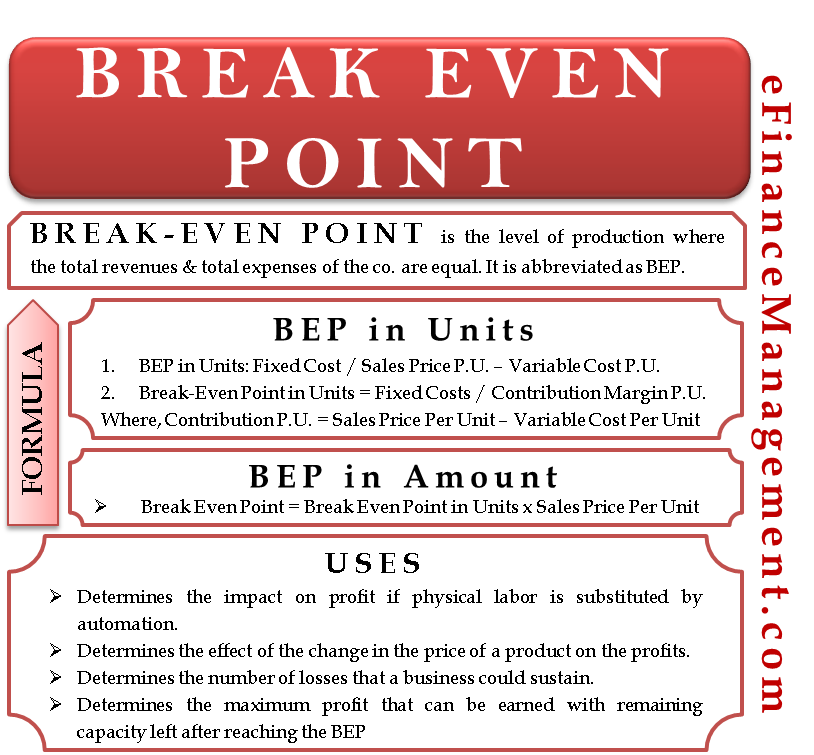

Break even point in sales value may be calculated in two ways but both give the same answer. Break even quantity Fixed costs Sales price per unit Variable cost per unit.

Break Even Point Definition Formula Example Uses Etc

Break Even Point Definition Formula Example Uses Etc

BEP in Accounting BEP in units Fixes Cost Contribution Margin per unit BEP in amount Fixed Cost Profit Volume Ratio Where Profit Volume Ratio Contribution margin per unit Selling price per unit 5.

Bep finance formula. The break-even point formula is calculated by dividing the total fixed costs of production by the price per unit less the variable costs to produce the product. Increasing the sale price. Basic earning power BEP ratio is similar to return on assets.

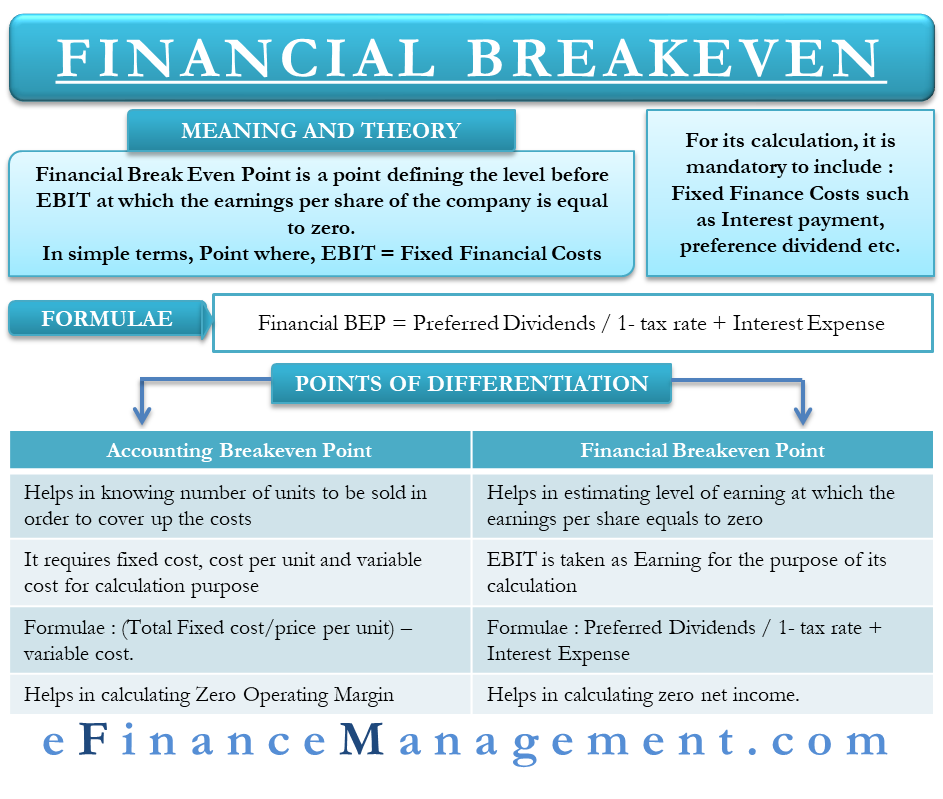

Financial break-even point attempts to find EBIT that results in zero net income. EBIT level that results in zero net income. The formula for break-even point BEP is very simple and calculation for the same is done by dividing the total fixed costs of production by the contribution margin per unit of product manufactured.

We know our total revenue will be equal to our total cost plus profit. From this we can derive formula to calculate BEP. Here provided the financial break even point formula to find the break even finance.

To compute for break-even point in dollars the following formula is followed. The formula for calculating BEP in terms of money is. Financial Break Even Point Formula.

The BEP calculator first calculates the break-even point in sales by using the basic BEP formula and then divides the BEP sales by the sale price per unit to find the BEP in units. In order to calculate your companys breakeven point use the following formula. Break Even Point Break Even Point in Units x Sales Price Per Unit.

Methods to Calculate Break Even Point in Sales Value. Formula is defined as C O P - V where C Fixed Costs O Operating Cash Flow P Price Per Unit V Variable Cost Per Unit. Say a company XYZ sells a product A at 250 and incurs a variable cost per unit of 60 and a fixed cost of 5 million.

Basic Earning Power Ratio. It is calculated by dividing earnings before interest and taxes EBIT by total assets. Formula for Break Even Analysis The formula for break even analysis is as follows.

Divide fixed costs by the revenue per unit minus the variable cost per unit. This output tells the number of units to be sold to break-even. 0 EBIT 1 Interest Expense 1 Tax Rate Preferred Dividends Rearranging the above equation we get the following formula to find the financial break-even ie.

Then the break-even point would be calculated as. Total revenue Total Cost Profit. There are a few basic formulas for determining a businesss break-even point.

By Rashid Javed MCom ACMA. So Breakeven number of units using the above formula is Breakeven Units 6600 69 36 200 Accordingly the breakeven numbers for Product A are 50 of 200 that is 100 and similarly for Product B and Product C will be 60 and 40 respectively. One is based on the number of units of product sold and the other is based on points in sales dollars.

Basic earning power BEP ratio is a measure that calculates the earning power of a business before the effect of the business income taxes and its financial leverage. Fixed Costs Price - Variable Costs Breakeven Point in Units In other words the breakeven point is equal to the total fixed costs divided by the difference between the unit price and variable costs. Calculating your break-even point.

To calculate a break-even point based on units. At break even point or BEP we know that profit will be zero. What Is the Breakeven Point BEP.

In accounting the breakeven point formula is determined by dividing the total fixed costs associated with production by the revenue per individual unit minus the. BEP in number of units 5000000 250-60 26316 units. How BEP formula is derived.

Break-even point in units. Contribution ratio may be improved by. Selling price per unit number of units variable cost number of units fixed cost Profit.

Break-even Point Sales in dollars Fixed Costs Sales Price per Unit x BEP in Units Thats the financial break-even. Contribution ratio is calculated as. Reducing the variable costs.

Break Even Point Business Education Point Formula

Break Even Point Business Education Point Formula

Financial Breakeven Meaning Formula Examples And More

Financial Breakeven Meaning Formula Examples And More

Break Even Point In Accounting Guide To Accounting Break Even Analysis

Break Even Point In Accounting Guide To Accounting Break Even Analysis

How To Do A Breakeven Point And Analysis Find Your Profit Point Analysis Finding Yourself Make Business

How To Do A Breakeven Point And Analysis Find Your Profit Point Analysis Finding Yourself Make Business

Financial Statements Analysis Analysis Bankgeschafteenglisch Financial Statements Financial Statement Analysis Financial Statement Financial Analysis

Financial Statements Analysis Analysis Bankgeschafteenglisch Financial Statements Financial Statement Analysis Financial Statement Financial Analysis

Week 5 1 Of 2 2 Easy Steps Break Even Analysis For Cost Volume Profit Analysis Tutorial Youtube Business Management Degree Management Degree Analysis

Week 5 1 Of 2 2 Easy Steps Break Even Analysis For Cost Volume Profit Analysis Tutorial Youtube Business Management Degree Management Degree Analysis

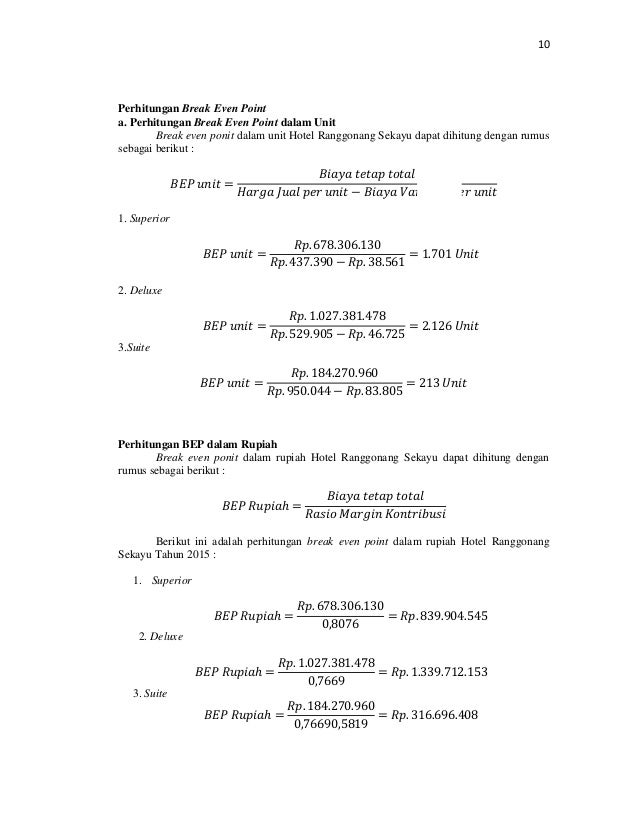

Break Even Point Sebagai Alat Perencanaan Laba Hotel

Break Even Point Sebagai Alat Perencanaan Laba Hotel

What Is The Break Even Analysis Theory Formula And Example Toolshero Financial Management Analysis Business Tools

What Is The Break Even Analysis Theory Formula And Example Toolshero Financial Management Analysis Business Tools

Break Even Point Calculator With Formula Analysis And 2 Easy Examples How To Find Out Analysis Evening

Break Even Point Calculator With Formula Analysis And 2 Easy Examples How To Find Out Analysis Evening

Break Even Point Bep Definition How To Calculate How To Reduce

Break Even Point Bep Definition How To Calculate How To Reduce

Pengertian Bep Break Even Point Dan Cara Menghitung Bep

Pengertian Bep Break Even Point Dan Cara Menghitung Bep

0 comments:

Post a Comment