratio for a stock using a cell reference with the example formula being.

Market Price per Share. A relative PE ratio is a PE that is benchmarked. PE Ratio Market value per share Earnings per share textPE Ratio fractextMarket value per sharetextEarnings per share PE Ratio Earnings per share Market value per share.

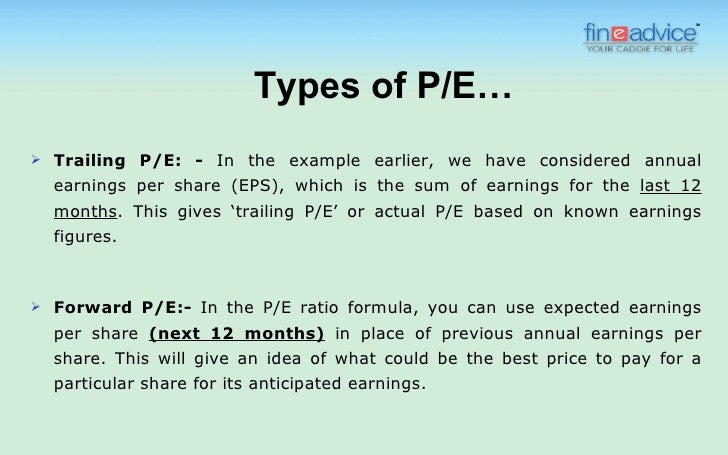

The Price-to-Earning PE ratio is calculated as a stocks current traded price divided by its earnings per share EPS for a year period for the most part the most recent a year it can be referred as trailing a year or trailing 12 months. Value D1 k-g or k-g x Value D1 or k-g D1Value or k D1Value g. The price-earnings ratio also known as PE ratio PE or PER is the ratio of a companys share price to the companys earnings per share.

Its displayed as a percentage. The price to earnings ratio is used as a quick calculation for how a companys stock is perceived by the market to be worth relative to the companys earnings. Using the previously mentioned formula you can calculate that XYZs price-to-earnings ratio is 100 5 20.

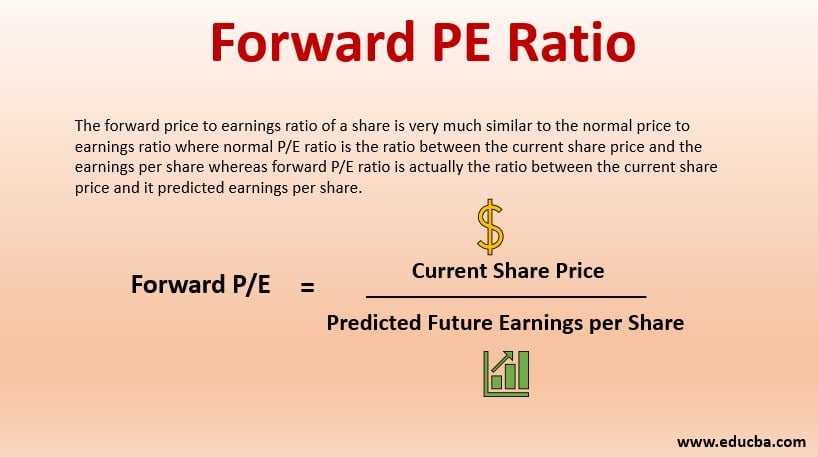

The Forward Price-to-Earnings or Forward PE Ratio. That is the PE ratio is compared to the industry average or historical pe ratios for individual stocks. EPS represents the E in PE ratio where EPS earnings total shares outstanding.

Now we divide both sides by expected next years earnings E1. EPS is found by taking earnings from the last twelve months divided by the weighted average shares outstanding Weighted Average Shares Outstanding Weighted average shares outstanding refers to the number of shares of a company calculated after adjusting for changes in the share capital over a reporting period. The disparity comes about because different industries have different characteristics.

The ratio is used for valuing companies and to find out whether they are overvalued or undervalued. PE Ratio Formula Explanation. If the PE ratio of similar companies is 4 the market value of a share of XY Limited should have been 40 4 10 thus the share is over valued by 20.

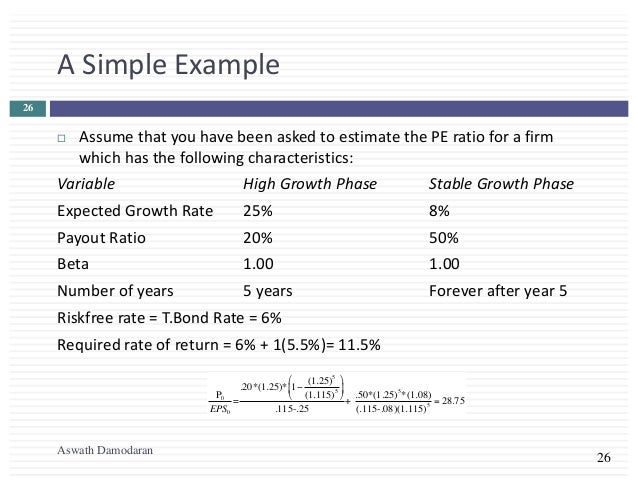

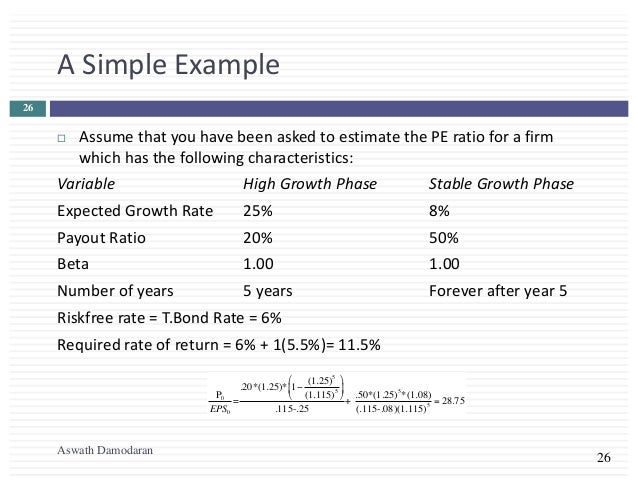

Justified PE formula To derive the justified PE ratio we start from the Gordon Growth model. The forward PE ratio or forward price-to-earnings ratio divides the current share price of a company by the estimated future forward earnings per share EPS Earnings Per Share Formula EPS EPS is a financial ratio which divides net earnings available to common shareholders by the average outstanding shares over a certain period of time. Price-to-Earnings Ratio PE Market value per share Earnings Per Share EPS Moving on from the basics let us do a sample calculation with company XYZ that currently trades at 10000 and has an earnings per share EPS of 500.

Current price per share values found through most financial resource sites while earnings per share are often reported on a quarterly or yearly basis via the same channels. It is also sometimes called the price multiple or earnings multiple. The technical definition of the PE ratio formula is as follows.

PE Ratio Price of a Share Earnings per Share Just to let you know the PE ratio is often written as PE ratio or just PE. PE Ratio Market Price per Share Earnings per Share. A higher PE ratio is the indication of strong position of the company in the market and a fall in ratio should be investigated.

The basic formula to calculate the price-earnings ratio is fairly standard and is as under. As long as a company has positive earnings the PE ratio can be calculated. The basic PE formula takes the current stock price and EPS to find the current PE.

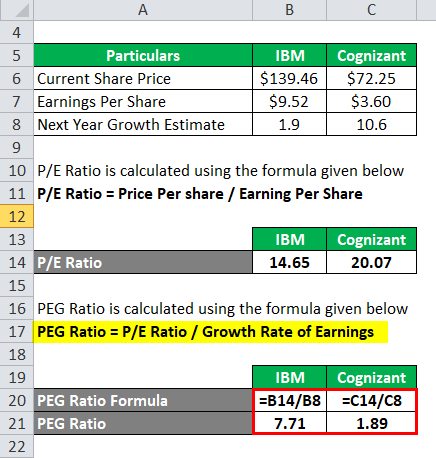

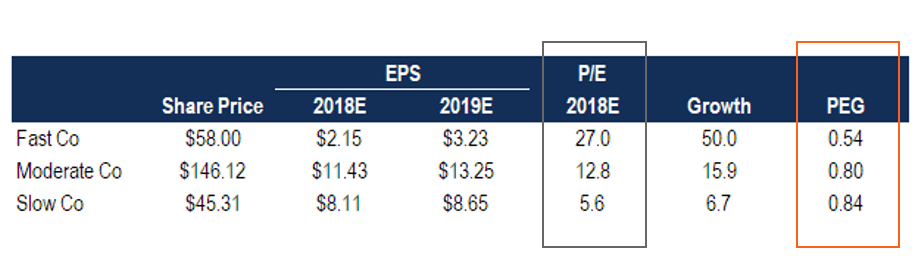

Peg Ratio Formula How To Calculate Price Earnings To Growth

Peg Ratio Formula How To Calculate Price Earnings To Growth

Forward Pe Ratio Formula Examples Excel Calculation Youtube

Forward Pe Ratio Formula Examples Excel Calculation Youtube

How To Calculate P E Peg Ratio

How To Calculate P E Peg Ratio

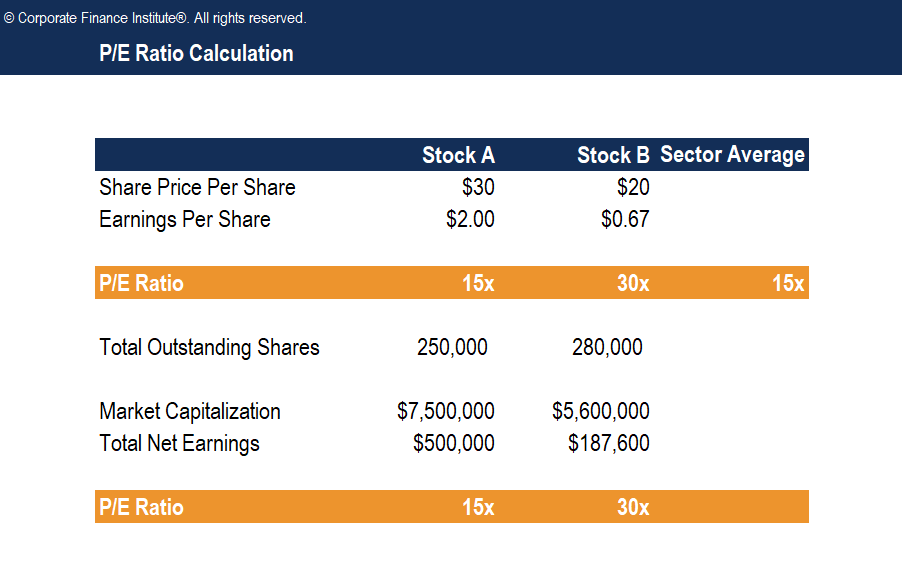

P E Ratio Template Download Free Excel Template

P E Ratio Template Download Free Excel Template

Pe Ratio Price To Earnings Definition Formula And More

Pe Ratio Price To Earnings Definition Formula And More

P E Ratio Meaning Valuation Formula Calculation Analysis More

P E Ratio Meaning Valuation Formula Calculation Analysis More

Pe Ratio Vs Earnings Yield Explanation Formulas

Pe Ratio Vs Earnings Yield Explanation Formulas

Forward Pe Ratio A Qucik Glance Of Forward Pe Ratio With Example

Forward Pe Ratio A Qucik Glance Of Forward Pe Ratio With Example

Peg Ratio Price Earnings Growth Ratio What It Really Means

Peg Ratio Price Earnings Growth Ratio What It Really Means

Post a Comment for "Pe Ratio Formula Finance"