Over the same period from 1976 to 1996 20 years this strategy led to an average yearly return of 230 better than the market. If the M-score is larger than -222 then it means that the company is probably manipulating the financial statements.

How To Create An Excel Financial Calculator Financial Calculators Excel Financial

How To Create An Excel Financial Calculator Financial Calculators Excel Financial

The current ratio also known as the working capital ratio measures the capability of a business to meet its short-term obligations that are due within a year.

F score formula finance. The F-1 Score metric is preferable when. The vertical dashed lines are at F-scores 1 185 and 245 For example considering F-score 245 188 of the FFR firms have F-scores 245 and 812 have F-scores less than 245. The F-score is a way of combining the precision and recall of the model and it is defined as the harmonic mean of the models precision and recall.

Piotroski F-score is a number between 0 and 9 which is used to assess strength of companys financial position. So using a cut-off F-score of 245 provides a hit rate of 188. First since managers know that analysts are using this specific model to detect manipulation managers will make sure that they stay undetected.

F Value Variance of 1 st Data Set Variance of 2 nd Data Set. There are three main disadvantages to using the M-score model. The Piotroski Score is a discrete score between zero and nine that reflects nine criteria used to determine the strength of a firms financial position.

Finance for Non Finance Managers Course 7 Courses Investment Banking Course117 Courses 25 Projects Financial Modeling Course 3 Courses 14 Projects The mode is Calculated Using the formula given below. The F-score also called the F1-score is a measure of a models accuracy on a dataset. Interestingly two of the factor the dummy factors in the 9-factor model are not really necessary as their impact on the formula is typically zero.

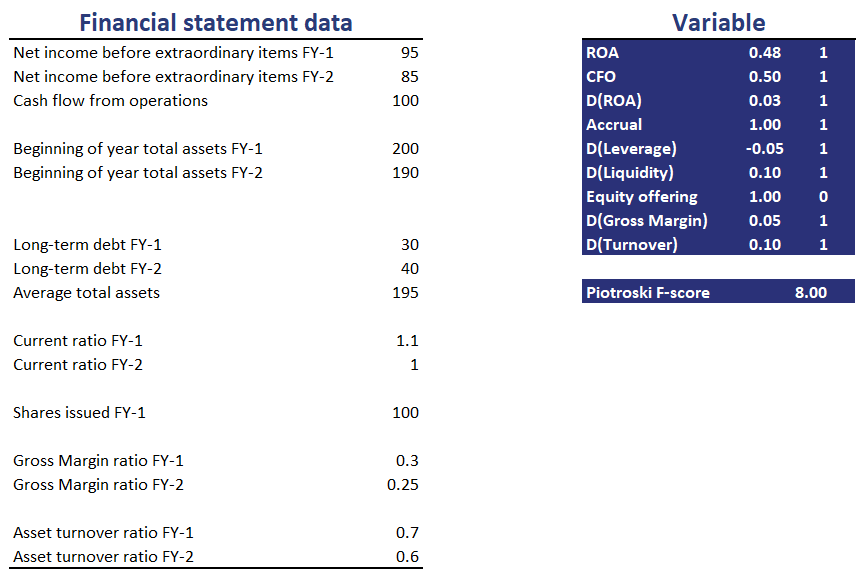

The Piotroski F-Score is a simple 9-point scoring system to determine the fundamental strength of the company. The Piotroski F Score is certainly a number you want to consider when searching for investment opportunities. In other words an F1-score from 0 to 9 0 being lowest and 9 being the highest is a mean of an individuals performance based on two factors ie.

The cumulative distribution of F-scores for FFR firms and can be used to estimate hit rates. The score is used by financial investors in order to find the best value stocks. Days Sales in Receivables Index DSRI DSRI Net Receivables t Sales t Net Receivables t-1 Sales t-1 Gross Margin Index GMI GMI Sales t-1 - COGS t-1 Sales t-1 Sales t - COGS t Sales t Asset Quality Index AQI.

It is used as a tool to uncover financial fraud. It is used to evaluate binary classification systems which classify examples into positive or negative. In a binary classification problem the formula is.

Beneish M Score Formula -484 092 DSRI 0528 GMI 0404 AQI 0892 SGI 0115 DEPI 0172 SGAI 4679 TATA 0327 LVGI Calculation of Beneish M-Score with Examples The following are the different Beneish ratios. If the M-score is less than -222 then this means that the company is unlikely to be manipulating the statements. The Piotroski Score is used to determine.

By focusing on the accounting it looks at business performance to filter the winners from the losers. The tool above provides different results from our original version of the F-Score formula which was based upon the original 2007 math. This models performance improves when it is combined with stocks with low price to book values.

F-1 score is one of the common measures to rate how successful a classifier is. The Beneish M-score is calculated using 8 variables financial ratios. These nine components are each given a pass 1 or fail 0.

In particular using 9 different business ratios that can be obtained from companies financial statements one can calculate the O-score. F1 score is defined as the harmonic mean between precision and recallIt is used as a statistical measure to rate performance. The Beneish model is a mathematical model that uses financial ratios and eight variables to identify whether a company has manipulated its earnings.

A discrete score between 0-9 which reflects nine criteria used to determine the strength of a firms financial position. Change in current ratio Current Ratio Formula The Current Ratio formula is Current Assets Current Liabilities. Here is another description of the Piotroski F Score.

This update to our original tool is the result of a collaborative project with Pasi Havia who was seeking to implement a Finnish-language version of the tool. Formula The F Score is the sum of nine components related to profitability leverage and op. The score is named after Stanford accounting professor Joseph Piotroski.

The Ohlson O-score is based on a linear factor model. Its the harmonic mean of two other metrics namely. If the ratio compared to the prior year is lower F score is 1 0 otherwise.

F Value is calculated using the formula given below. We owe our thanks to Pasi for his detective work in finding that the formula for calculating a companys F-score had changed from 2007 and for developing the new and improved code to calculate the F. Even more impressive were the results of a strategy of investing in the highest F-Score companies 8 or 9 and shorting companies with the lowest F-Score 0 or 1.

The 5 Basic Types Of Financial Ratios What Are Financial Ratios Common Financial Ratios Interpretation And List Financial Ratio Financial Analysis Financial

The 5 Basic Types Of Financial Ratios What Are Financial Ratios Common Financial Ratios Interpretation And List Financial Ratio Financial Analysis Financial

Audited Financial Statements Sample Unique In E Statement Template Free Excel Download Income Statement Statement Template Personal Mission Statement

Audited Financial Statements Sample Unique In E Statement Template Free Excel Download Income Statement Statement Template Personal Mission Statement

Piotroski F Score Implementation In Excel

Piotroski F Score Implementation In Excel

How To Calculate Your Credit Score Credit Score Financial Health Credits

How To Calculate Your Credit Score Credit Score Financial Health Credits

Use The Piotroski F Score To Seriously Improve Your Returns

Use The Piotroski F Score To Seriously Improve Your Returns

What Is A Credit Score A Credit Score Is A Number Generated By A Mathematical Formula That Is Meant To Pre Credit Score What Is Credit Score Credit Worthiness

What Is A Credit Score A Credit Score Is A Number Generated By A Mathematical Formula That Is Meant To Pre Credit Score What Is Credit Score Credit Worthiness

Countif Counta Percentage Formula Find Percentage Mom Jobs Excel

Countif Counta Percentage Formula Find Percentage Mom Jobs Excel

Fraction Calculator Math Calculator Fraction Calculator Online Math Calculator All Math Calculator Math Calculator Online Calculator F Pecahan Matematika

Fraction Calculator Math Calculator Fraction Calculator Online Math Calculator All Math Calculator Math Calculator Online Calculator F Pecahan Matematika

Pin By Berrian My Debt On Berrian My Debt Financial Strategies Successful Business Owner Investment Portfolio

Pin By Berrian My Debt On Berrian My Debt Financial Strategies Successful Business Owner Investment Portfolio

0 comments:

Post a Comment