Finance Commission And Their Formula For Sharing Taxes

The Commission states that the surcharge should be treated as additional income-tax which should be sharable along with income-tax revenue. Accordingly the FC determines a formula for tax-sharing between the states which is a weighted sum of the states population area forest cover tax capacity tax effort and demographic performance with the weights expressed in percentages.

What Did The 15th Finance Commission Recommend For 2020 21

What Did The 15th Finance Commission Recommend For 2020 21

Though no specific recommendation is put forward by the Commission with respect to the sharing of income tax it however coincided with the states demand for a larger share raising it from 10 per cent to 15 per cent of the proceeds of the non-sharable surcharge on the income- tax.

Finance commission and their formula for sharing taxes. The terms of reference or ToR of the. The 14th Finance Commission had recommended a 10 percentage point increase in tax devolution to states to 42. The 15th finance commission will be reviewing the enhanced tax devolution formula which determines the share of states in national taxes.

The collection factor with weightage varying between 10 and 20 was used for tax sharing by the 1st to the 9th Finance Commissions for income tax. The Finance Commission also decides the share of taxes and grants to be. The formula for sharing revenues is decided by the Finance Commission every five years.

The key function of a Finance Commission is to recommend the tax devolution formula or the share of central taxes that all states are entitled for. 25 for tax effort. Actor-politician Pawan Kalyan on Sunday questioned the population based formula for sharing tax revenues by the Finance Commission.

The 10th Finance Commission discontinued. That is why our constitution makers were quite cautious on the count and provided for a finance commission under Article 280 to recommend mainly the financial transfers from the union to the states with a view to reducing vertical as well as horizontal federal. The 14th Finance Commission has recommended a record 10 increase in the states share in the Union taxes to 42 as compared to the 13th Finance Commission.

Its report for 2020-21 was tabled in Parliament on Saturday. Will south India be punished for its. Any matter in the interest of sound finance may be referred to the Commission by the President.

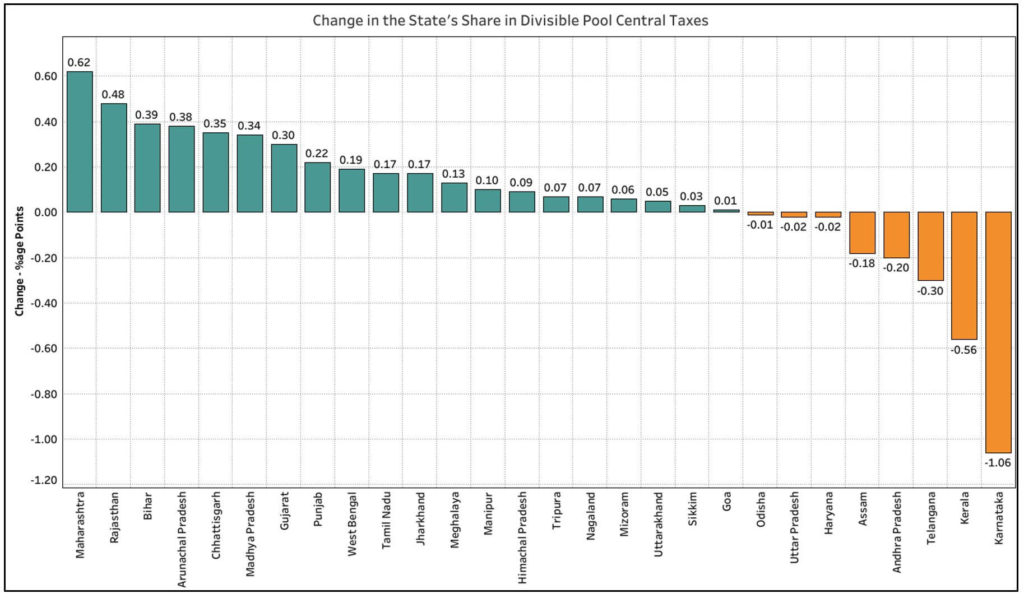

Further the weightage assigned to each criterion has varied with each Finance Commission. Y V Reddy The share of states in the net proceeds of the shareable Central taxes should be 42. The Commission led by Chairperson NK Singh has recommended a 1 decrease in the net proceeds of tax collected by the Centre to be shared with states.

Set up under Article 280 of the Constitution its core responsibility is to evaluate the state of finances of the Union and State Governments recommend the sharing of taxes between them lay down the principles determining the distribution of these taxes among States. The Commission decides the basis for sharing the divisible taxes by the centre and the states and the principles that govern the grants-in-aid to the states every five years. Finance Commission is a constitutional body that determines the method and formula for distributing the tax proceeds between the Centre and states and among the states.

10 for forest and ecology. Previous Finance Commissions have considered various factors to determine the criteria such as the population and income needs of states their area and infrastructure etc. FE Knowledge Desk Finance Commission is a constitutional body that determines the method and formula for distributing the tax proceeds between the Centre and states.

Formula To Share Taxes With States The key role of the Finance Commission is to recommend the tax devolution formula or the share of central taxes that all states are entitled to. 15 for the area. This time however the 15th Finance Commission will decide the formula for six years.

This crucial role of the Commission makes it instrumental in the implementation of fiscal federalism. This is 10 percentage points higher than the recommendation of 13th Finance Commission. Revenue deficit to be progressively reduced and eliminated.

The panel headed by former bureaucrat and lawmaker NK Singh is due to submit its final report later this year. For 2020-21 the Commission has recommended a total devolution of Rs 855176 crore to the states which is 41 of the divisible pool of taxes. Major Recommendations of 14th Finance Commission headed by Prof.

It suggested that 41 of the net proceeds of union taxes be devolved to states in FY21. The Finance Commission is a Constitutionally mandated body that is at the centre of fiscal federalism. The most Crucial problems in a federation is that of balancing powers and resources between the governments.

So against the 42 of tax revenue that states. 125 for demographic performance and. The panel has recommended keeping that largely unchanged.

The share in central taxes is distributed among states based on a formula. The Union government on Tuesday said it has accepted the recommendation of the 14th Finance Commission to share 42 of its net tax revenue with states during the five-year period starting 2015-16.

14th Finance Commission Tax Formula Raises Fund Flow To States

14th Finance Commission Tax Formula Raises Fund Flow To States

Capital Gains Yield Cgy Formula Calculation Example And Guide

Capital Gains Yield Cgy Formula Calculation Example And Guide

How To Reduce Your Taxable Income And Pay No Taxes Personal Capital

How To Reduce Your Taxable Income And Pay No Taxes Personal Capital

15th Finance Commission Cuts States Share Of Central Taxes To 41 Vs 42

15th Finance Commission Cuts States Share Of Central Taxes To 41 Vs 42

Finance Agreement Sample Template

Finance Agreement Sample Template

What Is Finance Commission The Financial Express

What Is Finance Commission The Financial Express

Cash Flow Projection Template Excel Cash Budget Template Cash Budget Template Will Be Related To Maintaining Thre Cash Flow Statement Cash Budget Cash Flow

Cash Flow Projection Template Excel Cash Budget Template Cash Budget Template Will Be Related To Maintaining Thre Cash Flow Statement Cash Budget Cash Flow

Centre State Relation Relatable Financial How To Plan

Centre State Relation Relatable Financial How To Plan

14th Finance Commission Share Of States In The Union Tax Revenue

14th Finance Commission Share Of States In The Union Tax Revenue

Estonian Taxes And Tax Structure As Of 1 January 2019

Estonian Taxes And Tax Structure As Of 1 January 2019

Post a Comment for "Finance Commission And Their Formula For Sharing Taxes"