Finance Kurtosis Formula

The usual estimator of the population excess kurtosis defined as follows. Valuing formulas such as return on assets ROA the NOPAT formula the Asset Ratio Formula the Nominal Rate Formula the Perpetuity Formula the Risk.

Skewness Kurtosis Data Science Learning Data Science Statistics Math

Skewness Kurtosis Data Science Learning Data Science Statistics Math

Taking the square of the volatility model we have.

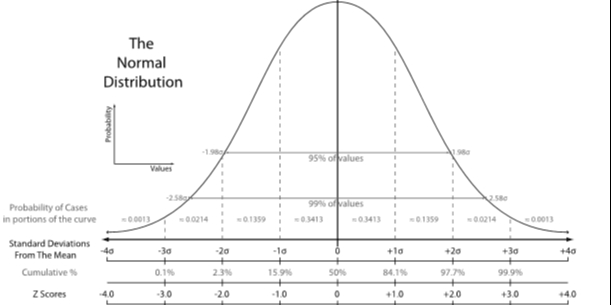

Finance kurtosis formula. High kurtosis in a data set is an indicator that data has heavy tails or outliers. For a very large sample very high n the differences between and among n1 n n-1 n-2 and n-3 are becoming negligible and the sample kurtosis formula approximately equals. If the coefficient of kurtosis is larger than 3 then it means that the return distribution is inconsistent with the assumption of normality in other words large magnitude returns occur more frequently than a normal distribution.

Finance Formulas will assist you to develop the financial formulas equations and computers that you need to be effective from college leaners who study finance and businesses to experts dedicated to corporate finance. Based on the assumption we have the following. Statistical formulas such as the format of Central Limit Theorem Mean Formula Rule of Formula 72 Range are addressed.

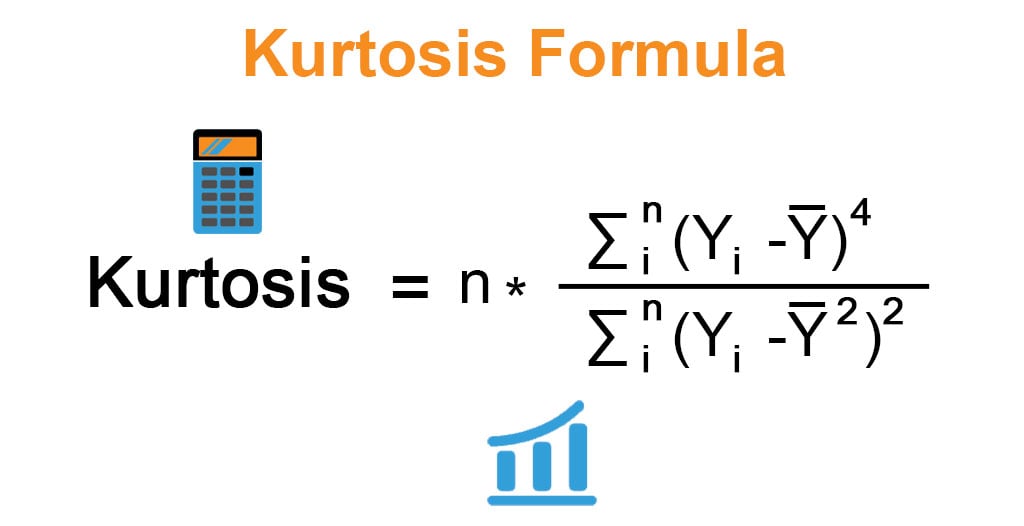

Mboxkurtosis fracsum_i1NY_i - barY4N s4 where barY is the mean s is the standard deviation and N is the number of data points. N is the number of observations of the sample. Skewness quantifies how asymetric a distribution is about the mean.

Were not used to that in finance. Kurtosis Fourth Moment Second Moment 2. That excess is in comparison to a normal distribution kurtosis of 3.

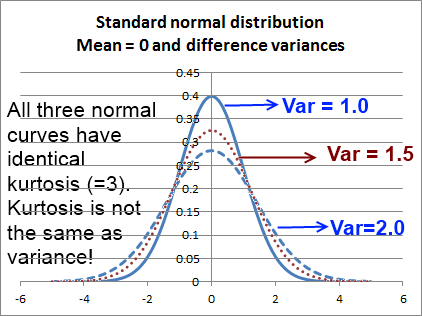

223 α t S t B S h x t σ 1 t 1 α t S t B S h x t σ 2 t. Kurtosis is calculated using the formula given below. Kurtosis is a statistical measure used to describe the distribution of observed data around the mean.

Tails of the distribution of data and therefore provides an indication of the presence of outliers. N sample size. In Excel the function for sample excess kurtosis is KURT.

The kurtosis can be derived from the following formula. It is used to describe the extreme values in one versus the other tail. If there is a high.

Given a sub-set of samples from a population the sample excess kurtosis above is a biased estimator of the population excess kurtosis. It is actually the measure of outliers present in the distribution. You can calculate either population or sample excess kurtosis in the Descriptive Statistics Calculator in cell D14.

This distribution is zero kurtosis excess. This type of distribution has a coeffecient of kurtosis of 3 which is the same as that of a normal distribution. Skewness is defined as.

There is no built-in Excel function for population kurtosis you need to calculate it manually by adjusting from KURT see how. The types of kurtosis are determined by the excess kurtosis of a particular distribution. Estimators of population kurtosis.

Kurtosis is the average of the standardized data raised to the fourth power. In 1986 Moors gave an interpretation of kurtosis. Thus excess kurtosis 078613 22139 excess kurtosis 07861 3 22139 Since the excess kurtosis is negative we have a platykurtic distribution.

A distribution with negative excess kurtosis equal to -1 has an actual kurtosis of 2. Therefore sample kurtosis equals. σ is the standard deviation barx is the mean of the distribution.

Definition of Kurtosis For univariate data Y 1 Y 2 Y N the formula for kurtosis is. Taking expectation of the equation and using the two properties mentioned earlier we obtain. Kurtosis provides a measurement about the extremities ie.

Σ xi - x4 4537936 Kurtosis n-1 SD4 5-1 49704 1859 Youll then get the Kurtosis of 1859. The rationale for 223 is to consider that a mixture of two normal distributions with standard. Next we subtract 3 from the sample kurtosis and get the excess kurtosis.

Kurtosis quantifies how peaked or flat the distribution is. S sample standard deviation. Kurtosis is all about the tails of the distribution not the peakedness or flatness.

Z X μ σ displaystyle Z frac X-mu sigma where X is a random variable μ is the mean and σ is the standard deviation. Vara t. Where K ϵ is the excess kurtosis of the innovation ϵ t.

Now by definition of the kurtosis. Kurtosis is often has the word excess appended to its description as in negative excess kurtosis or positive excess kurtosis. The excess kurtosis can take positive or negative values as well as values close to zero.

It is sometimes referred to as the volatility of volatility Education. Therefore the excess kurtosis is found using the formula below. Provided that 1 α 1 β 1 0 and The excess kurtosis of.

Reading 7 LOS 7l. Excel calculates the kurtosis of a sample S as follows. To account for excess kurtosis and skewness in stock log-returns a fast empirical approach amounts to consider that the option price a time t is given by a weighted average.

Excess Kurtosis Kurtosis 3. E X m e a n 3 x i x m e a n 3 N. κ displaystyle kappa and by the well-known identity.

S 2 sample variance. G 2 k 4 k 2 2 displaystyle G_ 2 frac k_ 4 k_ 2 2. Where x is the mean and s is the standard deviation of S.

The kurtosis of a normal distribution equals 3.

Pin By Tjpockets On Statistics Everything Else Spss Statistics Statistics Data Science

Pin By Tjpockets On Statistics Everything Else Spss Statistics Statistics Data Science

Kurtosis Formula Explantion Example With Excel Template

Kurtosis Formula Explantion Example With Excel Template

![]() Skewness And Kurtosis Finance Train

Skewness And Kurtosis Finance Train

Sarveshwar Inani S Blog Four Moments Of Distribution Mean Variance Skewness And Kurtosis

Sarveshwar Inani S Blog Four Moments Of Distribution Mean Variance Skewness And Kurtosis

Other Moments Measures Of Shape Vose Software

Other Moments Measures Of Shape Vose Software

Skewness Calculator Skewness And Kurtosis Formulas

Skewness Calculator Skewness And Kurtosis Formulas

Skew And Kurtosis 2 Important Statistics Terms You Need To Know In Data Science Data Science Statistics Data

Skew And Kurtosis 2 Important Statistics Terms You Need To Know In Data Science Data Science Statistics Data

Kurtosis And Bitcoin A Quantitative Analysis Hacker Noon

Kurtosis And Bitcoin A Quantitative Analysis Hacker Noon

Post a Comment for "Finance Kurtosis Formula"