Where N s is a number of common stock outstanding P s is a current common stock price total common equity is a book value of common equity. Market Value Added MVA is the difference between the equity market valuation of a listedquoted company and the sum of the adjusted book value of debt and equity invested in the company.

How To Calculate Market Value Added Mva In 2021 Formula Example

How To Calculate Market Value Added Mva In 2021 Formula Example

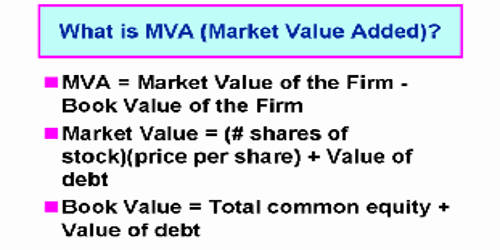

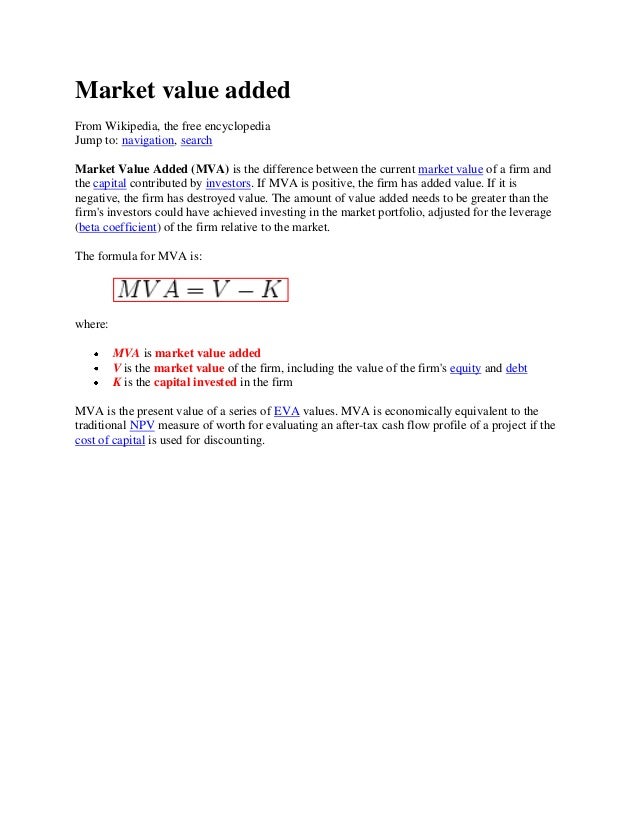

MVA market value added V It is the market value of the firm which includes both the debt and the equity of the firm K the total capital that is invested in the market by the investors which include both the bondholders and the shareholders of the firm.

Mva finance formula. MVA Market Value of Shares Book Value of Shareholders Equity. Lets look at an example. MVA Current market value of debt and equity Economic book value.

K is the capital invested in the firm. Thus its not a good investment. Although one may encounter different formula for computing MVA the simplest one is.

MVA is market value added. This can apply to cleared trades which require initial margin and non-cleared trades where initial margin requirements are being phased in over time. MVA Market Value of Stock - Total Equity.

Market Value Added MVA Market Capitalization Total Common Shareholders Equity Total Shares Outstanding Current Market Price Total Common Equity. Where MVA is the market value added of the firm V is the market value of the firm including the value of the firms equity and debt its enterprise value and K is the total. The formula for MVA is.

Margin valuation adjustment MVA Margin valuation adjustment allows for the funding costs of the initial margin posted for a derivatives trade. Market Value Added MVA market value - invested capital. MVA is the present value of a series of EVA values.

MVA V - K. Market Value Adjustment MVA A Market Value Adjustment MVA can be attached to a deferred annuity that features fixed interest rate guarantees combined with an interest rate adjustment factor that can cause the actual crediting rates to increase or decrease in response to market conditions. MVA factor 1 - 1 004 1 0035412 -0044438 MVA 135000 x -0044438 -599913 Surrender charge 135000 - -599913 x 006 845995.

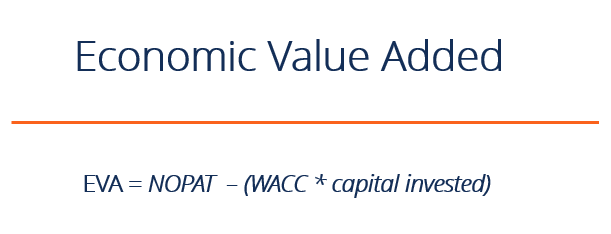

Finance Charge Capital invested WACC. Market Value Added MVA Market Value of the Firms Securities Total Capital Invested or depending on the inputs available to you a good approximation is. Market Value Added Market value added MVA on the other hand is simply the difference between the current total market value of a company and the capital contributed by investors including.

This figure is calculated by taking the companys total number of outstanding shares and dividend it by its current share price. V is the market value of the firm including the value of the firms equity and debt. NOPAT Net Operating Profit After Tax Capital Charge Invested x Cost of Capital This research is a quantitative descriptive study.

The following formula for EVA calculation Rudianto Management Accounting 2013. This formula can be modified as follows. MVA N s P s - Total Common Equity.

EVA NOPAT WACC capital invested. The central counterparty basis is also a form of MVA. Thus given the adjusted taxes we can write the economic value-added formula as follows.

Where Economic Book Value Share capital Free Reserves Debt The aim of a companys managers is to maximize value in order to do value creation. FVA NOPAT Taxes ED Information. The sampling method Market Value Added MVA Market Value Added MVA is the.

MVA Total value Total capital or. MVA N s P s N ps P ps - Total Common Equity. The MVA formula is calculated by subtracting the invested capital from the firm FMV.

Market Value Added MVA Market Capitalization Shareholders Equity Market capitalization or market cap is often known as the market value of equity. Also a negative MVA signals to investors that the company is not using its capital effectively or efficiently. Calculating the Finance Charge.

MV of stocks - Book value of stockholders equity. The market value MV of stocks is computed by multiplying the number of outstanding shares by the market price per share. The formula in computing for the market value added is.

And WACC KeE ED Kd 1-tD ED where Ke required return on equity and Kd 1-t after tax return on debt. To find the market value of shares simply multiply the outstanding shares by the current market price per share. If a company has preferred stock outstanding market value added available to all stockholders can be calculated as follows.

MVA Market Value of Debt Equity Book Value of Debt Equity and Preferred Stock Economic Value Added EVA NOPAT WACC Total Capital or more conceptually.

Market Value Added Mva Definition Formula Calculation Example Advantages And Disadvantages Mva And Eva

Breaking Down The Economic Value Added Eva Calculation By Dobromir Dikov Fcca Magnimetrics Medium

Breaking Down The Economic Value Added Eva Calculation By Dobromir Dikov Fcca Magnimetrics Medium

Market Value Added Mva Assignment Point

Market Value Added Mva Assignment Point

Economic Value Added Eva Formula Examples And Guide To Eva

Economic Value Added Eva Formula Examples And Guide To Eva

Economic Value Added Eva Break Down And Calculation Magnimetrics

Economic Value Added Eva Break Down And Calculation Magnimetrics

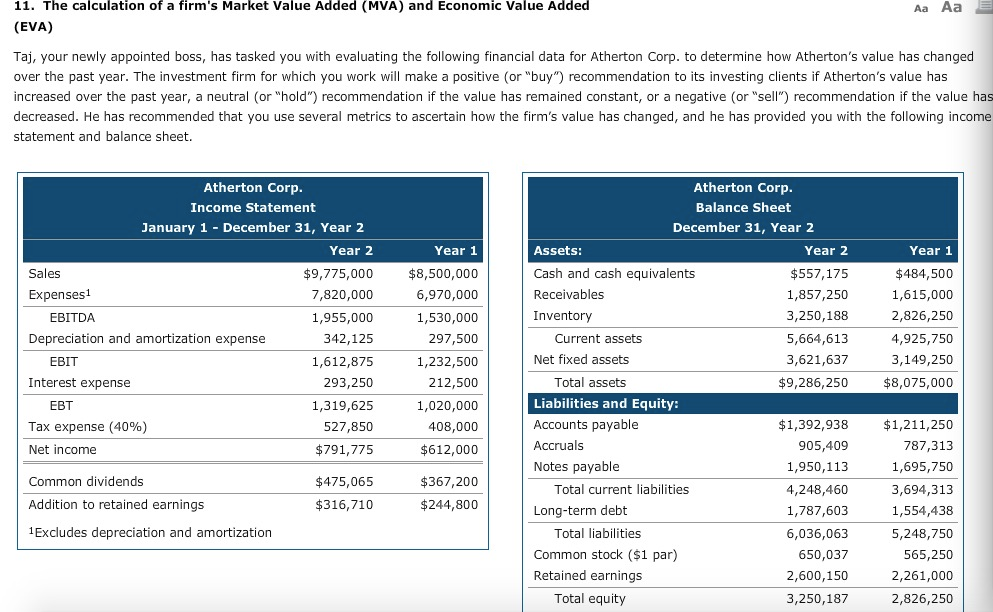

Solved 11 The Calculation Of A Firm S Market Value Added Chegg Com

Solved 11 The Calculation Of A Firm S Market Value Added Chegg Com

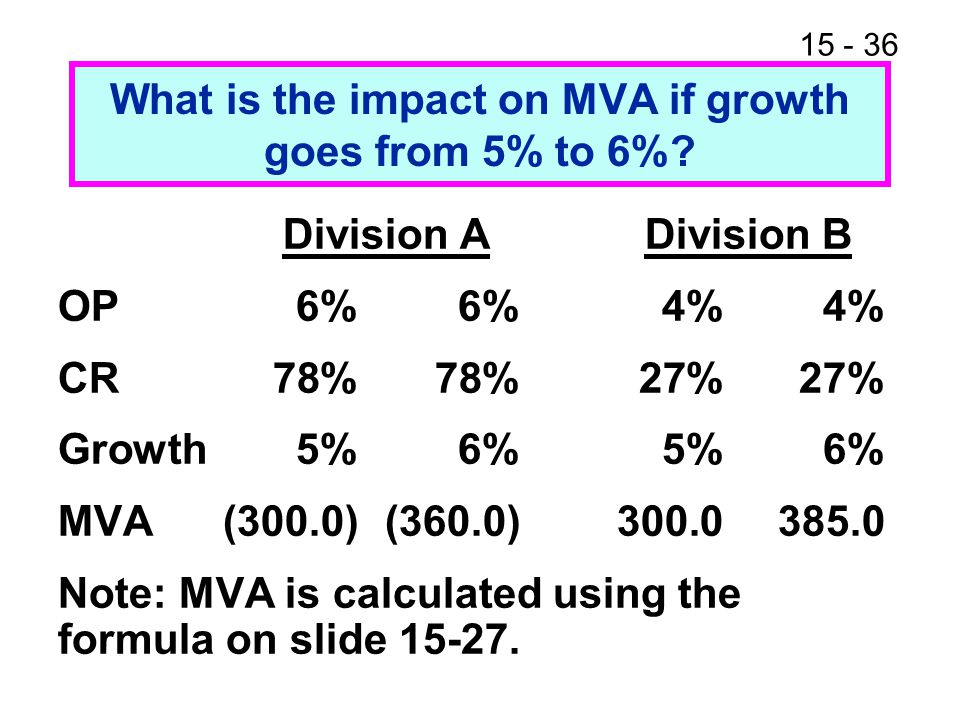

Corporate Valuation List The Two Types Of Assets That A Company Owns Ppt Video Online Download

Corporate Valuation List The Two Types Of Assets That A Company Owns Ppt Video Online Download

Chapter 02 Financial Statements 2 Value Fcf 1 Fcf 2 Fcf 1 Wacc 1 1 Wacc 1 Wacc 2 Free Cash Flow Fcf Market Interest Rates Firm S Ppt Download

Chapter 02 Financial Statements 2 Value Fcf 1 Fcf 2 Fcf 1 Wacc 1 1 Wacc 1 Wacc 2 Free Cash Flow Fcf Market Interest Rates Firm S Ppt Download

Financial Statements Cash Flow And Taxes Ppt Video Online Download

Financial Statements Cash Flow And Taxes Ppt Video Online Download

Ppt Mva And Eva Powerpoint Presentation Free Download Id 4070775

Ppt Mva And Eva Powerpoint Presentation Free Download Id 4070775

0 comments:

Post a Comment