Thetat fracpartialpartial t f0t at f0t frac12 leftfracpartial2partial t2 V0t at fracpartialpartial t V0t right Where. Phileft d1 right frace-fracd122sqrt2pi.

The calculation of theta is expressed as a yearly value.

Theta finance formula. X Strikeprice S Stockprice q divident r interest T-t Time to Maturity and sigma is volatility. The BlackScholes formula calculates the price of European put and call options. Theta indicates the amount an options price would decrease as the time to expiration decreases all else equal.

MODIFIER LETTER SMALL THETA. The Theta option Greek is also referred to as time decay. - A44EXP -1POWER K4422SQRT 2PI C44S44 2SQRT G44 D44R44P44- E44A44N44S44 IF C202Time UnitsD4Time UnitsD3.

For example assume an investor is long an option with a theta of -050. But heres the formula for calculating the theta for a stockoption. Analogically to call theta the formula for put theta in cell AD44 is.

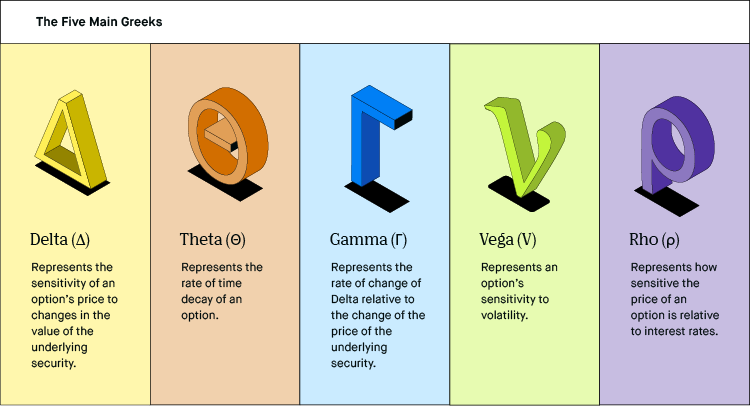

Differences between the Greek formulas for calls and puts are often very small usually a minus sign here and there. Below you can find formulas for the most commonly used option Greeks. Theta is a sensitivity measure that determines the decline in this extrinsic value of the option over time.

However the figure is often divided by the number of days in a year to arrive at a daily rate. Starting off with a deep out of money call option we plot the same curves for an at and near money option as well as a deep in money option. Small d2 d1 - sigma sqrtt.

If your aggregate options theta is positive then you will do better if the market moves slower. If the options time to maturity decreases by one day the options price will change by the theta amount. For example see the following three panels that show the shift of the 5 Greek shapes across spot prices and money-ness.

The mathematical result of the formula for theta see below is expressed in value per year. By convention it is usual to divide the result by the number of days in a year to arrive at the amount an options price will drop in relation to the underlying stocks price. Phileft d1 right frace-fracx22sqrt2pi.

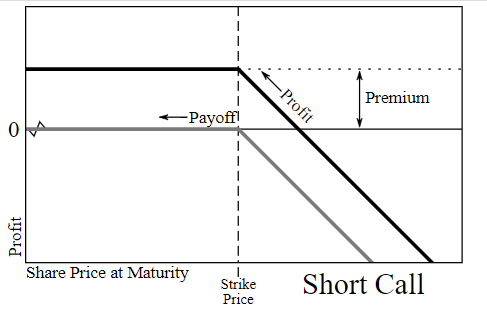

The theta value rises for options at or near the money as the option nears expiration. Black-Scholes Formulas for Option Greeks. Other Greeks delta theta and rho are different.

From 60 to 30 days to expiration the rate of decay began to accelerate. Other Greeks include delta gamma vega and rho and these formulas help you assess the risks inherent with an options. Theta θ is a measure of the sensitivity of the option price relative to the options time to maturity.

Small d1 fracln left fracSK right leftrfracsigma22righttsigmasqrtt. If your aggregate options theta is negative then you will get a good profit if the market moves very quickly. Small d1 fracln left fracSK right leftrfracsigma22righttsigmasqrtt.

This follows since the formula can be obtained by solving the equation for the corresponding terminal and boundary conditions. If all other variables are constant an option will lose value as time draws closer to its maturity. Therefore if dividend yield is zero then e-qt 1 and the models are identical.

Options with a shorter term have a higher theta since the time value is at its highest and there is more premium to lose on a day-to-day basis. Named character reference. Encodings decimal hex decimal hex decimal hex decimal hex decimal hex Unicode.

As illustrated here the decay of at-the-money option prices accelerates as expiration gets closer and closer. The theta is at its highest when options are at the money and lowest when they are out of the money or in the money. Small d2 d1 - sigma sqrtt.

The solution in the paper is as follows. Formula theta -fracSphileft d1 right sigma2sqrttrKe-rtNleft -d2 right small where. E1 B6 BF Numeric character reference.

F0t text instantaneous forward rate at time t VtT int_tT sigmauT2 du sigmauT sigmauBuT BtT Et int_tT fracduEu Et eint_0t au du I imagine one can follow a similar method done in simpler versions. Rather than remember the formula try and remember behavior shape and shifts. Some of the Greeks gamma and vega are the same for calls and puts.

The daily rate is the amount the value will drop by. This price is consistent with the BlackScholes equation as above. This is calculated by merely adding up all the options thetas of your individual options.

More specifically the rate of at-the-money decay was fairly slow from 75 to 60 days to expiration. Theta refers to the rate of decline in the value of an option over time. Time decay is also called theta and is known as one of the options Greeks.

Formula theta -fracSphileft d1 right sigma2sqrtt-rKe-rtNleft d2 right small where. There is no q in the formula for d 1.

Options Theta Decay Explained New Trader U

Options Theta Decay Explained New Trader U

Are There Comprehensive Analyses Of Theta Decay In Weekly Options Quantitative Finance Stack Exchange

Are There Comprehensive Analyses Of Theta Decay In Weekly Options Quantitative Finance Stack Exchange

What Are Options Greeks Robinhood

What Are Options Greeks Robinhood

What Is Theta In Finance Overview How To Interpret How To Calculate

What Is Theta In Finance Overview How To Interpret How To Calculate

:max_bytes(150000):strip_icc()/credit-585ee3015f9b586e02d0c1bb.png) What Does Positive Theta Mean For Credit Spreads

What Does Positive Theta Mean For Credit Spreads

Theta Explained The Options Futures Guide

Theta Explained The Options Futures Guide

0 comments:

Post a Comment