Hpr Finance Formula

Annualized HPR Income End of Period Value Initial ValueInitial Value1 1t-1. It also captures any additional income that one earns from an investment.

Chapter 8 Risk And Return Ppt Download

Chapter 8 Risk And Return Ppt Download

The holding period return ratio is usually expressed as a percentage.

Hpr finance formula. Alternatively returns for regular time intervals can be calculated thus. Holding period return refers to the change in the value of an investment over the period it is held expressed as a percentage of the originally invested amount. HPY 12000 0 - 10000 10000 HPY 2000 10000 02 or 20 Johns holding period yield over the period is 20.

If you are required to determine the annualized holding period return then the formula for annualized HPR is as shown below. V 0 the beginning value of the investment. If you need to calculate the annualized HPR you can use the following formula.

HPR for Fund X 5 1 5 0 1 0 0 1 0 0 5 5 beginalignedtextitHPR for Fund Xfrac5150-10010055010pttextitHPR for Fund Bfrac10320-20020065end. If the original HPR is calculated over multiple years then the annualized returns can be calculated as follows. The holding period return formula is.

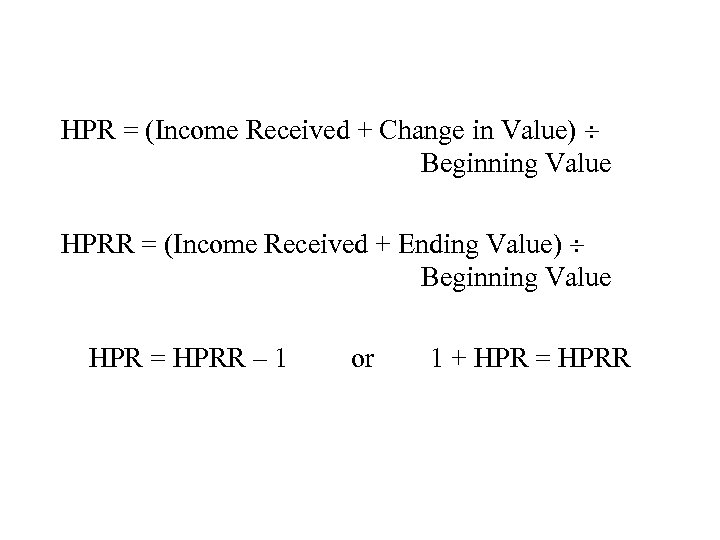

His holding period yield would be. HPR Income end of period value - original value original value 100 Fred purchased shares in the Big Blue fund four years ago for 5000. Holding Period Return Holding period return also called holding period yield is the total return earned on an investment over its whole holding period expressed as a percentage of the initial value of the investment.

This is sometimes called earning interest on interest. The HPR is calculated by taking the income and other gains on the investment and dividing it by the historical cost. INDEXGOOGLEFINANCEAAPLHighdate201722722 In this example I have used the GOOGLEFINANCE formula to give me the highest price of Apple stock on February 27 2017.

Where the End Value includes income such as dividends earned on the investment. The return on a bond or asset over the period in which it was held is called the holding period return HPR. HPR is the change in value of an investment asset or portfolio over a particular period.

Text HPR cfrac text Ending value text beginning value text asset income. HPR 102 100 2100 4. In this case you would combine the GOOGLEFINANCE formula with the INDEX formula.

There is an active secondary market for bonds. Income the distributions or cash flows from the investment eg dividends Vn the ending value of the investment. Example of Holding Period Return Formula.

Secondly what does HPR stand for in finance. Formula for Calculating the Return. Annualized HPR Bond A 1 1856 13 1 58 Annualized HPR Bond B 1 3158 15 1 56 From the above calculation if we look at HPR alone without factoring annualized return bond B provides the highest return at 3158 while bond A is only at 1856.

HPR Income end of period value - original value original value 100. A portfolio manager buys a stock for 50 and sells it for 56 after a year. Holding Period Return The return on an investment during the time one holds the investment.

HPR End Value - Initial Value Initial Value. The general formula for calculating the HPR is. It is useful for calculating returns over regular intervals which could include annualized or quarterly returns.

The holding period return formula is. The extra 1 can be attributed to the effect of compounding through earning 10 in the second year on the 10 that was earned in the first year. It is the entire gain or loss which is the sum income and capital gains divided by the value at the beginning of the period.

Income initial value and end-of-period value. By using the holding period return formula the amount gained would be 21. TextHPR_text t etextRcc text t 1 Question.

It is calculated as the sum capital gain and income divided by the opening value of investment. The correct answer is A. Here t number of years.

In general to determine the HPR after t years. Annualized Holding Period Return Holding Period Return 1 1n 1. Lesson Summary The holding period return or HPR is the total return from income and asset appreciation over a period of time expressed as a percentage.

The continuously compounded rate of return is closest to. The holding period returns can be annualized from either longer periods or shorter periods. The holding period return serves four common uses namely to assess investment risk determine investment value compare multiple investment values and understand tax implications.

It is a useful way to compare the expected return to the actual return. The HPR formula requires three variables.

Corporate Finance Lecture Eight Risk And Return Ppt Download

Corporate Finance Lecture Eight Risk And Return Ppt Download

Analysis Of Risk And Return Chapter07 Contemperary Financial Manage

Analysis Of Risk And Return Chapter07 Contemperary Financial Manage

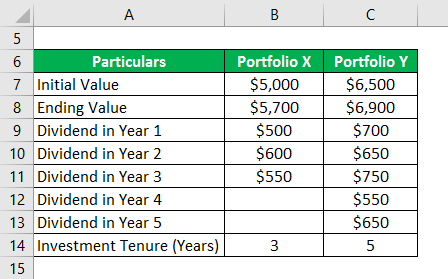

Holding Period Return Formula Calculator Excel Template

Holding Period Return Formula Calculator Excel Template

Measuring Risk And Return Ppt Video Online Download

Measuring Risk And Return Ppt Video Online Download

Cfa Level 1 Money Weighted Return Vs Time Weighted Return Soleadea

Cfa Level 1 Money Weighted Return Vs Time Weighted Return Soleadea

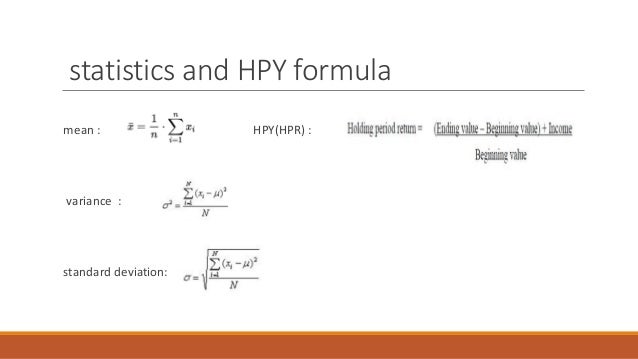

Chapter 2 Measuring Returns And Risk Measures

Chapter 2 Measuring Returns And Risk Measures

Holding Period Return Hpr Formula Examples Business Class Video Study Com

Holding Period Return Hpr Formula Examples Business Class Video Study Com

Cfa Level 1 Chapter 3 The Time Value Of Money By Richuk101 Issuu

Cfa Level 1 Chapter 3 The Time Value Of Money By Richuk101 Issuu

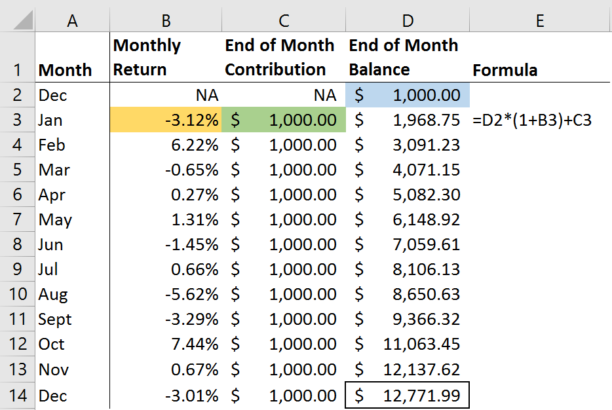

Investment Returns How To Calculate Return Sensible Financial Planning

Investment Returns How To Calculate Return Sensible Financial Planning

Risk And Return Intro Returns Hpr Cagr Ytm Rcytm Apr And Apy Dy Ppt Video Online Download

Risk And Return Intro Returns Hpr Cagr Ytm Rcytm Apr And Apy Dy Ppt Video Online Download

Post a Comment for "Hpr Finance Formula"