Hence the net salvage value is market value tax effect 499800 205800 294000. Its important to understand exactly how the NPV formula works in Excel and the math behind it.

Tech 89 Calculus Iii Formula Sheet Physics And Mathematics Calculus Math Formulas

Tech 89 Calculus Iii Formula Sheet Physics And Mathematics Calculus Math Formulas

As a conclusion in structure 2 the formal charges on C and S ig.

Ncs finance formula. Current Assets are the assets that are available within 12 months. The National Compensation Survey NCS is an establishment-based survey that collects data on employer costs for employee compensation and incidence and details of employer-sponsored benefits. The calculation details for the Employment Cost Index ECI Employer Costs for Employee Compensation ECEC and Employee Benefits are covered in this section.

This is used as an international standard for shipping to New Caledonia. A beta of less than 10 signifies a less dispersed return relative to the overall market. We discount the terminal cash flows to todays value.

588000 294000 117600 764400. Then he calculates the tax effect 35 of the initial investment. Ok let me try to set you straight.

NPV F 1 rn where PV Present Value F Future payment cash flow r Discount rate n the number of periods in the future. A bond between Nitrogen Carbon and Oxygen should give you NCS. It is also relative to the growth of the company.

NCS is the net credit sales. You can read more about NSC here and find further information below the NSC Calculator. D is the total number of days.

Within the 2 nd tab named Method 2 you can calculate the net working ratio by applying this equation. The formula for net working capital NWC sometimes referred to as simply working capital is used to determine the availability of a companys liquid assets by subtracting its current liabilities. Average Collection Period Formula.

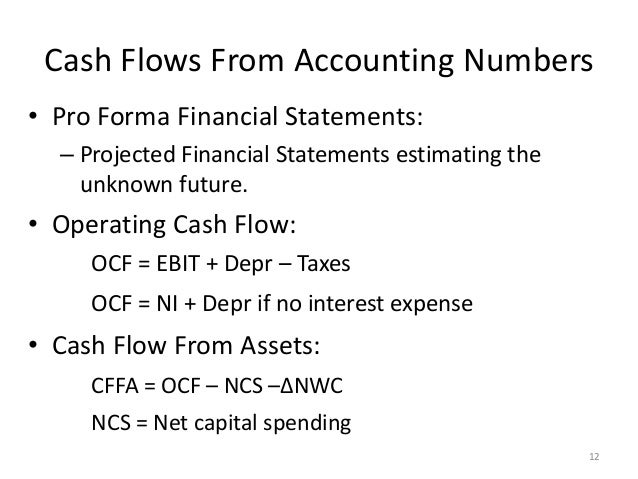

The net capital spending is the total of the initial investment and the net salvage value minus depreciation. The more free cash flow a company has the more it can allocate to dividends. Atom 1 2 N 1 1 C 0 2 S 0 2.

Current assets current liabilities. Dividends Paid - Stocks Sold - Stocks Repurchased. The Gordon Growth formula is used to calculate Terminal Value at a future annual growth rate equal to the 10-year government bond rate of 27.

NR is the average net receivables. Within the 1 st tab named Method 1 you can determine the absolute value of the net working capital by this formula. Current assets - Inventory Current liabilities.

For example a security with a beta of 087 will likely trail the overall marketif the market is up 10. So 2 must be more a accurate structure. As per net capital spending formula to find the capital spending of a firm subtract the beginning fixed assets from the ending fixed assets and then subtract the obtained value from depreciation value to get the result.

Choose from 500 different sets of finance exam 1 formulas flashcards on Quizlet. Learn finance exam 1 formulas with free interactive flashcards. Formal charge FC can easily be calculated w the shortcut.

Phase Grades 10 to 12 the extent to which the NCS curricula were repackaged or rewritten in the formula tion of the NATIONAL SENIOR CERTIFICATE GRADE 12 MAY 6TH 2018 - NATIONAL SENIOR CERTIFICATE GRADE 12 MATHEMATICAL LITERACY P1 2 DBE 2014 NSC GRADE 12 EXEMPLAR USE THE FORMULAGrade 12 Mathematical Literacy 2014 March Comon Paper Caps 10 17. Cash Flow From Assets f - n - w Where f Operating cash flow n Net capitalspending w Changes in net working capital Related Calculator. 2 lone pairs per N and S.

Assets Liabilities and Equity pay off debt. 588000 x 35 205800. Capital Spending or NCS is used to represent the difference between capital expenditure CAPEX and depreciation.

Free cash flow FCF is the money a company has left over after paying its operating expenses and capital expenditures. A chart for the formal charges. Where ACP is the average collection period.

FC column - lines - dots. ISO 3166-2 geocode for New Caledonia. The NSC National Saving Certificate Calculator allows you to calculate the return on your investment when saving using the National Savings Certificate Scheme.

NCS ending fixed assets beginning fixed assets depreciation o NCS 1457343 - 1351384 145734 251693 NWC ending NWC beginning NWC. Bond becomes polar because of 2 and 2 make it weaker whereas in structure 1 there are less charge separations. The follow equation is used to calculate the average collection period.

A slang term for non-callable bond. ISO 3166-1 alpha-2 code for New Caledonia. Assets Liabilities and Equity take on debt or issue stock.

Average Collection Period Definition. NWC Cash cash equivalents Inventory Marketable investments Trade accounts receivable - Trade accounts payable. This is the code used in international transactions to and from New Caledonian bank accounts.

ACP D NR NCS.

Net Capital Spending Formula Example How To Calculate

Net Capital Spending Formula Example How To Calculate

Financial Statements Taxes And Cash Flow Ppt Download

Financial Statements Taxes And Cash Flow Ppt Download

Ncs Net Capital Spending By Acronymsandslang Com

Pin On How To Make Money From Home

Pin On How To Make Money From Home

Payroll Analysis Spreadsheet Payroll Template How To Plan Payroll

Payroll Analysis Spreadsheet Payroll Template How To Plan Payroll

Safety Stock Calculation In Excel With Sales Forecasting 2017 Safety Stock Excel Forecast

Safety Stock Calculation In Excel With Sales Forecasting 2017 Safety Stock Excel Forecast

The Challenges Of Measuring Roi For Innovation Programs Ncs Madison

The Challenges Of Measuring Roi For Innovation Programs Ncs Madison

How To Write An Advisory Board Invitation Letter For Your Business Letter Example Lettering Business Invitation

How To Write An Advisory Board Invitation Letter For Your Business Letter Example Lettering Business Invitation

Pin By Dan Bell On Thinking Maps Anchor Charts Microsoft Office Microsoft Applications Microsoft

Pin By Dan Bell On Thinking Maps Anchor Charts Microsoft Office Microsoft Applications Microsoft

Click The Image To Learn More About It Digital Marketing Language Learning

Click The Image To Learn More About It Digital Marketing Language Learning

0 comments:

Post a Comment