Finance Car Anz

You can apply for pre-approval for an ANZ car loan by filling out a simple online application form where youll have to submit relevant identity employment and income documentation. With ANZ Vehicle Finance you can get the vehicles your business needs to keep moving with the option of tailoring your repayments to suit your cash flow.

ANZ is committed to funding and facilitating at least 50 billion in sustainability solutions by October 2025.

Finance car anz. Personal loans Car travel loans debt consolidation overdrafts Insurance Home life mortgage and car insurance Investing super Investing advice super retirement ANZ Share Investing. Interest rates and fees are subject to change. Give yourself around 30 minutes to complete the car loan application.

The business is one of the more experienced lenders in the automotive industry and has been involved in the. For an ANZ Secured Car Loan the total loan repayments shown is an estimate based on the total loan repayments total interest and the Loan Administration Charge of 5 per month but does not include the Establishment Fee of 350 and other fees which may be incurred such as late payment fees. With ANZ equipment finance you can get the tools and machinery your business needs with the option of tailoring your repayments to suit your cash flowAsset Finance - Streamlined Motor Vehicles.

This target will fund and facilitate at least 50 billion towards sustainable solutions for our customers including initiatives that help improve environmental sustainability and increase access to affordable housing and promote financial wellbeing. We are proud to offer car loans by ANZ formerly known as Esanda an experienced lender in the automotive industry. With a structured repayment plan and fixed rate your car boat or motorcycle could be paid off in no time.

Repeat business lies at the core of our market-leading position which has seen ANZ consistently awarded for its lead role in landmark transactions and nominated as the Project Finance Bank of choice by our customers. They offer a variety of products to meet the needs of New Zealanders of all walks. Minimum age of 18.

ANZs car loan eligibility criteria. ANZ OnePath and UDC Finance. For an ANZ Secured Car Loan the total loan repayments shown is an estimate based on the total loan repayments total interest and the Loan Administration Charge of 5 per month but does not include the Establishment Fee of 350 and other fees which may be incurred such as late payment fees.

Below is high-level overview of ANZs criteria. ANZs minimum requirements for a car loan. Its a personal loan you could use to purchase a car motorcycle boat or other vehicle.

ANZ Car Loans ANZ Bank is an umbrella of financial services providers comprised of three companies. This will help you set your limits while selecting your car. ANZ Car Loans Car Loan.

ANZs car loans business was known as Esanda up until early 2019 when it was fully absorbed into the ANZ brand. Getting pre-approval on your car loan can give you a good idea of how much you may be allowed to borrow. There is a standard application fee of 115 but this is currently being waived for a limited time.

We have specialist project finance capabilities across the resources energy and infrastructure sectors in Australia New Zealand and the Asia Pacific region. The ANZ Personal Loan interest rate is currently 1290 pa. But can change and you can pay these loans off between six months and seven years.

Contact us now and get in before 30 June 2021. Before looking for a new car get approved for an ANZ personal loan so that you can shop with confidence. For example if you borrowed 5000 for two years at 1290 pa the total interest payable would be about 699.

Approved customers may not have to pay a deposit freeing up your valuable capital for other cash flow needs. Online security Stay protected from ever-changing cybersecurity threats. Before you apply for a car loan be sure to understand and meet the ANZs lending criteria.

We use our asset finance product capability industry knowledge asset expertise and structuring skills to deliver market leading solutions across a diverse range of asset classes including term receivables. Earn a minimum of 15000 per annum. Global network We operate in 33 markets around the world including 14 markets across Asia.

How much does an ANZ personal loan cost. Before you apply for an ANZ Personal Loan its important to figure out how much you could borrow and what you can afford to repay. Our banking specialists deliver asset finance solutions for business-critical investment in capital goods and related services.

ANZ Research Global economics industry research forecasts. Both the ANZ Fixed Rate Loan and ANZ Variable Rate Loan can be used for a specific purpose such as consolidating debt or a big purchase like buying a new or used car. Whether its new or used has two wheels or four an ANZ Personal Loan could help get you where you need to be.

ANZ Digital Services All your banking platforms such as Transactive - Global Transactive Trade FX Online and more. Personal loans Debt consolidation buying a new or used car renovations and more Insurance Home life mortgage and car insurance Investing super Investing advice super retirement ANZ Share Investing. All ANZ personal loans have a standard interest rate of 129 pa.

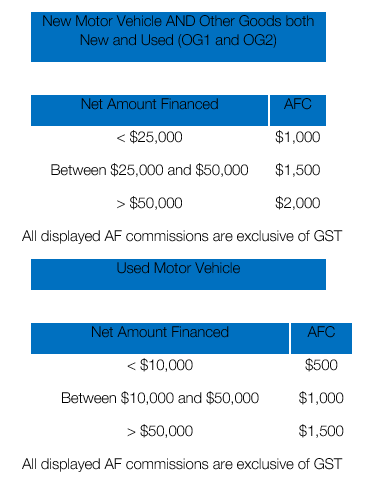

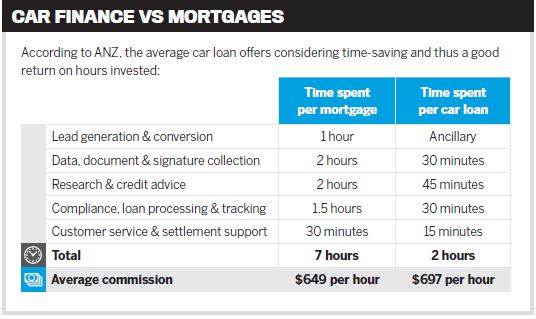

Anz Asset Finance Pricing Commission Changes Blog Connective

Anz Asset Finance Pricing Commission Changes Blog Connective

Join The Anz Financial Wellbeing Challenge Anz

Join The Anz Financial Wellbeing Challenge Anz

Boat Caravan Motorbike And Truck Loans Anz

Boat Caravan Motorbike And Truck Loans Anz

Anz Anz Car Loans Positive Lending Solutions

Anz Anz Car Loans Positive Lending Solutions

Everything You Need To Know About Financing A Car Car Loan Basics

Everything You Need To Know About Financing A Car Car Loan Basics

Anz Charged 24 Per Cent On Car Loans

Anz Charged 24 Per Cent On Car Loans

Simple Car Loan Finance Geelong Bellarine Mortgage Choice

Simple Car Loan Finance Geelong Bellarine Mortgage Choice

Anz To Scrap Car Loans And Consumer Finance Loans In April

Anz To Scrap Car Loans And Consumer Finance Loans In April

Post a Comment for "Finance Car Anz"