Finance For Non Residents Nz

You may also be required to have a specific amount of New Zealand dollars in a New Zealand bank account. New residents and New Zealanders who have been living outside New Zealand for at least 10 years can get an exemption from paying tax on some investments.

Guide To Foreign Investment In New Zealand

Guide To Foreign Investment In New Zealand

You need to be at least 18 years old a NZ Citizen or Resident or have a Work VISA and have consistent and regular income of at least 500 per week.

Finance for non residents nz. New Zealand has a reciprocal health agreement with Australia that covers Australian residents and citizens who are not ordinarily resident in New Zealand for immediately necessary medical treatment while they are on holiday. If youre an Australian citizen present in New Zealand at the time youre applying for your IRD number you will complete an IRD number application. What if I have bad credit.

To cease to be a New Zealand tax resident a person must be absent from New Zealand for at least. Your exemption lasts for up to 4 years and means you do not pay PIR on income that you get from foreign investments as long as. Non-resident income tax return.

If you are not eligible make sure you have travel insurance that includes health cover. If youre a New Zealand tax resident youll become a non-resident taxpayer if you both. Minimum income conditions also apply for some cards.

Are away from New Zealand for more than 325 days in any 12-month period. Lending transactions range from 2 million to. Tax assessment notice for the non-resident income tax as regards the calculation of the tax Change of address or family situation as non-resident Rates and taxable income.

Capital gains tax for non-residents. Do not have a permanent place of abode in New Zealand. Subsidies on prescribed medicines.

Subsidised primary healthcare services eg doctors visits. Also called the 325-day rule youll need to know how to count days absent from New Zealand. You will be asked to provide details of your monthly expenses including rent and boarding costs.

New Zealand residents and non-residents Resident in New Zealand has the same meaning as that used in current New Zealand income tax practice where a non-resident withholding tax NRWT flag is used to identify non-residents. You are a New Zealand citizen or. Living and working in different EU Member States.

NRWT is deducted from a non-residents New Zealand income. Knowing when you become a non-resident taxpayer. You are an Australian citizen.

Personal loans for non-residents Personal loans are not usually loans that are specifically designed for migrants but rather are loans that have flexible eligibility criteria that allow migrants. You are not unlawfully resident in New Zealand or here on a temporary entry class visa or temporary permit or. Counting the 325 days.

IRD number application - non-residentoffshore individual IR742 June 2018 If these dont apply then use the IRD number application - resident individual IR595 form. You are considered to be lawfully resident to apply for a benefit or pension if you live in New Zealand and. Under the New Zealand tax system non-residents are taxed only on their New Zealand-sourced income.

Special Tax Rates applicable to Non-residents for various incomes. Data is provided according to accounting policies that meet the terms of the Financial Reporting Act 1993. You must have a regular New Zealand taxable income to apply for a credit card.

The types of income non-resident passive income and the maximum rates of NRWT are. It is not means tested and is paid regardless of any other private income you may receive although ACC benefits for injury from accidents may affect your allowance. - dividends30 - interest15 - royalties15.

Income Tax Slabs Rates for Non Resident Individual Firm and Corporate tax payers for AY 2020-21 and AY 2021-22 TDS Rates AY 2021-22. TDS Rates for AY 2021-22 FY 2020-21 for Salary Wage and Other Payments to Non-Resident payees. Sometimes payments made under a contract are taxed at a flat rate called a withholding payment or schedular payment tax is withheld from your fee.

If youre getting interest dividends or royalties from a New Zealand source youll probably pay non-resident withholding tax NRWT on this income. If you are eligible you could get free or subsidised health and disability services in New Zealand. Interest dividends and royalties.

In the case of interest you may choose to pay the approved issuer levy AIL instead. The shareholders of Spinnaker are well known and respected New Zealand domiciled businessmen who have been involved in the property finance industry for over 35 years. No Proof of Income.

NZ Super and help for the elderly NZ Super is available for citizens and residents aged 65 and over. You pay tax on NZ Super payments. 1 For full details go to wwwirdgovtnz search keyword.

External site link If youre not a resident of NZ and are only here to work on a contract. The income from them is made outside New Zealand. Spinnaker Capital is a private non bank lender on commercial and residential property development and bridging projects in New Zealand.

Expenses cant be claimed against non-resident passive income.

Expat Tax 2020 Formal Emigration Is Not The Answer Emigration Expat South Africa

Expat Tax 2020 Formal Emigration Is Not The Answer Emigration Expat South Africa

Unsecured Loans Nz Get A Quick Unsecured Cash Loan In 60 Minutes Unsecured Loans Cash Loans Loan Lenders

Unsecured Loans Nz Get A Quick Unsecured Cash Loan In 60 Minutes Unsecured Loans Cash Loans Loan Lenders

Difference Between Nro Nre And Fcnr Account Managing Finances Finance Finance Bank

Difference Between Nro Nre And Fcnr Account Managing Finances Finance Finance Bank

Non Resident Finance Non Bank Broker

Non Resident Finance Non Bank Broker

Self Employed Mortgages Home Loans New Zealand Ilender

Self Employed Mortgages Home Loans New Zealand Ilender

State Houses In Porirua East Nzhistory New Zealand History Online New Zealand Nz History History Online

State Houses In Porirua East Nzhistory New Zealand History Online New Zealand Nz History History Online

Ilender Mortgage And Lending Specialists 0800 Lender Finance Loans Mortgage Brokers Mortgage

Ilender Mortgage And Lending Specialists 0800 Lender Finance Loans Mortgage Brokers Mortgage

Received A Letter From New Zealand S Ird Requesting Details Of Overseas Income Stop Read This Essential Artic New Zealand Filing Taxes Understanding Yourself

Received A Letter From New Zealand S Ird Requesting Details Of Overseas Income Stop Read This Essential Artic New Zealand Filing Taxes Understanding Yourself

Helping Get Home Loans For Non Residents In Nz Approved Mortgages

Helping Get Home Loans For Non Residents In Nz Approved Mortgages

Banking Project Pictures Loans Deposits Rates Of Interest Bar Graphs Pie Charts Etc Google Search Finance Pie Chart Bank Deposit

Banking Project Pictures Loans Deposits Rates Of Interest Bar Graphs Pie Charts Etc Google Search Finance Pie Chart Bank Deposit

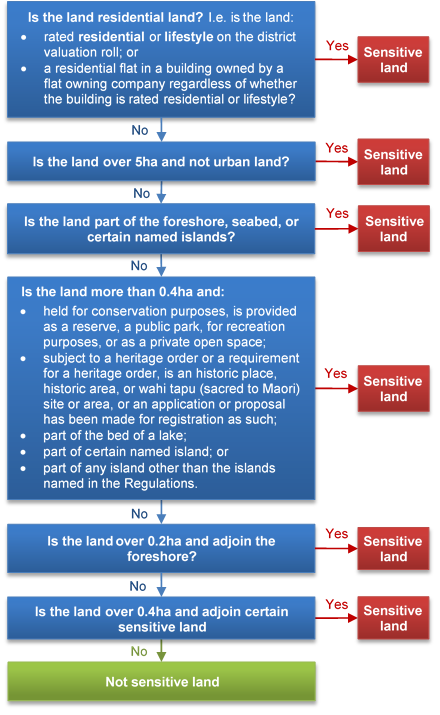

New Rules For Non Resident Buyers In New Zealand New Zealand Property Guides

New Rules For Non Resident Buyers In New Zealand New Zealand Property Guides

Post a Comment for "Finance For Non Residents Nz"