Google Finance Beta Formula

Its a great way to get updated ticker information and I use Google finance particularly to see past ticker information. Being a Google Finance user myself I was not able to figure out how it computes the beta.

The Capital Asset Pricing Model Part 2 Acca Global

The Capital Asset Pricing Model Part 2 Acca Global

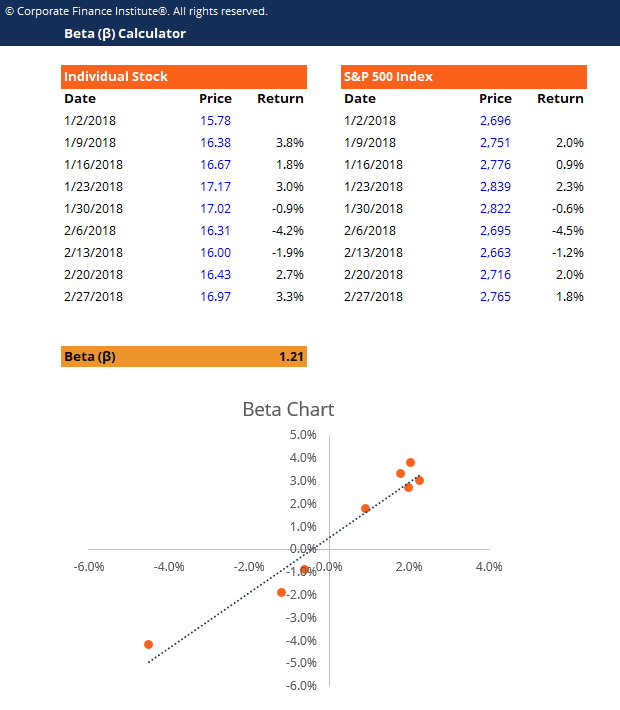

SP500 and 36 or 60 monthly observations.

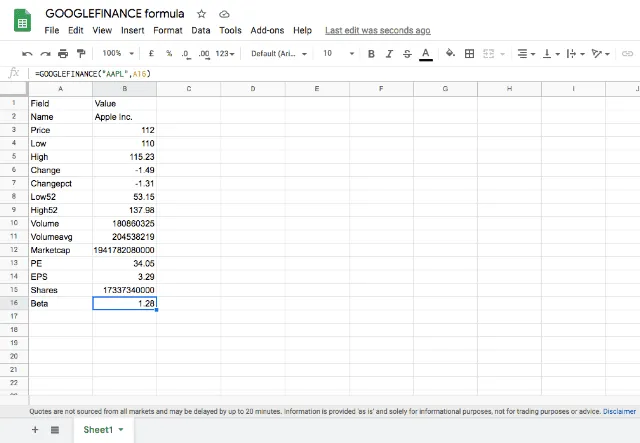

Google finance beta formula. With that information hope you can create your financial portfolio tracker in Google Sheets. In finance the beta β or market beta or beta coefficient is a measure of how an individual asset moves on average when the overall stock market increases or decreases. Shares The number of outstanding shares.

I chose Google Sheets because it can query Google Finance to pull market data. Which give me Google Finance Internal Error. β 1 exactly as volatile as the market.

21 2 2 bronze badges. β 1 more volatile than the market. This helps me identify which stocks in my portfolio are reaching a trigger point where I may want to buy which I typically base on PE ratio.

CAPM formula shows the return of a security is equal to the risk-free return plus a risk premium based on the beta of that security. First lets cover what financial data Google Sheets can pull in. My expertise is on Google Sheets functions and formulas.

Finance is Googles real-time tool that displays current market information and aggregates business news. If you want to monitor stock prices you need an easy way to keep your data up to date. This page on Yahoo Finance states that beta is calculated from monthly price for the previous 36 months relative to the SP 500.

However my best guess is that its done in a way that is very similar to the methods used by Yahoo and Bloomberg. Google Finance provides real-time market quotes international exchanges up-to-date financial news and analytics to help you make more informed trading and investment decisions. If you are a trader or have used any trading platform in the past you may find the GoogleFinance function very easy to use.

To fetch Googles current stock price into Google Sheets open a new Google Sheet and type the following formula into cell A2. The top screenshot shows the stock price for a stock on Google FInance while the bottom part shows a formula in Google Sheets that automatically imports the price into a spreadsheet. This isnt the whole story though.

High - The current days high price. A company with a higher beta has greater risk and also greater expected returns. Priceopen - The price as of market open.

The beta coefficient can be interpreted as follows. Thus beta is a useful measure of the contribution of an individual asset to the risk of the market portfolio when it is added in small quantity. Google Finance provides a beta for this company of 548 which means that with respect to the historical variations of the stock compared to the Standard Poors 500 US CORP increased on average.

Beta The beta value. This function imports data from the Google Finance web application which provides daily stock prices news from the currency and financial. Currency The currency in which the security is priced.

What is Google Finance. For stock exchange codes the delay time if any of available stock quotes from different markets and associated disclaimers please see this official Google Finance Disclaimer page. Changepct The percentage change in price since the previous trading days close.

Download the excel file here. Follow answered Mar 5 20 at 710. Stock prices are always changing.

But how are these values calculated. Google finance is a great tool to use in your investing arsenal. You can use the GoogleFinance function in Google Sheets to get live as well as historical stock prices and currency exchange rates.

Issue only goes away if I close the tab on Chrome or Brave in my case go back to my Drive and open the sheet again. Its currently integrated with Google Search so if you look up the ticker symbol of a specific corporation on Google such as WMT for Walmart or AAPL for Apple you will immediately see the current stock quote and historical data for that security. GOOGLEFINANCEGOOG price Essentially what this formula is doing is querying Google Finance for GOOG current price GOOG is the ticker symbol for Google Inc.

Yahoo Finance gives beta values for stocks. Beta is a measure used in fundamental analysis to determine the volatility of an asset or portfolio in relation to the overall market. The overall market has a beta of 10 and individual stocks.

Closeyest The previous days closing price. How to calculate be. You can set the exact date range of when to see past price closing prices as well as 1d 5d 1m 3m 6m YTD 1yr 5yr 10yr and All.

Attribute - OPTIONAL - price by default - The attribute to fetch about ticker from Google Finance and is required if a date is specified. Attribute is one of the following for real-time data. Find out how with a detailed step-by-step explanation.

Price - Real-time price quote delayed by up to 20 minutes. As well as enabling you to track current stocks and shares information it can also be used to retrieve historical securities data. Thiss because you may find the arguments in this function familiar to you.

The GOOGLEFINANCE function allows you to import real-time financial and currency market data straight into Google Sheets.

How To Use The Googlefinance Function In Google Sheets Sheetgo Blog

How To Use The Googlefinance Function In Google Sheets Sheetgo Blog

How To Calculate Capital Asset Pricing Model Investing Capital Assets Time Value Of Money

How To Calculate Capital Asset Pricing Model Investing Capital Assets Time Value Of Money

Beta Calculator Template Download Free Excel Template

Beta Calculator Template Download Free Excel Template

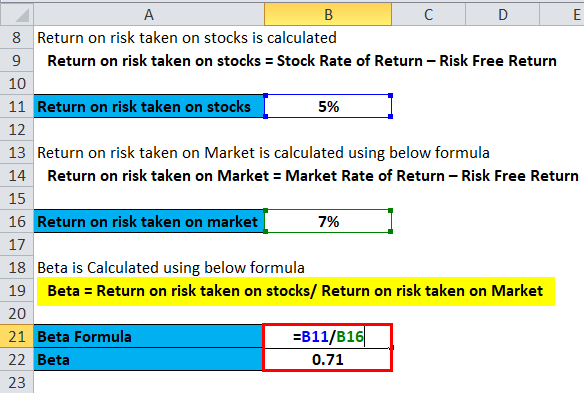

How Do You Calculate Beta In Excel

Beta Formula Top 3 Methods Step By Step Examples To Calculate Beta

Beta Formula Top 3 Methods Step By Step Examples To Calculate Beta

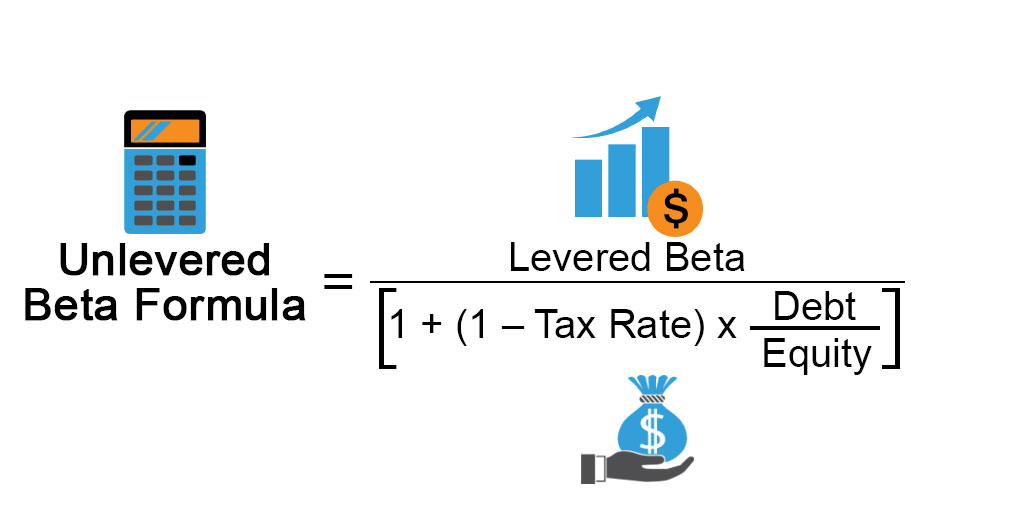

Unlevered Beta Formula Calculator Examples With Excel Template

Unlevered Beta Formula Calculator Examples With Excel Template

How To Calculate Beta In Excel

How To Calculate Beta For Indian Stock Market Unofficed

Beta Formula Calculator For Beta Formula With Excel Template

Beta Formula Calculator For Beta Formula With Excel Template

The Best Free Stock Portfolio Tracking Spreadsheet Using Google Drive Stock Portfolio Investment Tools Portfolio

The Best Free Stock Portfolio Tracking Spreadsheet Using Google Drive Stock Portfolio Investment Tools Portfolio

How To Calculate The Beta Of A Company Magnimetrics

How To Calculate The Beta Of A Company Magnimetrics

Post a Comment for "Google Finance Beta Formula"