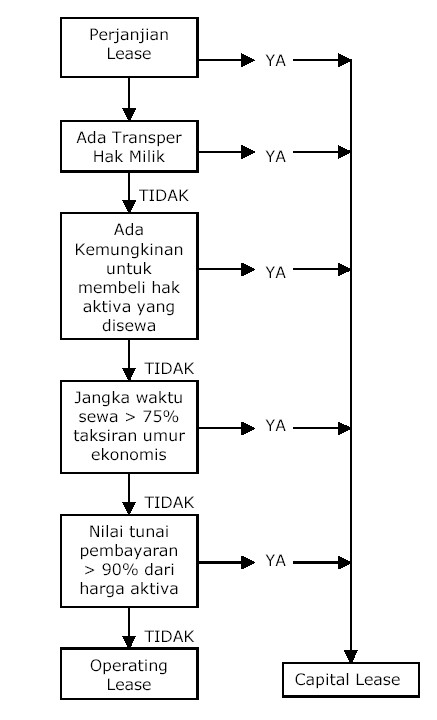

This option is usually determined at the beginning of the lease. These criteria help to identify whether a lease allows the lessee to have effective control over the underlying asset.

Pengertian Dan Klasifikasi Persewaan Leasing Gudang Teori

Pengertian Dan Klasifikasi Persewaan Leasing Gudang Teori

There is a bargain purchase option an option given to the lessee to purchase the asset at a price lower than its fair value at a future date typically the end of the lease term.

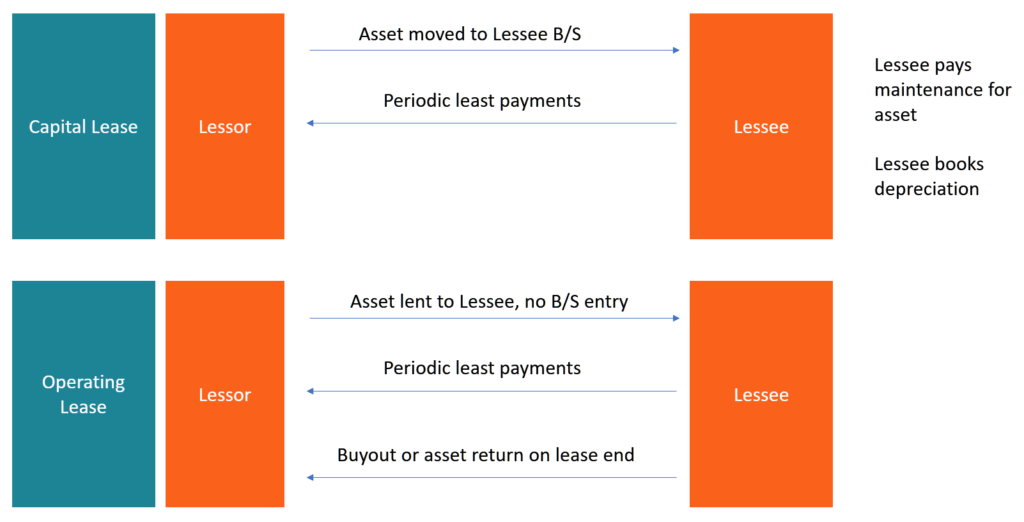

5 criteria for finance lease. Because this lease doe not meet any of the five criteria for a finance lease it is an operating lease under the new standard but the lease term is greater than 12 months so the new standard requires balance sheet presentation. At the inception of the lease the present value of the minimum lease payments amounts to substantially all of the fair value of the asset. In the case of a financial lease the lessee would need to take care and maintain the asset.

In the case of an operating lease the lessor would need to take care and maintain the asset. ASC 842 requires leases to be classified as finance leases if they meet any of the following five criteria. 1 Transfer of Ownership.

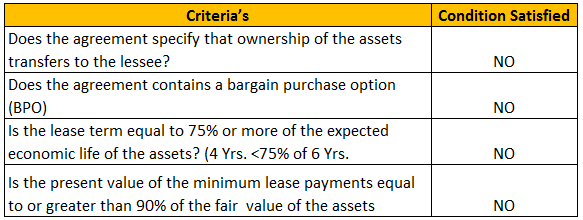

The requirements for capital lease revolves around mainly four things ownership purchase option the term of the contract present value of lease rentals. A bargain purchase option ie one that is reasonably certain to be exercised for the leased asset exists. The lease transfers ownership of the underlying asset to the lessee by the end of the lease term.

At the commencement of a finance lease the leased asset should be recognised as a non-current asset at the lower of. The issue that arises here is whether the lead entity should recognise the finance leases on a gross basis in its accounts or whether it should net off the transactions in its accounts. The treatment will depend on the terms of the individual transaction.

Initial Recognition of Finance Leases. The contract is called the rental agreementcontract. Capital lease criteria should be satisfied before calling it a capital lease.

A company would need to perform the finance versus operating lease test which is composed of five parts under topic 842. The lease grants the lessee an option to purchase the underlying asset that the lessee is reasonably certain to exercise. Other indicators that a lease is a finance lease include.

The fair value of the asset and. At least one of the following criteria must be met in order to consider the lease a financing lease. The lease term is for the major part of the remaining economic life of the asset.

The leased asset is of a specialised nature. Ownership of the asset is transferred to the lessee at the end of the lease term. The lessee can buy the asset from the lessor at the end of the lease term for a below-market price.

Service concession arrangements see IFRIC 12 Service Concession Arrangements. The criteria for a capital lease can be any one of the following four alternatives. IFRS 16 Leases applies to all leases including subleases except for.

There is an option to purchase the underlying asset that is likely to be exercised. The present value of minimum lease payments. Remember if a lease meets any of the five criteria it is a finance lease.

Finance leases must meet the following criteria under IAS 17. When a lessee has designated a lease as a finance lease it should recognize the following over the term of the lease. The underlying asset transfers ownership to the lessee at the end of term.

The lease conveys no ownership at the end of the lease term contains no purchase option and requires no guarantee of residual value. The ongoing amortization of the right-of-use asset The ongoing amortization of the interest on the lease liability Any variable lease payments that are not included in the lease liability. CLASSIFICATION CRITERIA FOR LEASE LESSOR AND LESSEE 5 CRITERION PROCESS TO CLASSIFY A LEASE At the commencement of a lease an entity must consider five criteria for classifying the lease.

In this case the entity should currently look at the de-recognition requirements of IAS 39 Financial Instruments. Under US accounting standards a finance capital lease is a lease which meets at least one of the following criteria. Ownership is transferred at the end of the lease term.

The lease agreement transfers ownership of the asset to the lessee by the end of the lease. The ownership of the asset is shifted from the lessor to the lessee by the end of the lease period. Ownership of the asset is transferred by the end of the lease term.

If the lease meets any of the following five criteria then it is a finance lease. IFRS 163 leases to explore for or use minerals oil natural gas and similar non-regenerative resources. At commencement of the lease term finance leases should be recorded as an asset and a liability at the lower of the fair value of the asset and the present value of the minimum lease payments discounted at the interest rate implicit in the lease if practicable or else at the entitys incremental borrowing rate IAS 1720.

Leases of biological assets held by a lessee see IAS 41 Agriculture. If a lease agreement contains at least one out of the five following criteria it should be classified as a finance lease. This prevents companies from hiding financial obligations that are basically liabilities.

The fair value of the asset is the amount the entity would pay in cash to purchase the asset outright. The contract is called a loan agreementcontract. Keeping in mind the little-talked-about new details and definitions surrounding finance leases lets move on to the criteria for finance leases as outlined in ASC 842.

A lease meeting any of the following five criteria is classified as a finance lease. There is a title transfer at the end of the lease term. Transference of titleownership to the lessee Transfer of ownership occurs by the end of the lease term.

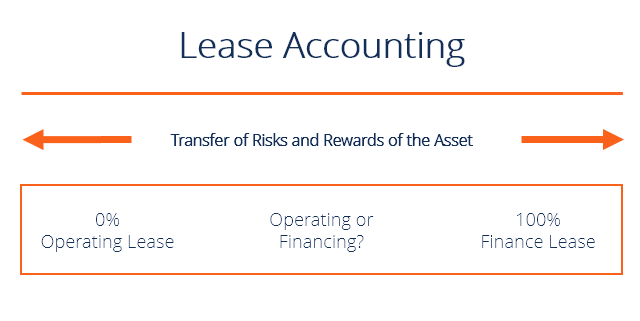

Lease Accounting Operating Vs Financing Leases Examples

Lease Accounting Operating Vs Financing Leases Examples

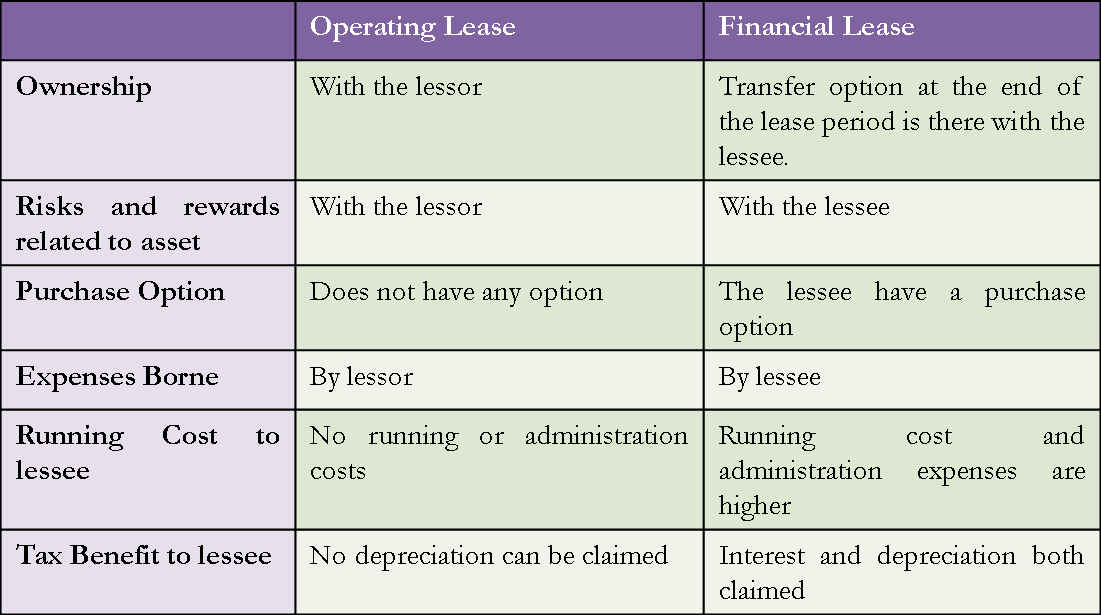

Financial Lease Vs Operating Lease Top 10 Differences

Financial Lease Vs Operating Lease Top 10 Differences

Capital Lease Vs Operating Lease Difference And Comparison Diffen

Capital Lease Vs Operating Lease Difference And Comparison Diffen

Capital Lease Vs Operating Lease What You Need To Know

Capital Lease Vs Operating Lease What You Need To Know

Lease Classification Cornell University Division Of Financial Affairs

Lease Classification Cornell University Division Of Financial Affairs

21 Chapter Accounting For Leases Intermediate Accounting 12th Edition Ppt Video Online Download

21 Chapter Accounting For Leases Intermediate Accounting 12th Edition Ppt Video Online Download

Capital Lease Criteria Top 4 Step By Step Examples With Explanation

Capital Lease Criteria Top 4 Step By Step Examples With Explanation

-A-Guide-for-Tech-Com/Tech_Lease-Accounting-Guide_brochure_10-18_webcharts1.png.aspx) Lease Accounting A Guide For Tech Companies Bdo Insights

Lease Accounting A Guide For Tech Companies Bdo Insights

Difference Between Operating Versus Financial Capital Lease Efm

Difference Between Operating Versus Financial Capital Lease Efm

0 comments:

Post a Comment