Afn Finance Formula

AFN AS 0ΔS LS 0ΔS MS 1 RR Where. Increases asset requirements increases AFN.

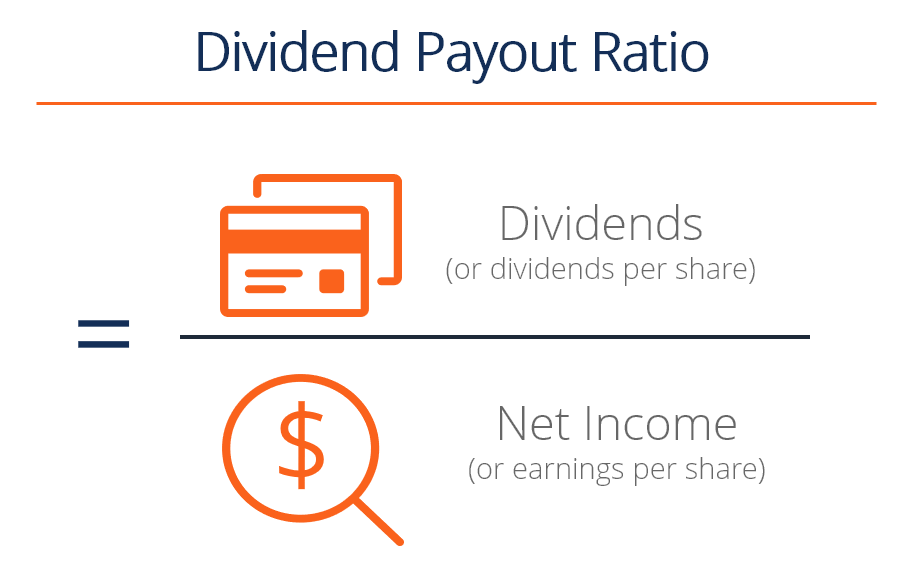

Dividend Payout Ratio Formula Guide What You Need To Know

Dividend Payout Ratio Formula Guide What You Need To Know

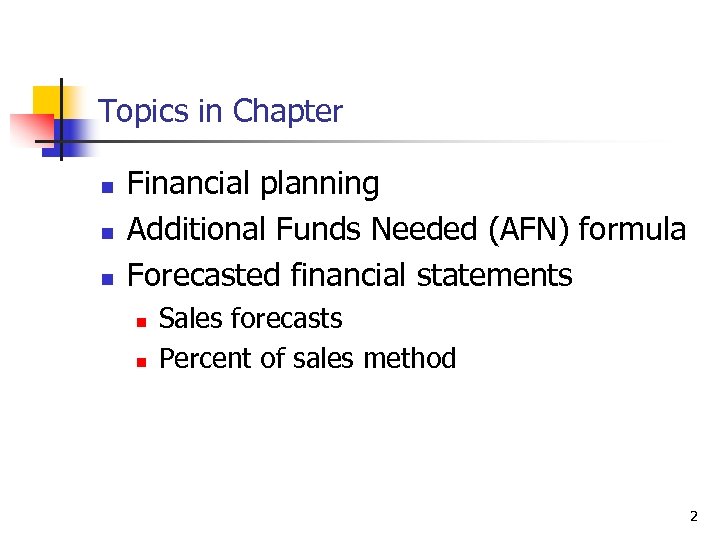

The AFN formula method.

Afn finance formula. The formula for AFN is. Which of the following is not one of the steps taken in the financial planning process. If this value is negative this means the action or project which is being undertaken will generate extra income for the company which can be invested elsewhere.

AFN AS 0S - LS 0S - MS 1RR AFN 10002000500 - 1002000500 - 0027025001 - 04 AFN 1845 million. Determining the amount of external funding needed is a key part of calculating AFN. The AFN equation shows that external financing requirements depend on five key factors.

The Additional Funds Needed AFN formula The AFN method is defined with the following formula. The simplified formula is. 11 How would increases in these items affect the AFN.

The number of new shares of common stock required to finance wcs of additional funds needed is m cs MAFNP csw cs. Formula AS x Δ Sales. AFN Additional Funds NeededPresented bySyed Faraz Rizvi.

Million what is the AFN. AFN Projected increase in assets spontaneous increase in liabilities any increase in retained earnings. If a negative value is found for AFN that means that the action would generate extra income that could be invested elsewhere.

If this value is negative this means the action or project which is being undertaken will generate extra income for the company which can be invested elsewhere. AFN Projected increase in assets spontaneous increase in liabilities any increase in retained earnings. AFN Projected increase in assets spontaneous increase in liabilities any increase in retained earnings.

Project financial statements and use these projections to analyze the effects of the operating plan on projected profits and various financial ratios. Namun jika rasio yang diharapkan tetap konstan maka rumus berikut dapatdigunakan untuk meramalkan kebutuhan keuangan. THE AFN FORMULA Rata-rata untuk memperkirakan kebutuhan modal mereka perusahaan membuat laporan pro forma laba danneraca seperti yang telah dijelaskan.

Reduces funds available internally. This can help businesses to set goals with respect to their assets liabilities sales and retained earnings to remain economically stable and move toward a more financially positive future. The Formula Method for ForecastingAFN Additional Funds NeededForecasting is the iterative process both in way FinancialStatements are generated Financial plan is developedFirst Construct Pro forma Income Statement BalanceSheet.

Instead of preparing a set of forecasted financial statements you can also calculate your external financing needs EFN by using a formula that looks at three changes. AFN Projected increase in assets spontaneous increase in liabilities any increase in retained earnings. The simplified formula is.

A Assets tied directly to sales and will increase L Spontaneous liabilities that will be affected by sales. The AFN formula projects additional funds required next year for a business to remain viable. Formula AS x Δ Sales.

This can be determined by mathematical formulas which use inputs that can be found in a companys financial statements. Required increases to assets given a change in sales. Sales growth AS.

L 0. The simplified formula is. The AFN equation is as follows.

AFN A S 0 S L S 0 S NPMS 1 b. The remaining 118 million must be raised from external sources. This value is an approximation but it is only slightly different from the AFN figure 1147 million we developed in Table 11-3.

S 1 PM b. EqAFN Capex Increase in current assets - Increase in spontaneous liabilities-NI1-d eq. In this lesson youll learn about pro-forma financial.

What is AFN formula. A 0. Higher dividend payout ratio.

This can be determined by mathematical formulas which use inputs that can be found in a companys financial statements. The simplified formula is. Additional funds needed AFN is calculated as the excess of required increase in assets over the increase in liabilities and increase in retained earnings.

Instead of preparing a set of forecasted financial statements you can also calculate your external financing needs EFN by using a formula that looks at three changes. A Modification of the AFN Formula To address the divergence in funding needs sometimes encountered when comparing the projected balance sheet and equation methods a modified AFN MAFN model is derived.

Chapter 9 Financial Planning And Forecasting Financial Statements

Chapter 9 Financial Planning And Forecasting Financial Statements

Retention Ratio Definition Formula And Example

Retention Ratio Definition Formula And Example

Additional Funds Needed Afn Formula Pro Forma Financial Statements Ppt Download

Additional Funds Needed Afn Formula Pro Forma Financial Statements Ppt Download

Customer Lifetime Value Ltv Calculation Formula Definition Customer Lifetime Value Investment Analysis Customer Retention

Customer Lifetime Value Ltv Calculation Formula Definition Customer Lifetime Value Investment Analysis Customer Retention

Financial Planning And Forecasting Financial Statements Ppt Video Online Download

Financial Planning And Forecasting Financial Statements Ppt Video Online Download

Financial Planning And Control Zfinancial Planning Zsales Forecasts Afn Formula Method Ppt Download

Financial Planning And Control Zfinancial Planning Zsales Forecasts Afn Formula Method Ppt Download

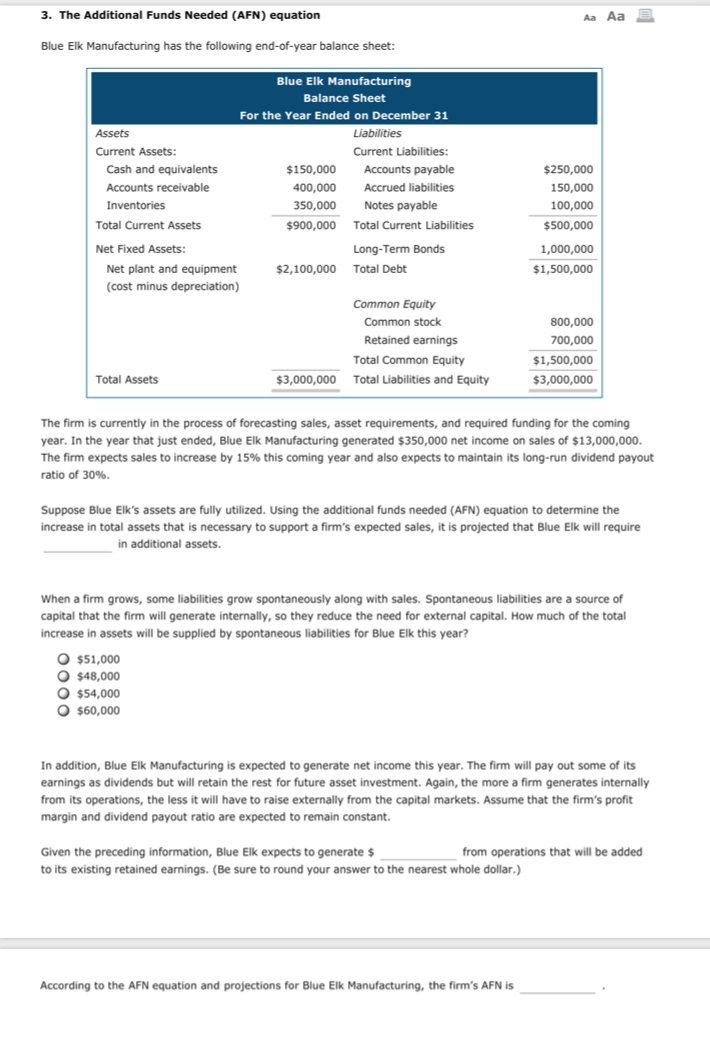

Solved 3 The Additional Funds Needed Afn Equation Aa A Chegg Com

Solved 3 The Additional Funds Needed Afn Equation Aa A Chegg Com

Trade Discount Definition Formula In Accounting Journal Entry Discount Formula Education Journal Entries

Trade Discount Definition Formula In Accounting Journal Entry Discount Formula Education Journal Entries

Original Hand Signed Bruno Senna Autograph Signature Paper Sheet F1 Goodwood Ebay Goodwood Autograph Senna

Original Hand Signed Bruno Senna Autograph Signature Paper Sheet F1 Goodwood Ebay Goodwood Autograph Senna

Afn Needed Calculation Youtube

Afn Needed Calculation Youtube

Lecture Four Financial Forecasting Latest Financial Statements Sales Forecast Cost Accounting Forecasts Financial Market Data Preliminary Projections Ppt Download

Lecture Four Financial Forecasting Latest Financial Statements Sales Forecast Cost Accounting Forecasts Financial Market Data Preliminary Projections Ppt Download

Post a Comment for "Afn Finance Formula"