However the forecast doesnt need any board approval. A cash budget is a tool for planning and controlling near-term cash inflows and outflows.

12 Beyond Budgeting Principles Budget Forecasting Budgeting Personal Finance

12 Beyond Budgeting Principles Budget Forecasting Budgeting Personal Finance

This spending plan is called a budget.

What is a 6 6 budget forecast. Excel Forecast vs Actual Variance. If the business relies on a static budget it will need to wait until the next budgeting Budgeting Budgeting is the tactical implementation of a business plan. If you are forecasting an increase in sales the cost of producing the goods will also increase you will need to purchase more components or stock.

BUDGET -Represents a business enterprises annual financial plan. It helps to keep everyone focused and forces the leadership team to be united in its approach to achieving company goals. In business cash budgets are like the check register that individuals use to manage a personal checking account.

Report Budget Forecast and Dashboard Template Glossary What is a Financial Dashboard for Nonprofits. Budgets also ensure planned approach towards managing cash flows and debt requirements in the business. The cash budget and the check register both record incoming and outgoing transactions as they occur.

Period to reflect the changes. In essence a budget is a quantified expectation for what a business. The COGS forecast relates to your sales forecast.

Budgeting planning and forecasting BPF is a three-step process for determining and detailing an organizations long- and short-term financial goals. What is a Budget. To forecast COGS you will need to include all the direct costs associated with production and preparation for sale.

More than you make you will have a problem. A budget is a management tool used to forecast revenues and expenses during a specified period for the purpose of identifying avenues for cost-cutting and be more efficient and productive in operations. This sheet may be required by different departments in a company or can help you to determine your salary if you own your own business.

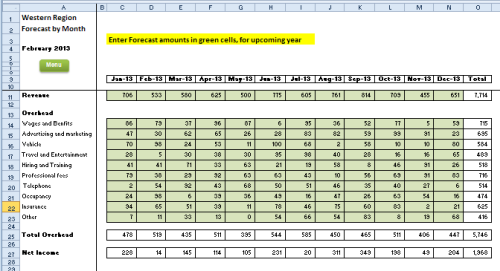

In comparison to the product line level forecast a budget breaks the numbers down to the customer and product SKU level. The process is usually managed by an organizations finance department under the Chief Financial Officers CFOs guidance. Get this free workbook then enter budget forecast amounts and actual amounts.

The forecast is essentially redoing the budget for the remaining months in the current fiscal year based on feedback from department heads. View or print the report sheets where formulas show the year to date totals and calculate the variance between the forecast and actuals. Reforecasting once a quarter is one of those painful but necessary tasks.

As the year progresses the forecast for the year will become more accurate the more that it comprises actual months and fewer forecast months. You typically finalize the budget by November if you are planning a calendar year budget Jan-Dec. Your profit and loss is your businesss financial plan comprised of your income and expenditures including interest.

In short the PL budget shows you how much profit or loss your business is planning to make most often on a monthly basis. Your budget should mirror year one of your forecast. - A comprehensive master budget is a formal statement of managements expectation for sales expenses volume and other financial transactions for the coming period.

The key difference between a budget and a forecast is that a budget lays out the plan for what a business wants to achieve while a forecast states its actual expectations for results usually in a much more summarized format. Often times the CFO or controller will provide an informal approval of the forecast each month. To achieve the goals in a businesss strategic plan we need some type of budget that finances the business plan and sets measures and indicators of performance.

If they dont balance and you spend. The idea is that instead of managing the business based on a static budget that was created in the prior year rolling forecasts are used to revisit and update budgeting assumptions throughout the year. A budget is a micro level analysis of the upcoming year.

Forecasting is a technique that uses historical data as inputs to make informed estimates that are predictive in determining the direction of future trends. It also helps to keep your spending in check since you are planning your budget many months. A forecast budget sheet is an easy way to work out your expected budget for the next year.

A 39 forecast shows three months of actuals and nine months of forecast. As the year progresses the forecast for the year should become more accurate the more it comprises actual months and fewer forecast months. A 66 shows six months of actuals and six months of forecast.

However the practice of using a rolling forecast enables a company to respond more quickly to such marketplace changes. With this forecast the company could maintain their costs while keeping track with the revenue in every sector. Budgeting is simply balancing your expenses with your income.

Therefore 210 forecast could greatly facilitate the economic logic part in Hambrick and Fredricksons Strategy Diamond. A rolling forecast is a report that uses historical data to predict future numbers and allow organizations to project future budgets expenses and other financial data based on their past results. The budget would become more accurate and narrowed down to a less fluctuating cost predicting the final income.

224 239 080 686 963 923 672 345 453 113 Year over Year Percent Change 34 Forecasted Sales Tax Revenue in Millions FY 2010 Budget of 1896 was 1 over FY 2009 Estimate FY 2010 Estimate 225 or 43 M below budget -FY 2011 Projection. Budget vs forecast Final Thoughts. Reforecasting once a quarter is a painful but necessary task.

Creating this spending plan allows you to determine in advance whether you will have enough money to do the things you need to do or would like to do. A 66 shows 6 months of actuals and 6 months of forecast. Financial Dashboards are considered analysis and business monitoring tools and are used by executives and financial managers analyze key financial metrics on a single screen and with powerful.

I Will Build Excel Financial Model Forecasts Budget Business Plan Financial Modeling Tutoring Business Personal Budget

I Will Build Excel Financial Model Forecasts Budget Business Plan Financial Modeling Tutoring Business Personal Budget

Download Cash Flow Forecast 12 Months Cash Flow Statement Cash Flow Spreadsheet Template

Download Cash Flow Forecast 12 Months Cash Flow Statement Cash Flow Spreadsheet Template

How To Develop A Personal Finance Forecast Learn How To Create A Personal Finance Forecast More Than A Budge Personal Finance Finance Personal Finance Budget

How To Develop A Personal Finance Forecast Learn How To Create A Personal Finance Forecast More Than A Budge Personal Finance Finance Personal Finance Budget

Search Results For Budgets Templates Financial Plan Template Business Budget Template Bookkeeping Business

Search Results For Budgets Templates Financial Plan Template Business Budget Template Bookkeeping Business

Monthly Cash Flow Forecast Model Guide And Examples Cash Flow Financial Modeling Cash Flow Statement

Monthly Cash Flow Forecast Model Guide And Examples Cash Flow Financial Modeling Cash Flow Statement

Financial Projection Templates In Excel Excel Templates Excel Financial

Financial Projection Templates In Excel Excel Templates Excel Financial

Image Result For Business Plan Financial Projections Sample Business Planning Financial Graphing

Image Result For Business Plan Financial Projections Sample Business Planning Financial Graphing

Excel Budget Report With Value Selector Budget Forecasting Excel Budget Budget Spreadsheet

Excel Budget Report With Value Selector Budget Forecasting Excel Budget Budget Spreadsheet

Creating Financial Projections For A New Restaurant Projectionhub Blog Saving Money Budget Budgeting Money Financial

Creating Financial Projections For A New Restaurant Projectionhub Blog Saving Money Budget Budgeting Money Financial

Difference Between Budget And Forecast Budget Forecasting Budgeting Forecast

Difference Between Budget And Forecast Budget Forecasting Budgeting Forecast

Cash Flow Forecast Spreadsheet Cash Flow Cashflow Forecast Business Template

Cash Flow Forecast Spreadsheet Cash Flow Cashflow Forecast Business Template

0 comments:

Post a Comment