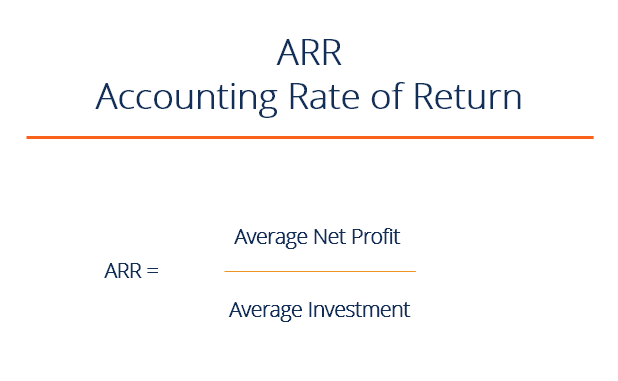

The formula to calculate Accounting Rate of Return ARR is as follows. Expressed as a percentage and where.

Accounting Rate Of Return Template Download Free Excel Template

Accounting Rate Of Return Template Download Free Excel Template

Average Room Rate ARR or ADR Total Room Revenue Total Rooms Sold.

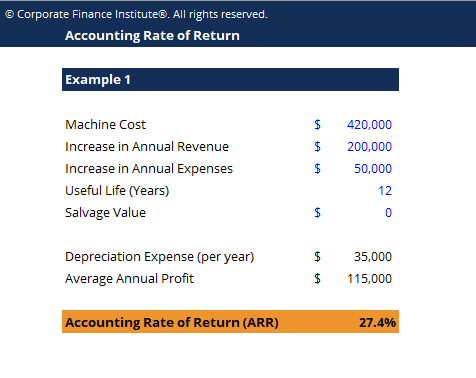

Arr finance formula. Accounting Rate of Return 12083 130000 93. Average Annual Profit is the annual cash inflow that the project will generate after deducting depreciation. Doing an ARR calculation is relatively simple.

Accounting Rate of Return shortly referred to as ARR is the percentage of average accounting profit earned from an investment in comparison with the average accounting value of investment over the period. The ARR formula divides an assets average revenue by the companys initial investment to derive the ratio or return that one may expect over the lifetime of the asset or related project. The ratio does not take into account the concept of time value of money.

The formula for ARR or ADR calculation with examples. Accounting rate of return also known as the Average rate of return or ARR is a financial ratio used in capital budgeting. ARR calculates the return generated from net income of the proposed capital investment.

The ARR formula can be understood in the following steps. Hence the formulae for annual recurring revenue is ARR A B C D E To calculate MRR divide this amount by 12 and you will get monthly recurring revenue. If the ARR is equal to or greater than the required rate of return the.

Average Accounting Income 32000 19917 12083. The first formula is the following. SEE HOW WE CALCULATE ARR IN YOUR BUSINESS In order to use ARR as a metric in your business you should have Term Agreements of one year or more or the majority of your Term Agreements should be one year or more.

Step 1 First figure out the cost of a project that is the initial investment required for the project. First make seperate computations for the. The ARR is a percentage return.

Average Investment Book Value at Year 1 Book Value at End of Useful Life 2. Annual Depreciation 130000 10500 6 19917. Of course that doesnt mean too much on its own so heres how to put that into practice and actually work out the profitability of your investments.

Average Rate of Return formula Average annual net earnings after taxes Average investment over the life of the project 100 Explanation The formula for the calculation of the average return can be obtained by using the following steps. ARR overall subscription cost per year recurring expansion revenue revenue lost from churned customers. ARR Overall Subscription Cost Per Year Recurring Revenue From Add-ons or Upgrades - Revenue Lost from Cancellations.

The Excel formula is 25000EndDate Start Date365 or you can use SaaSOptics to generate the value automatically. The ARR formula is simple. Text Average rate of return frac text Average annual profit text Cost of.

The ARR may be calculated over one or more years of a projects lifespan. ARR Average Annual profit after tax divided by Average capital investment then multiply the quotient by 100. ARR Average Annual Profit Average Investment.

Annual Depreciation Initial Investment Scrap Value Useful Life in Years. The ARR itself is derived from dividing the average profit positive or negative by the average amount of money invested. Accounting Rate of Return is also known as the Average Accounting Return AAR and Return on Investment ROI.

TextARRfractextAverage ProfitstextAverage Investmenttext timestext 100 text Accounting Rate of Return Example. It is defined as the value of the contracted recurring revenue components of your term subscriptions normalized to a one-year period. Formula for the calculation of the accounting rate of return of an asset or project.

1Average annual profit over the given period of the investment and 2. If calculated over several years the averages of investment and revenue are taken. Average Room Rate ARR or ADR Total Room Revenue Total Occupied Rooms.

The Accounting Rate of Return formula is as follows. Average Annual Profit Total profit over Investment Period Number of Years. To calculate the average rate of return a business will first calculate the average annual profit.

Formula textARR frac textaverage annual accounting profit textinitial investment. It would be better to state the formula as follows. Its important to note that any expansion revenue earned through add-ons or upgrades must affect the annual subscription price of a customer.

How to grow ARR. To calculate ARR simply add the dollar amount of yearly subscription revenue with the dollar amount gained from expansion revenue and then subtract the dollar amount lost from churn. Accounting Rate of Return ARR Average Annual Profit Initial Investment.

Say if ARR 7 then it means that the project is expected to earn seven cents out of each dollar invested. Accounting Rate of Return formula. ARR is an acronym for Annual Recurring Revenue a key metric used by SaaS or subscription businesses that have term subscription agreements meaning there is a defined contract length.

The accounting rate of return has two different formulas that can be used to derive the return of the project. To learn more launch our financial analysis courses. For instance if the annual profit for a given project over a three year span averages 100 and the average investment in a given year is 1000 the ARR would be 100 1000 10.

The formula for ARR is. ARR average annual profit average investment. How to calculate ARR.

How To Calculate Accounting Rate Of Return In 5 Steps Never Stop Learning Accounting Calculator

How To Calculate Accounting Rate Of Return In 5 Steps Never Stop Learning Accounting Calculator

Creating Effective Financial Powerpoint Presentations 24point0 Editable Powerpoint Slides Templates Financial Statement Financial Ratio Financial Statement Analysis

Creating Effective Financial Powerpoint Presentations 24point0 Editable Powerpoint Slides Templates Financial Statement Financial Ratio Financial Statement Analysis

List Of Kpi Key Performance Indicators For Hotel Front Office Front Office Key Performance Indicators Hotel Management

List Of Kpi Key Performance Indicators For Hotel Front Office Front Office Key Performance Indicators Hotel Management

Financial Management Formulas Part 2 Financial Management Finance Investing Investing

Financial Management Formulas Part 2 Financial Management Finance Investing Investing

Business Finance Doodle Hand Drawn Elements Concept Graph Chart Pie Arr Caratulas De Contabilidad Portada De Cuaderno De Ciencias Portadas De Matematicas

Business Finance Doodle Hand Drawn Elements Concept Graph Chart Pie Arr Caratulas De Contabilidad Portada De Cuaderno De Ciencias Portadas De Matematicas

Arr Accounting Rate Of Return Guide And Examples

Arr Accounting Rate Of Return Guide And Examples

Dropping A Product Line Shortcut Formula Simple Math Fixed Cost Segmentation

Dropping A Product Line Shortcut Formula Simple Math Fixed Cost Segmentation

Hotel Valuation Financial Model Template Efinancialmodels Hotel Revenue Management Budget Forecasting Financial Modeling

Hotel Valuation Financial Model Template Efinancialmodels Hotel Revenue Management Budget Forecasting Financial Modeling

Accounting Rate Of Return In Financial Management Rating Walls

Accounting Rate Of Return In Financial Management Rating Walls

Annual Financial Report Template Inspirational Annual Finance Report Template In 2021 Excel Templates Finance Report Template

Annual Financial Report Template Inspirational Annual Finance Report Template In 2021 Excel Templates Finance Report Template

0 comments:

Post a Comment