Demonstration of Various Compounding The following table shows the final principal P after t 1 year of an account initially with C 10000 at 6 interest rate with the given. PV present value the amount of money at the beginning of the transaction PMT payment amount.

Case Y stands for period PY1 is one payment per period and CY1 is one compounding per period.

What does p y and c y mean in finance. Tvm_PmtN I PV FV PY CY tvm_I Description. Probability of event A given event B occured. The period can be any time interval such as month quarter and.

P Y Precision Code GPS. Management uses this model to run different production scenarios and help predict what. P C e rt.

PA B 05. The Cauchy distribution named after Augustin Cauchy is a continuous probability distribution. At Yahoo Finance you get free stock quotes up-to-date news portfolio management resources international market data social interaction and mortgage rates that help you manage your financial life.

The Acronyms section of this website is powered by the Acronym Finder the webs most comprehensive dictionary of acronyms abbreviations and initialisms. P C 1 r t Continuous Compound Interest When interest is compounded continually ie. We should now consider the determination of nominal variables.

In other words it estimates the total cost of production given a specific quantity produced. ρXY the correlation between the variables X and Y CovXY the covariance between the variables X and Y σ X the standard deviation of the X-variable. Press the PY key 2ndIY Unless the settings have been changed you will see the default preset payment frequency.

So far we studied the determinants of real variables. PA B probability of events union. CY of interest compounding periods per year.

CY 1200 - 12 timesyear Copyright 2002 Alan Marshall 4. Tvm_IN PV FV PY CY tvm_PV. Corporate Finance Corporate finance deals with financing capital structure and money management to help maximize returns and shareholder value.

Probability that of events A or B. PA B probability of events intersection. The tvm_I function computes the per period interest rate for an annuity lump sum or a combination.

The price-to-earnings ratio PE is the relationship between a companys earnings and its share price and is calculated by dividing the current price per share by the earnings per share. MAq models try to capture the shock effects observed in the. It is also known especially among physicists as the Lorentz distribution CauchyLorentz distribution Lorentz function or BreitWigner distribution.

Probability of event A. The Cauchy distribution f displaystyle f is the distribution of the x-intercept of a ray issuing from displaystyle with a uniformly distributed angle. The positive covariance states that two assets are moving together give positive returns while negative covariance means returns move in the opposite direction.

I r WP N See Chapter 5. PY of payment periods per year. A cost function is a mathematical formula used to used to chart how production expenses will change at different output levels.

The Acronym Finder allows users to decipher acronyms from a database of over 1000000 entries covering computers technology telecommunications and the military. Probability that of events A and B. Meaning definition Example.

ARp models try to explain the momentum and mean reversion effects often observed in trading markets market participant effects. What Does Cost Function Mean. FV future value money at the end of the transaction Compound Interest Calculations.

A stocks PE also known as its multiple gives you a sense of what you are paying for a stock in relation to its earning power. PY 1200 - 12 paymentsyear Using the down arrow or up arrow v will scroll you to the next window the number of times per year the interest is compounded. It is also the distribution of the ratio of two independent normally distributed.

Business finance accounting marketing real estate shipping companies stock markets products etc. If you do not supply any arguments it will return the value that is stored in I in the TVM Solver. The price level P the nominal wage W the inflation rate the nominal interest rate i.

Year-Over-Year YOY is a frequently used financial comparison for comparing two or more measurable events on an annualized basis. PA B conditional probability function. BOE CEO EBIDTA FOB GAAP IKEA IPO MLS PL TVM.

N -- the compound interest equation takes the form. Over 76000 definitions Examples. The price level and the nominal wage rate depend on the level of the money supply.

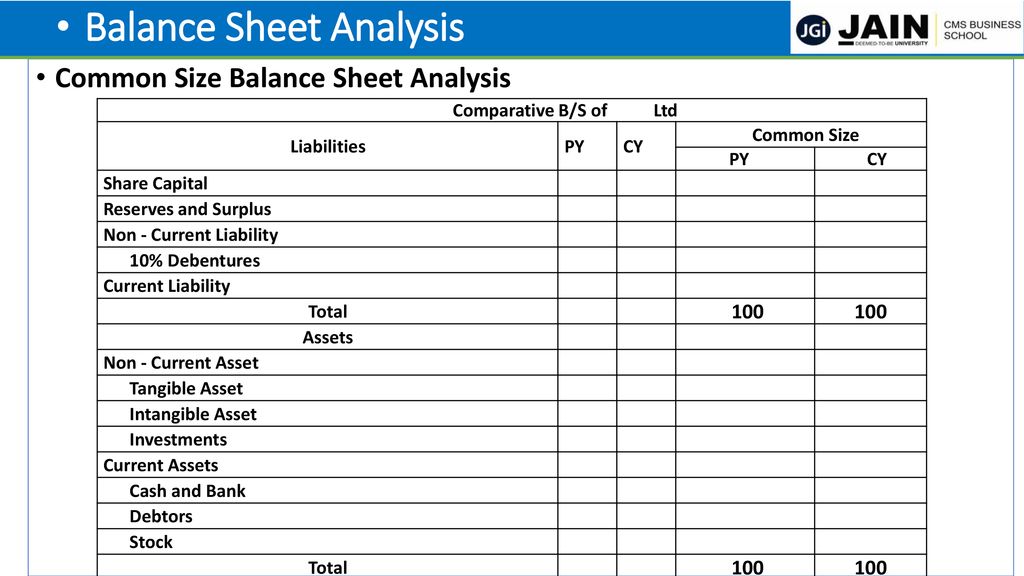

Financial Reporting Statements And Analysis Ppt Download

Financial Reporting Statements And Analysis Ppt Download

Adding Up And Down Arrows To Kpis In Power Bi Tessellation

Adding Up And Down Arrows To Kpis In Power Bi Tessellation

Number Of Annuity Payments Business Math Handbook

Number Of Annuity Payments Business Math Handbook

Monopoly Special Cases Of Monopoly Profit Maximization Problem Economics Economics Notes English Teacher Lesson Plans Economic Analysis

Monopoly Special Cases Of Monopoly Profit Maximization Problem Economics Economics Notes English Teacher Lesson Plans Economic Analysis

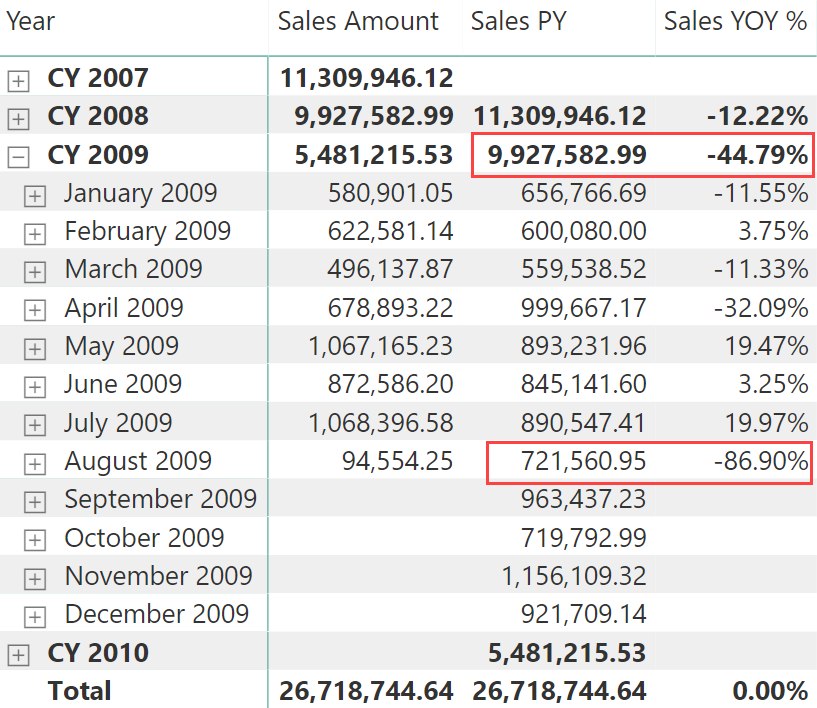

Hiding Future Dates For Calculations In Dax Sqlbi

Hiding Future Dates For Calculations In Dax Sqlbi

What Are Current Year Year To Date C Y Ytd And Previous Year Year To Date P Y Ytd Interests What Purpose Does It Serve What Might One Gain From Going Through Such Statistic From Both Borrowers

What Are Current Year Year To Date C Y Ytd And Previous Year Year To Date P Y Ytd Interests What Purpose Does It Serve What Might One Gain From Going Through Such Statistic From Both Borrowers

Profit Maximization Problem Perfect Competition Study Deeper Perfect Competition Economics Notes Competition

Profit Maximization Problem Perfect Competition Study Deeper Perfect Competition Economics Notes Competition

Why 2020 Is A Great Year For Rv Dealers To Adopt Lifo Or Expand Their Lifo Election Scope Lifopro Services Software

Why 2020 Is A Great Year For Rv Dealers To Adopt Lifo Or Expand Their Lifo Election Scope Lifopro Services Software

46brooklyn Brand Drug List Price Change Box Score Faqs 46brooklyn Research

46brooklyn Brand Drug List Price Change Box Score Faqs 46brooklyn Research

0 comments:

Post a Comment