Ke Finance Formula

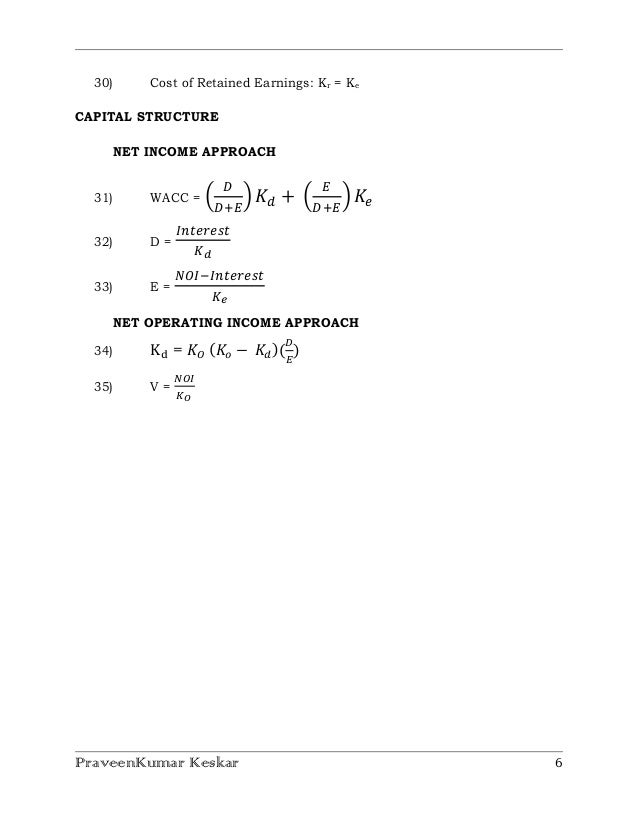

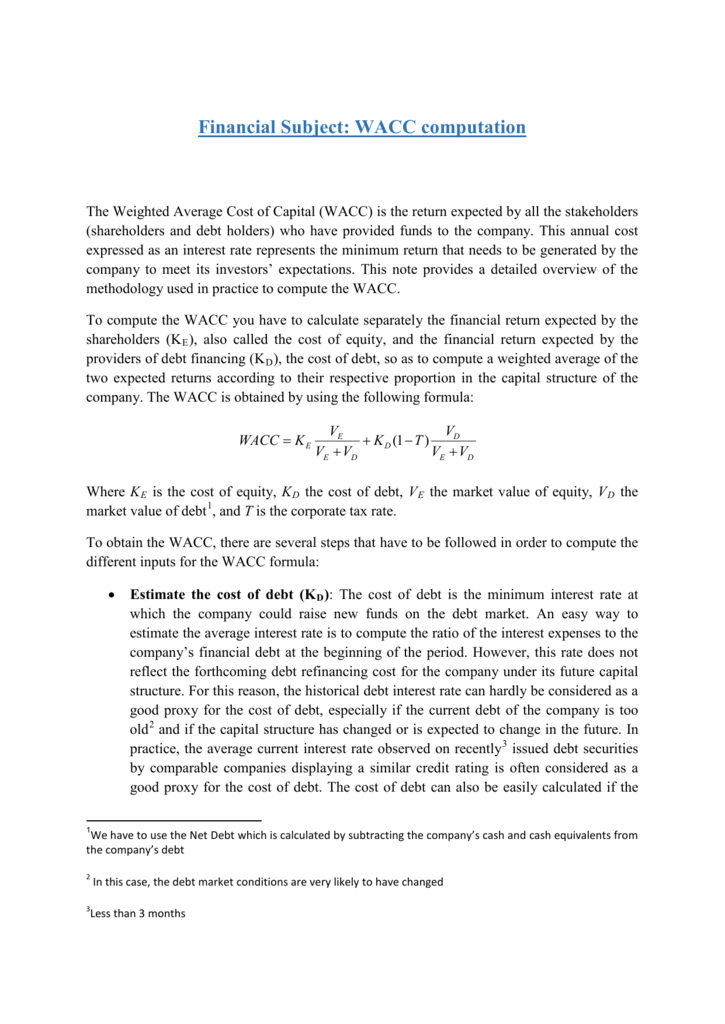

V Value of firm. V Total value of the firm.

R Cost of Equity or the required rate of return.

Ke finance formula. RUMUS EXCEL Pada kesempatan kali ini kita akan membahas materi tentang kumpulan rumus fungsi excel lengkap beserta contohnya dan fungsinya untuk di dunia kerja kita akan jabarkan secara detail mulai dari pengertian langkah langkah kode perintah dan materi dari excel beserta contoh pembahasannya. However you must adjust the range inside the formula to count rows. Pengaspalan sirkuit balap secara menyeluruh akan dimulai bulan depan.

Lets dive right in Compatibility Excel Formulas. S Value of equity. S V B V EBIT Ke.

Showing only Business Finance definitions show all 21 definitions Note. Cost of Equity 1763. B Total debt.

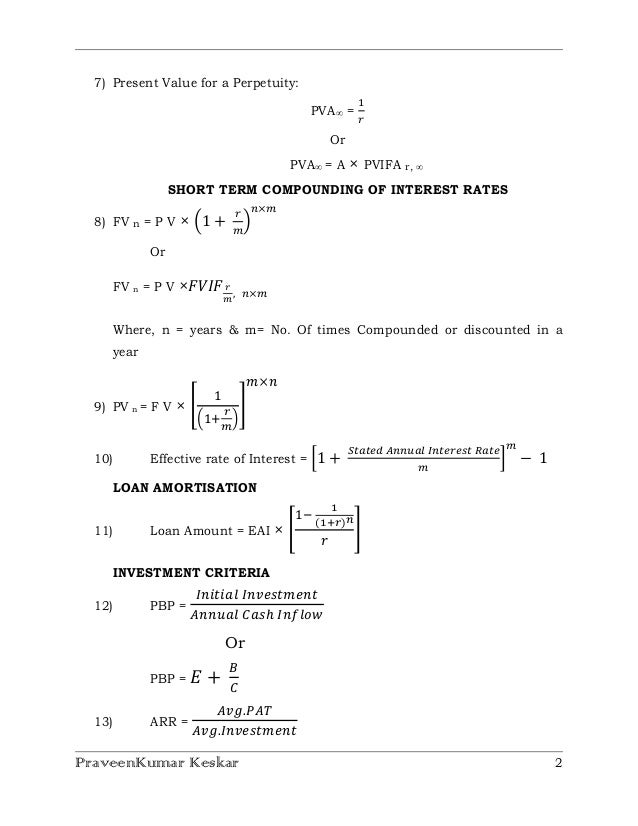

Sementara itu Perhelatan balap Formula E bakal digelar Juni mendatang. Annuity - Present Value. K Overall cost of capital.

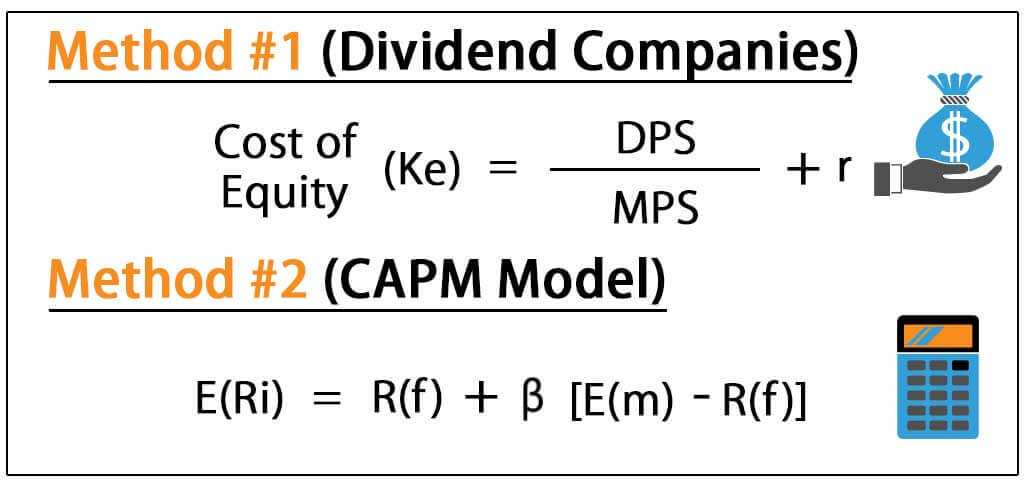

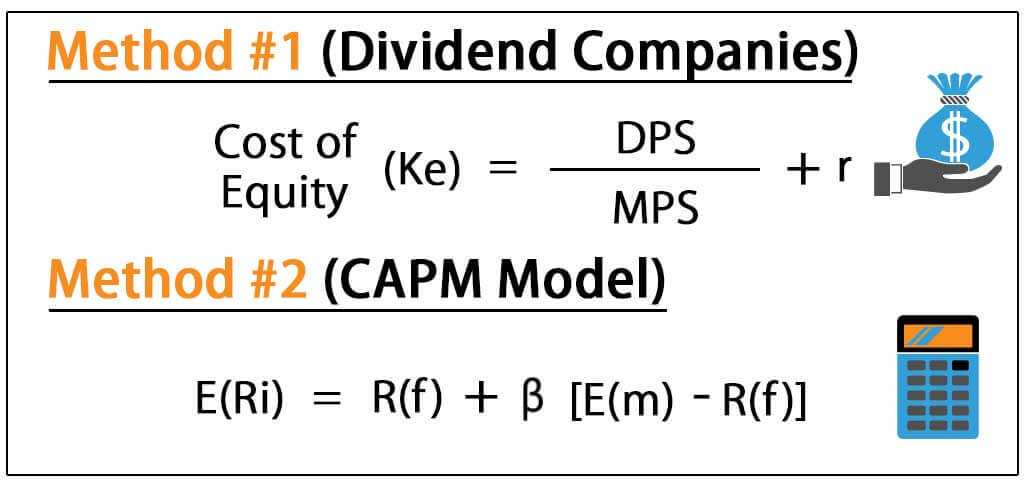

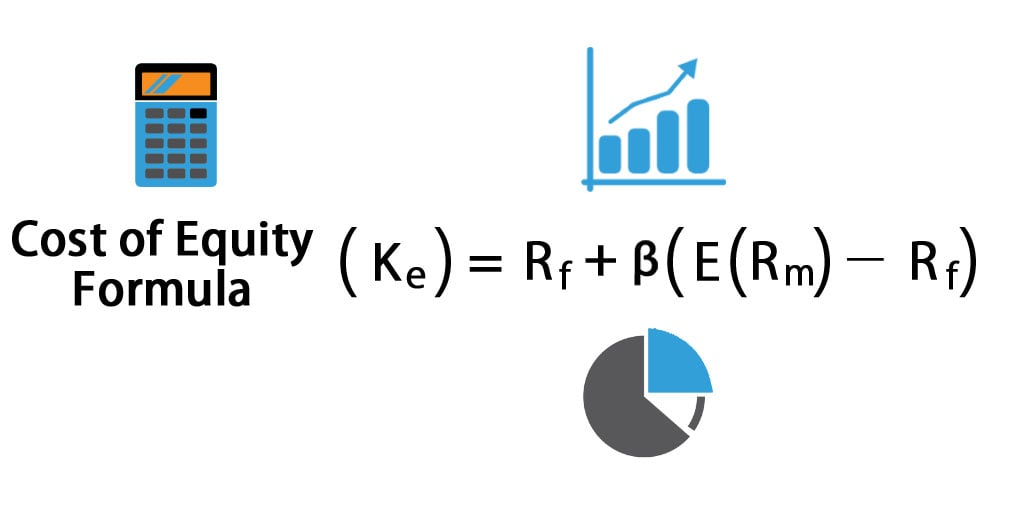

Database Excel Formulas Functions. Ke Equity Capitalisation Rate. Cost of Equity ke R f β ER m R f Cost of Equity 748 118 86 Cost of Equity 748 10148.

Lets take an example of a company Exxon Mobil listed on New York Stock Exchange. It is the rate which the company needs to generate to allure the investors to invest in their stock at the market price. Cost of Equity is calculated using below formula.

Based on years and years of experience we have compiled the most important and advanced Excel formulas that every world-class financial analyst must know. Annuity - Payment PV Annuity - Payment FV Annuity - PV Solve for n. And what is the current cost of capital.

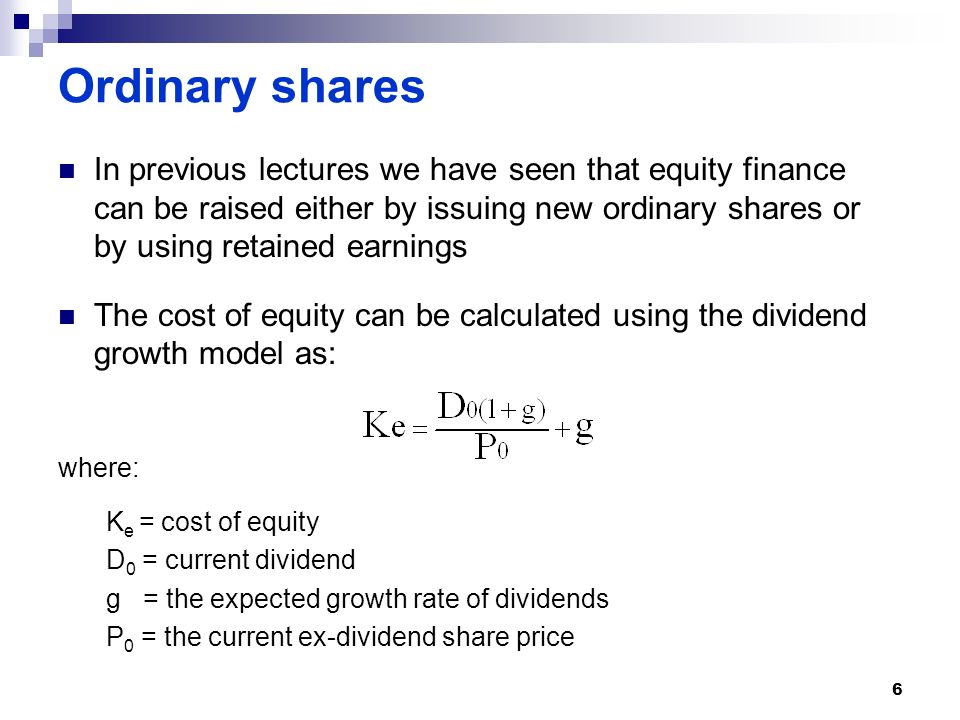

Ke D0 1gP0 g. These formulas we can use in Excel 2013. We have 15 other definitions for KE in our Acronym Attic.

G future dividend growth. The results of the regression are then used in the K-ratio. Annuity - Future Value.

At that point what will the Kne cost of new common equity be. The calculation involves running a linear regression on the logarithmic cumulative return of a Value-Added Monthly Index VAMI curve. VLOOKUP INDEX MATCH RANK AVERAGE SMALL LARGE LOOKUP ROUND COUNTIFS SUMIFS FIND DATE and many more.

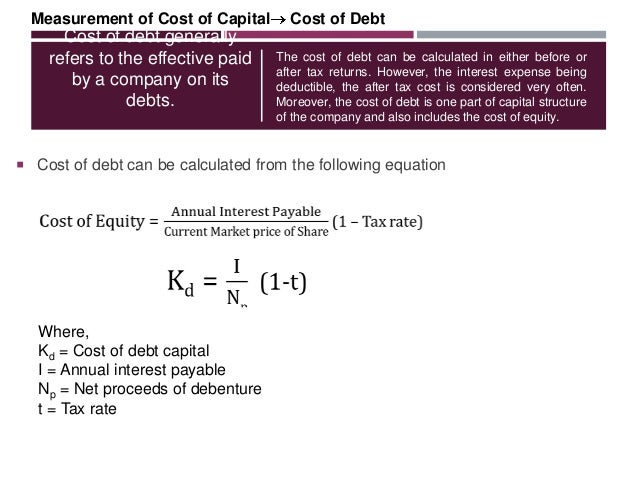

Assets Liabilities Shareholders Equity The three components of the basic accounting formula are. Kd cost of debt required rate of return i annual interest paid. Ke Cost of Equity Capital.

COUNTvalue1 value2 Example. Annuity - Future Value w Continuous Compounding. A Plc has 10 debentures quoted at 80 of par where par is 100.

Ke the cost of equity shareholders required rate of return D1 dividend to be paid at the end of year 1. Assumes dividends are paid and the company has a share price. And what will the cost of capital be.

What is the Basic Accounting Formula. D 1 Expected dividend amount for next year. What is the cost of debt.

You can use the following Cost of Equity Formula Calculator. Asset to Sales Ratio. As a financial analyst it is useful in analyzing data counts all cells in a given range that contain only numeric values.

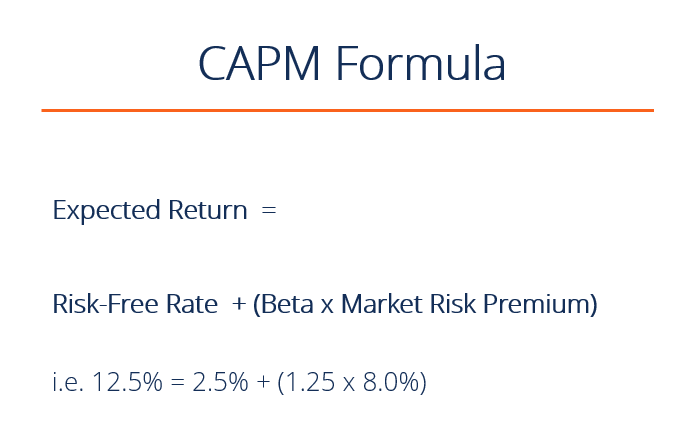

The CAPM Formula is. Cube Excel Formulas. Annuity - Present Value w Continuous Compounding.

What is the current Kd Kp and Ke assuming no new debt or stock. COUNTAA Counts all values that are numerical in A column. The Ke is not exactly what we refer to.

Pengaspalan di kawasan perhelatan Formula. Valuation of firm. D0 dividend paid.

It was introduced in Excel in 2000. Annuity - FV Solve for n. Ke Risk-Free Rate of Return Beta Market Rate of Return Risk-free Rate of Return Ke 004 1 006 004 006 6.

Kd 0125 125. P0 ex interest market value of debt. P0 share price.

INDEXC3E9MATCHB13C3C90MATCHB14C3E30 This is an advanced alternative to the VLOOKUP or HLOOKUP formulas which have several drawbacks and limitations. Cost of Equity Risk-Free Rate of Return Beta Market Rate of Return - Risk-Free Rate of Return In this equation the risk-free rate is the rate of return paid on risk. King Estate Eugene Oregon winery KE.

2016 as well as 2019. Assumes dividend growth can be estimated and is constant. Cost of Equity Formula Example 3.

Ke EBIT-I x 100 V-B. There is no tax payable. Its the responsibility of the company.

K kd BV KE SV Kd Cost of Debt. The basic accounting formula forms the logical basis for double entry accounting. Cost of Equity Calculations.

G Expected growth rate of dividends assumed to be constant The current dividend payout D 0 can be found in the Annual Report of a company. At what size capital structure will the firm run out of retained earnings. Gordon Growth Model Formula P dfracD_1r - g P Fair Value of the stock.

B Value of debt. The Excel Functions covered here are. S Market value of Equity.

So the cost of equity Ke for TCS will be-Cost of Equity Formula Rf β Em Rf Cost of Equity Formula 746 113 727 Cost of Equity Formula 1568. These are the tangible and intangible asse. Ke D1P0 g.

Cost Of Capital And Returns To Providers Of Finance Ppt Download

Cost Of Capital And Returns To Providers Of Finance Ppt Download

Cost Of Equity Formula How To Calculate Cost Of Equity Ke

Cost Of Equity Formula How To Calculate Cost Of Equity Ke

Corporate Finance Mli28c060 Lecture 6 Monday 19 October Ppt Download

Corporate Finance Mli28c060 Lecture 6 Monday 19 October Ppt Download

Cost Of Equity Formula Calculator Excel Template

Cost Of Equity Formula Calculator Excel Template

Corporate Finance Formulas Explained Financeviewer

Corporate Finance Formulas Explained Financeviewer

Financial Mgt Capital Asset Pricing Model

Financial Mgt Capital Asset Pricing Model

Formulae Of Financial Management

Formulae Of Financial Management

Weighted Average Cost Of Capital Wacc Finance Learner Conceptual Clarity

Post a Comment for "Ke Finance Formula"