A good payback period will vary depending on the investor investment and circumstance. For example if a company invests 300000 in a new production line and the production line then produces positive cash flow of 100000 per year then the payback period is 30 years 300000 initial investment 100000 annual payback.

Payback Period Learn How To Use Calculate The Payback Period

Payback Period Learn How To Use Calculate The Payback Period

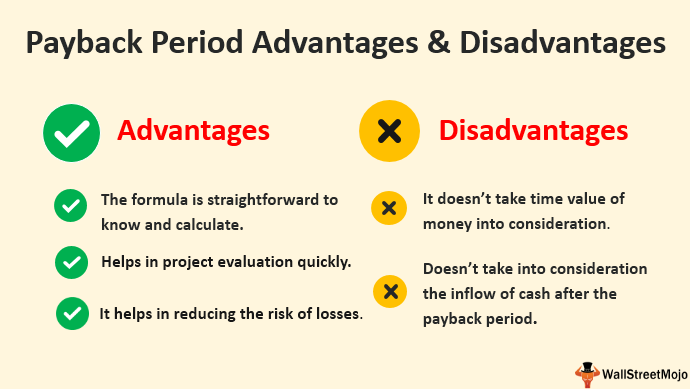

The payback period formula is used for quick calculations and is generally not considered an end-all for evaluating whether to invest in a particular situation.

Finance formula payback period. PP Initial Investment Cash Flow For example if you invested 10000 in a business that gives you 2000 per year the payback period is 10000 2000 5. The payback period is expressed in years and fractions of years. Also in order to use this formula the net cash flow must remain equal over each period of payments.

Payback Period formula Full Years Until Recovery Unrecovered Cost at the beginning of the Last YearCash Flow During the Last Year Capital Budgeting is one of the important responsibilities of a finance manager of a company. The formula to calculate the payback period of an investment depends on whether the periodic cash inflows from the project are even or uneven. The payback period is the amount of time usually measured in years it takes to recover an initial investment outlay as measured in after-tax cash flows.

Payback period Initial Investment or Original Cost of the Asset Cash Inflows. Applying the formula to the example we take the initial investment at its absolute value. Generally when deciding between multiple projects the project with the shorter payback period is the more attractive investment.

Net Cash Flow per Period. It is an important calculation used in. The payback period should not be the sole determining factor in capital budgetingIt should be considered alongside other financial metrics and analyses of micro and.

The payback period is calculated by dividing the amount of the investment by the annual cash flow. Period In this formula the net cash flow would be over the course of the set payback period. Payback Period Formula Payback.

Generally the shorter the payback period is the better it is for the firm. First we must discount ie bring to the present value the net cash flows that will occur during each year of the project. As you can see using this payback period calculator you a percentage as an answer.

With this information the payback period can be calculated as follows. If the cash inflows are even such as for investments in annuities the formula to calculate payback period is. The payback period formula is used to determine the length of time it will take to recoup the initial amount invested on a project or investment.

Because the cash inflow is uneven the payback period formula cannot be used to compute the payback period. The payback period formula is one of the methods used to analyse investment projects. When the cash flow remains constant every year after the initial investment the payback period can be calculated using the following formula.

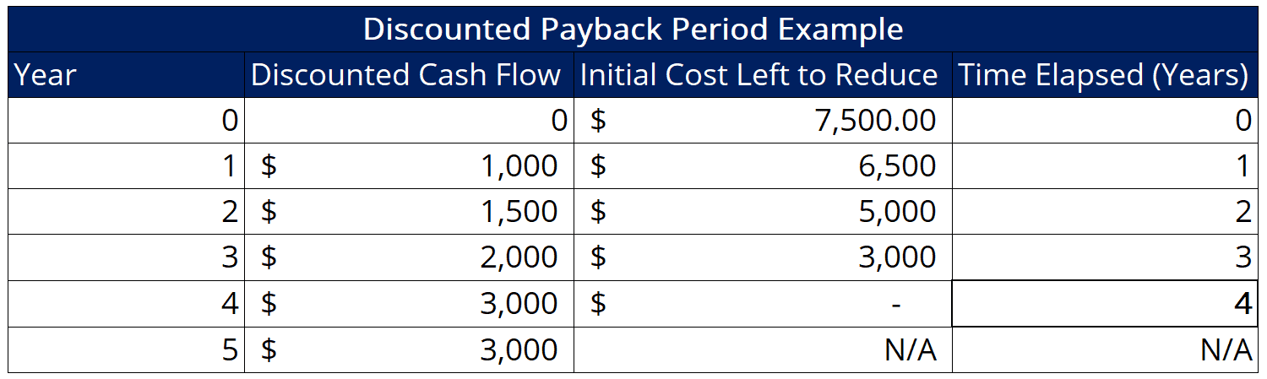

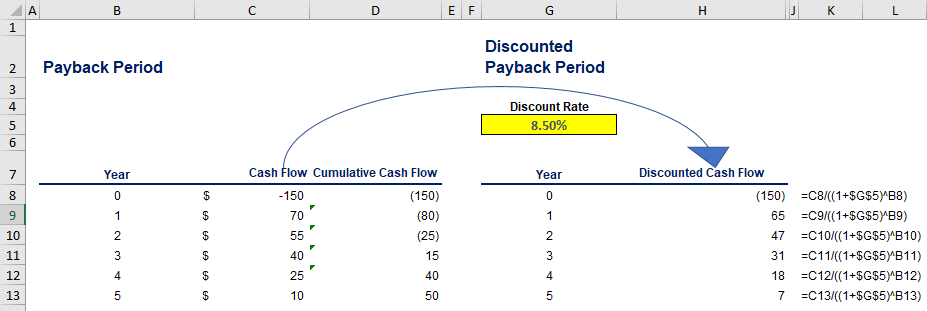

Understanding the Payback Period Corporate finance is all about capital budgeting. Discounted Payback Period Formula There are two steps involved in calculating the discounted payback period. We can compute the payback period by computing the cumulative net cash flow as follows.

Payback period Formula Total initial capital investment Expected annual after-tax cash inflow. A particular Project Cost USD 1 million and the profitability of the project would be USD 25 Lakhs per year. The simple payback period formula is calculated by dividing the cost of the project or investment by its annual cash inflows.

Second we must subtract the discounted cash flows. Payback Period 1 million 25 lakh. Payback period 3 15000 40000 3 0375.

The simple payback period formula would be 5 years the initial investment divided by the cash flow each period. Let us see an example of how to calculate the payback period when cash flows are uniform over using the full life of the asset. The opening and closing period cumulative cash flows are 900000 and 1200000 respectively.

The calculation used to derive the payback period is called the payback method. Payback period PP is not used to understand whether an investment is profitable or not. Assuming the rate is 10 the present value of the first cash flow would be 90909 which is 1000 divided 1r.

Payback period 2 years 10002000 25 years The payback period is a measure of the firms liquidity. A period of time in which the cost of investment is expected to be covered with cash flows from this investment. To find exactly when payback occurs the following formula can be used.

Its time that needed to reach a break-even point ie. Using Payback Period Formula We get-. Calculate the Payback Period in years.

However the discounted payback period would look at each of those 1000 cash flows based on its present value.

Discounted Payback Period Definition Formula And Example

Discounted Payback Period Definition Formula And Example

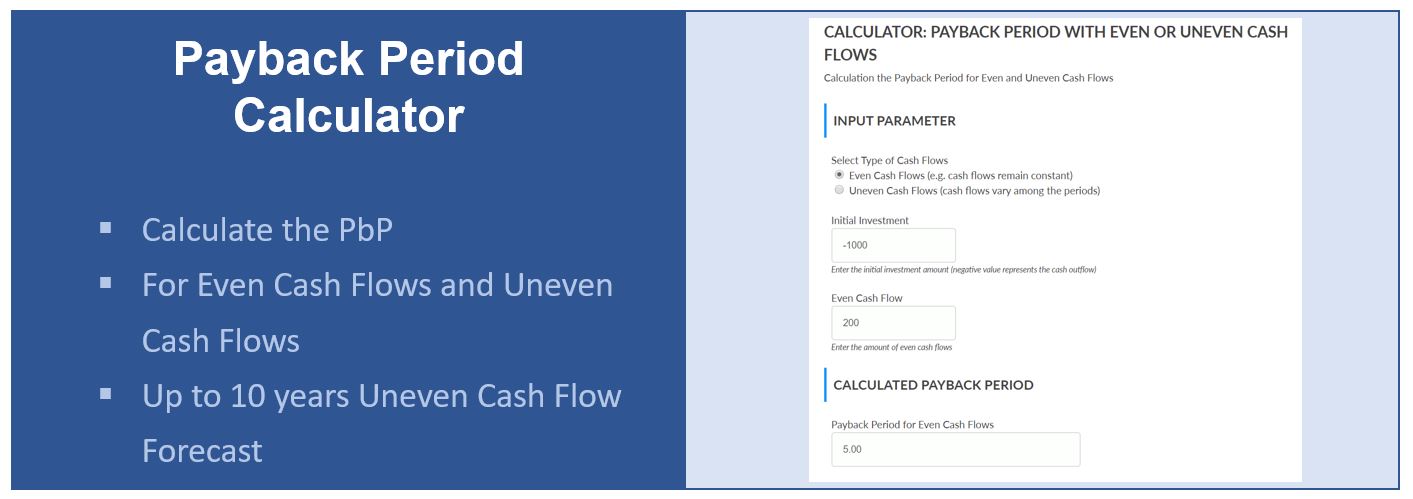

Payback Period Calculator Pbp For Even Uneven Cash Flows Project Management Info

Payback Period Calculator Pbp For Even Uneven Cash Flows Project Management Info

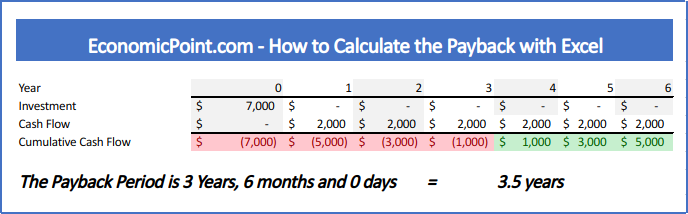

How To Calculate The Payback Period In Excel

How To Calculate The Payback Period In Excel

Calculation Of Pay Back Period Pbp Assignment Point

Calculation Of Pay Back Period Pbp Assignment Point

Discounted Payback Period Vs Payback Period Soleadea

Discounted Payback Period Vs Payback Period Soleadea

Finance 2 2 Static Cm Static Payback Period Method Spp Flashcards Quizlet

Finance 2 2 Static Cm Static Payback Period Method Spp Flashcards Quizlet

What Is The Discounted Payback Period 365 Financial Analyst

What Is The Discounted Payback Period 365 Financial Analyst

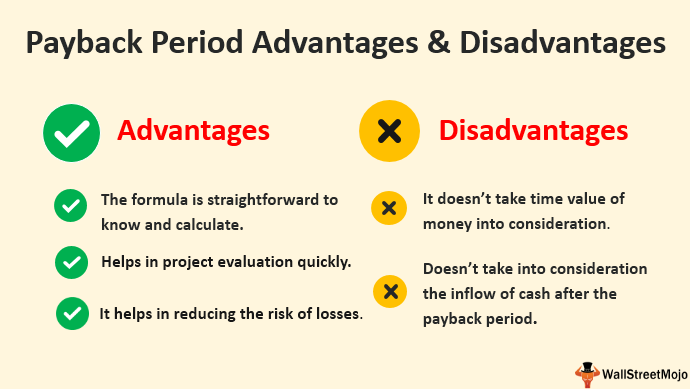

Payback Period Advantages And Disadvantages Top Examples

Payback Period Advantages And Disadvantages Top Examples

Discounted Payback Period Meaning Formula How To Calculate

Discounted Payback Period Meaning Formula How To Calculate

How To Calculate The Payback Period With Excel

Payback Period Business Tutor2u

Payback Period Business Tutor2u

0 comments:

Post a Comment