Finance Gamma Formula

Gamma is the rate of change for an options delta based on a single-point move in the deltas price. Black-Scholes Formulas for Option Greeks.

Delta Hedging Options Using Monte Carlo Simulations In Excel Monte Carlo Delta Meaning Delta

Delta Hedging Options Using Monte Carlo Simulations In Excel Monte Carlo Delta Meaning Delta

Long options have a positive gamma.

Finance gamma formula. Remember that in most cases Greeks will behave differently depending on the money-ness of the option. European on a non-dividend paying stock is shown by Black and Scholes to be. EXP -1POWER K4422SQRT 2PI S44 A44J44.

I would like to have proven to me the above formula mostly because I dont quite understand it. The options delta is 50 and the options gamma is 3. Gamma is a second order non linear Greeks which means that its values will be exactly the same for Calls and Puts.

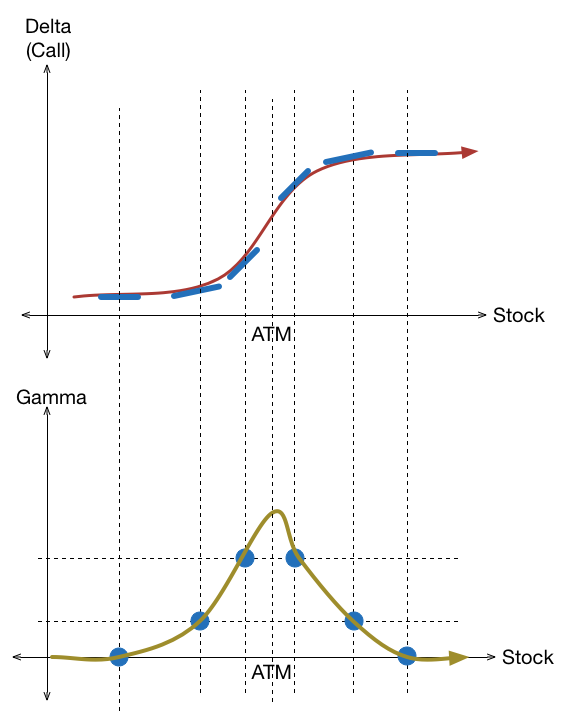

One Greek gamma as well as others not listed here is a partial derivative of another Greek delta in this case. Note that the gamma and vega formulas are the same for calls and puts. Gamma Γ is a measure of the deltas change relative to the changes in the price of the underlying asset.

Gamma is at its highest when an option is at the money and is at its lowest when it is further. Phileft d1 right frace-fracd122sqrt2pi. Gamma is the Greek-alphabet inspired name of a standard variable from the Black-Scholes Model the first formula recognized as a standard for pricing options.

Below you can find formulas for the most commonly used option Greeks. An options delta changes as the stock price changes. Stock Price S displaystyle S Strike Price K displaystyle K Risk-Free Rate r displaystyle r Annual Dividend Yield q displaystyle q Time to Maturity τ T t displaystyle tau T-t and Volatility σ displaystyle sigma.

Within this formula are two particular. It is the first derivative of delta with respect to the stock price. If the price of the underlying asset increases by 1 the options delta will change by the gamma amount.

In mathematical finance the Greeks are the quantities representing the sensitivity of the price of derivatives such as options to a change in underlying parameters on which the value of an instrument or portfolio of financial instruments is dependent. Gamma is a measure of the rate of change in the delta with respect to changes in the underlying price. The formula is an approximation of the profit from gamma tradinggamma hedging 05 Gamma Delta S2 So my questions are how to prove that and secondly what does it mean exactly by profit.

If the futures price moves to 201 the options delta is changes to 53. It is one of the many measures that are denoted by a Greek letter. The second derivative of the call option with respect to the price of the stock is called the Gamma of the option and is given by 2Ct S2 t St.

BLACK AND SCHOLES BS FORMULA The equilibrium price of the call option C. Some of the Greeks gamma and vega are the same for calls and puts. The whole formula for gamma same for calls and puts is.

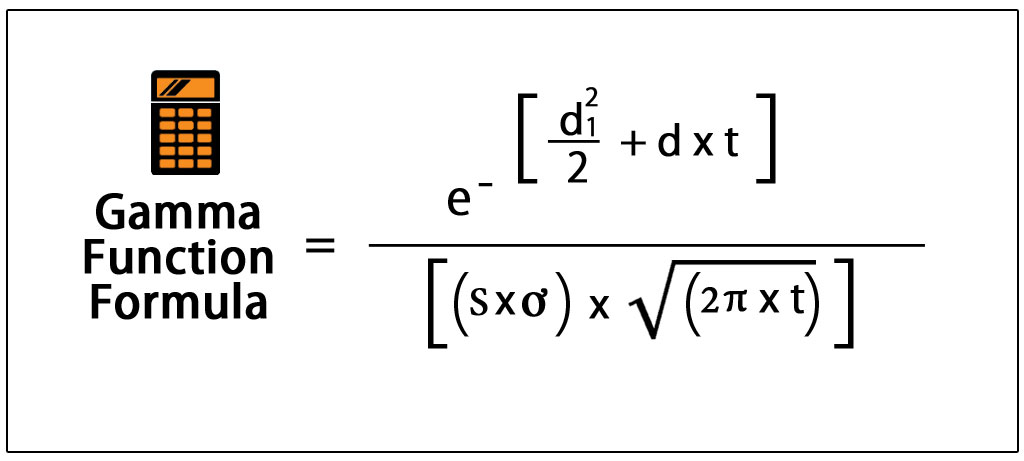

The Gamma of a call option. Formula gamma fracphileft d1 right Ssigma sqrtt small where. S Spot price of the underlying asset.

In the world of finance gamma refers to the rate of change in delta Delta Δ Delta is a risk sensitivity measure used in assessing derivatives. Gamma is the difference in delta divided by the change in underlying price. Financial institutions will typically set risk limit values for each of the Greeks that their traders must not exceed.

The main application of gamma is the assessment of the options delta. The name is used because the most common of these sensitivities are denoted by Greek letters as are some other finance measures. ơ Standard deviation of the underlying asset.

Differences between the Greek formulas for calls and puts are often very small usually a minus sign here and. The series of risk. Other Greeks delta theta and rho are different.

Gamma is the second derivative of the option premium with respect to the stock price. T Time to the expiration of the option. Small d1 fracln left fracSK right leftrfracsigma22righttsigmasqrtt.

To estimate it the fair values of the option at the nodes in time step 2 are also needed. Gamma of an option on a stock worth 10 will be double the gamma of the equivalent option on a stock worth 20 with same characteristics. You have an underlying futures contract at 200 and the strike is 200.

Dollar Gamma cash PL from delta-hedging process Gamma is a useful concept but since it measures change in delta per unit of underlying it is dependent on the absolute level on the underlying. It is used more specifically when talking about options. A gamma is the change of the delta divided by the change in the price of the underlying.

Gamma is represented as follows. The Greeks are important not only in the mathematical theory of finance but also for those actively trading. Suppose the fair values at time step 2 are corresponding to the three possible underlying prices noting that.

Vega is an interesting variation since its value remain the same for call and puts but it is a first order estimate. Mathematically the gamma function formula of an underlying asset is represented as where d 1 ln S K r ơ 2 2 t ơ t d Dividend yield of the asset.

Option Credit Spreads Explained The Greeks Implied Volatility Option Trading Options

Option Credit Spreads Explained The Greeks Implied Volatility Option Trading Options

Options Gamma Explained Delta Sensitivity To Price

Options Gamma Explained Delta Sensitivity To Price

Hedging Gamma Vega The Higher Order Greeks Hedge Optimization Excel Spreadsheet Part I Financetrainingcourse Com Optimization Excel Spreadsheets Vega

Hedging Gamma Vega The Higher Order Greeks Hedge Optimization Excel Spreadsheet Part I Financetrainingcourse Com Optimization Excel Spreadsheets Vega

How Black Scholes Formula Blew Up The Financial World Financial Financial Engineering Finance

How Black Scholes Formula Blew Up The Financial World Financial Financial Engineering Finance

Delta Hedging Gamma And Dollar Gamma

Option Greeks Gamma Brilliant Math Science Wiki

Option Greeks Gamma Brilliant Math Science Wiki

Gamma Of An Option Definition Formula Calculate Gamma In Finance

Gamma Of An Option Definition Formula Calculate Gamma In Finance

Gamma Explained The Options Futures Guide

Gamma Explained The Options Futures Guide

Option Gamma Made Easy A Practical Interpretation Of Gamma By Anthony Maylath Quantitative Insights Medium

Option Gamma Made Easy A Practical Interpretation Of Gamma By Anthony Maylath Quantitative Insights Medium

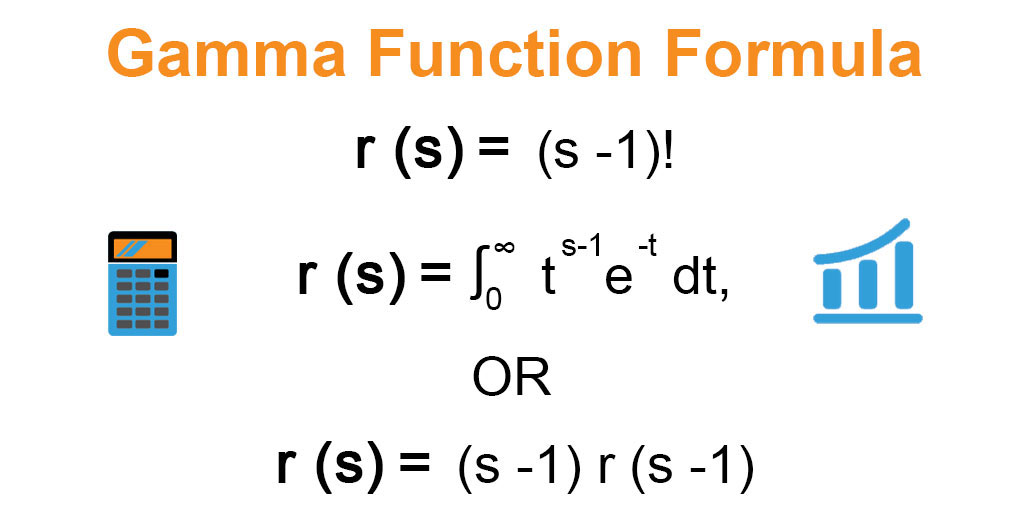

Gamma Function Formula Example With Explanation

Gamma Function Formula Example With Explanation

Five Steps To Hedging Vega And Gamma Exposure In Excel Financetrainingcourse Com Excel Spreadsheets Vega Excel

Five Steps To Hedging Vega And Gamma Exposure In Excel Financetrainingcourse Com Excel Spreadsheets Vega Excel

Post a Comment for "Finance Gamma Formula"