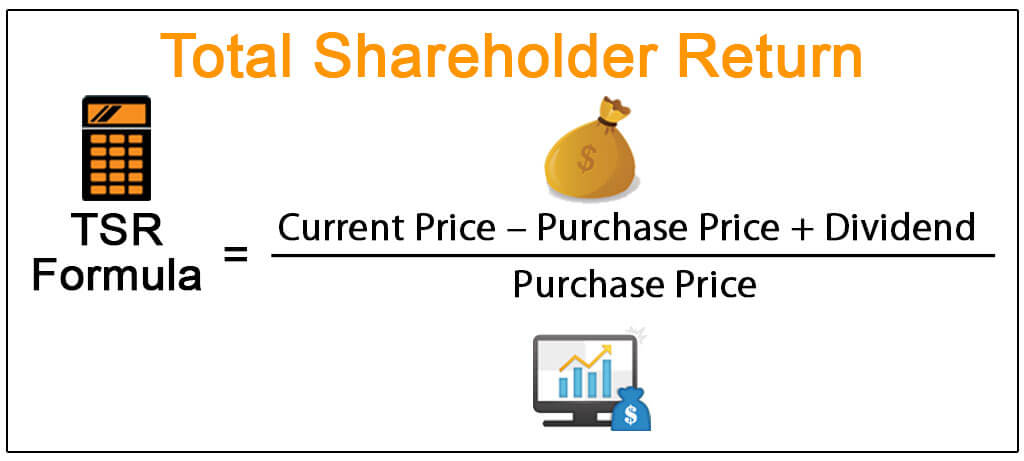

In this formula the dividends would include any money that has been paid out to the shareholder by the company. Total Shareholder Return Change in Stock Price Dividends PaidBeginning Stock Price where Dividends Paid means the total of all dividends paid on one 1 share of.

How To Calculate Return On Indices In A Stock Market The Motley Fool

P 1 ending stock price period 1 P 0 initial stock price.

Tsr finance formula. The formula to calculate annualized rate of return needs only two variables. TSR Current Price Purchase Price Dividend Purchase Price. If you want to know the cash amount of the return the following formula can be used.

Formula calculation Share Price EndOfPeriod - Share Price BeginOfPeriod Dividents Share Price BeginOfPeriod Total Shareholder Return TSR. It measures the full returns earned by an investment over the period of ownership including any dividend cashflows paid during that period. In the example add 1 to 3 which equals 4.

Total shareholder return TSR can be calculated using the following formula for a specific stock. Total shareholder return is the financial gain that results from a change in the stocks price plus any dividends paid by the company during the measured interval divided by the initial purchase. You could then convert this to a percentage ROI by dividing the result by your initial cost basis.

Where P1 is the value of the stock at the end of the period for which the TSR is being calculated P0 is the stock value at the time of purchase and D is the dividend declared if any. Total Shareholder Return for the Company and each company in the Healthcare Industry Index shall include dividends paid and shall be determined as follows. Multiply the average End Asset Value by the Accumulation Factor.

Dividends include not only regular dividend payments but also any cash payments to shareholders and also include special or one-time dividends and also include share buybacks. To get the total shareholder return you would add all of those together along with the difference between your initial cost basis purchase value and the current stock value. Calculate the average Asset Value at the Beginning and at the End of the period.

Initial stock price 12 - 10 050. Dividend Dividend received during the year. In the example subtract 15 from 18 which equals a 3 change in price.

I will show through logic and with simple formulas that managing for higher EVA is by definition managing for a higher TSR. Well be modelling the TSR for. Total shareholder return TSR is intended to be he ultimate bottom line of investment performance.

TotalStockReturnCashAmount 1200 - 1000 50 250. Multiply the average End Asset Value by the Accumulation Factor. While there are a wide variety of performance-based compensation designs in place the single most popular mid-term plan performance measure across companies is to pay based on relative total shareholder return TSR.

Calculate the TSR based on the ratio of the adjusted End Asset Value to the Beginning Asset Value. TSR total shareholder return TSR is computed as T S R P r i c e e n d P r i c e b e g i n D i v i d e n d s P r i c e b e g i n displaystyle TSRPrice_end-Price_beginDividendsPrice_begin. A n n u a l i z e d R e t.

But combined with a three-year horizon TSR has the potential to be dangerous payouts to executives may reward short- to mid-term stock price volatility rather than sustained long-term TSR performance. Total Shareholder Return Formula TSR P_1 - P_0 D. Add the total dividends received to the change in price.

In essence total shareholder return is the internal rate of return IRR of all cash flows paid to investors. Total shareholder return for a particular stock can be determined using the following formula. TSR P1-P0 D P0.

Subtract the beginning price from the ending price to calculate the change in price. Then the total stock return in cash amount for investment in the previous example is. TotalStockReturnCashAmount P_E - P_B D.

Purchase Price Price at which stock is acquired. Then I will present empirical evidence that EVA does in fact explain differences in TSR better and more completely than any other financial metric. The returns for a given period of time and the time the investment was held.

TSR Change in market price Dividends. Calculate the TSR based on the ratio of the. In example 1 TSR is expressed as a percentage.

Here Current Price Price at which stock is trading currently. TSR Current Price Purchase Price Dividend Purchase Price Here. Brought to you by Sapling.

The formula for total return ratio is.

Total Shareholder Return Definitin Formula How To Calculate

Total Shareholder Return Plans Accounting Implications Valuation Assumptions Opportune Llp Jdsupra

Cagr Calculator Compound Annual Growth Rate Formula

Gr Pro 2 0 Ea Gain 1200 Monthly Forex Wiki Trading Forex Creating Goals Success And Failure

Aplikasi Period Calendar Kalender Menstruasi Della Azizah Munawar 006 400pxl Google Play Store Aplikasi Android

A Better Way To Understand Trs Mckinsey

Fighter Planes In Racing Car Colours Bac Tsr 2 Mclaren Mercedes West C Clavework Graphics Mclaren Mercedes Fantasy Racing Fighter Planes

Accounting Department Organization Chart Google Search Organization Chart Accounting Organizational Chart

Btec Level 3 Business Unit 3 Personal Business Finance All The Formulas Sheet Teaching Resources

Real Estate Development Financial Feasibility Real Estate Development Development Property Development

0 comments:

Post a Comment