Pi Finance Formula

We know 500 definitions for PI abbreviation or acronym in 8 categories. Calculation of profitability index is possible with a simple formula with inputs as discount rate cash inflows and outflows.

Profitability Index Learn How To Calculate The Profitability Index

Profitability Index Learn How To Calculate The Profitability Index

Pi 2 Arcsinsqrt1 - x2 absArcsinx.

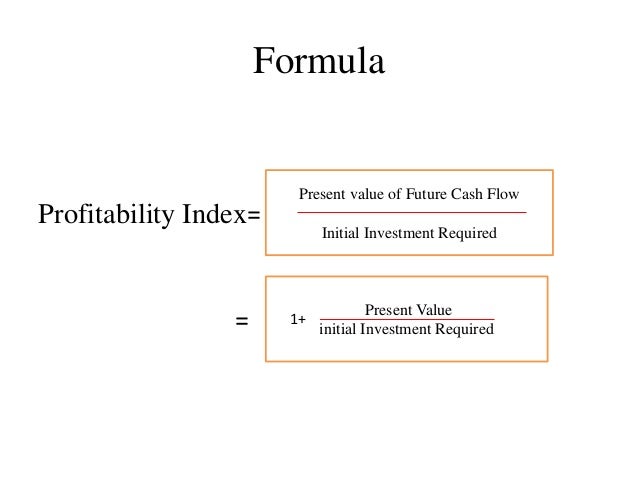

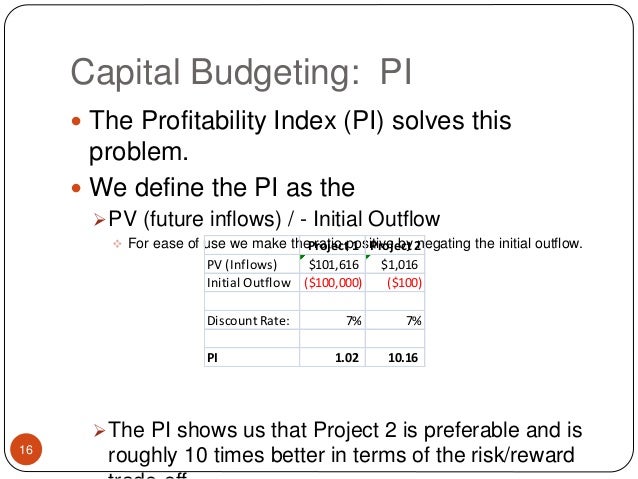

Pi finance formula. The profitability index PI is a measure of a projects or investments attractiveness. As stated Profitability Index PV of future cash flows Initial Investment. Use the following formula where PV the present value of the future cash flows in question.

Discounted cash flow technique is used in arriving at the profitability index. X2 refers to an exponent in this case x squared. It only includes the inflows or future returns.

What does PI Stand For in Business Finance. Formula for the PI Function. Plug your number into the following formula and the result will be roughly equal to pi.

This can be further broken down to. Profitability index also known as profit investment ratio and value investment ratio is the ratio of payoff to investment of a proposed project. The syntax for the PI function is PI In Excel if you just input PI you will get the value of PI as shown below.

PI greater than or equal to 1 is interpreted as good and acceptable criterion. It is an evaluation of the profitability of an investment and can be compared with the profitability of other similar investments which are under consideration. I r π displaystyle irpi The Fisher equation can be used in either ex-ante before or ex-post after analysis.

Profitability Index PV of future cash flows Initial investment. Profitability Index Present Value of Future Cash Flows Initial Investment in the Project. If the PI is less than 1 the project destroys value and the company should not proceed with the project.

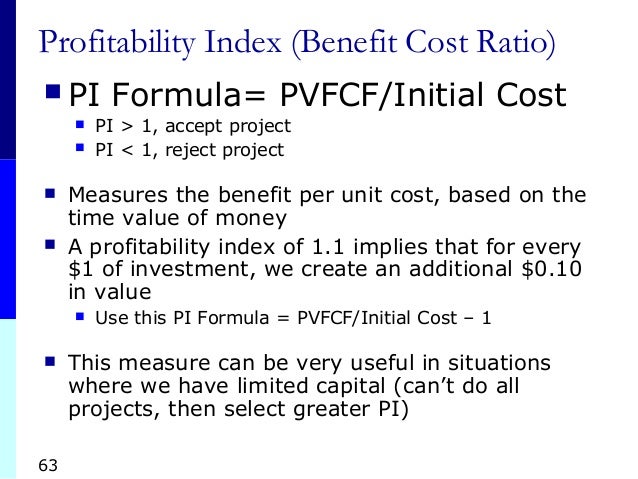

The PI rule is that a result above 1 indicates a go while a result under 1 is a loser. However Excel stores the value of PI accurately to 15 digits and up to 14 decimal places. It is a useful tool for ranking projects because it allows you to quantify the amount of value created per unit of investment.

The profitability index is also referred to as benefit-cost ratio cost-benefit ratio or even capital rationing. Please look for them carefully. How to do calculations using the PI Function in Excel.

The formula for PI is the present value of future cash flows divided by the initial cost of the project. Sqrt is short for square root. Profitability Index Net Present Value Initial Investment Initial Investment.

If the PI is greater than 1 the project generates value and the company may want to proceed with the project. It is also known as benefit-cost ratio. The present value of future cash flows is a method of discounting future cash to its current value and requires the implementation of the time value of money calculation.

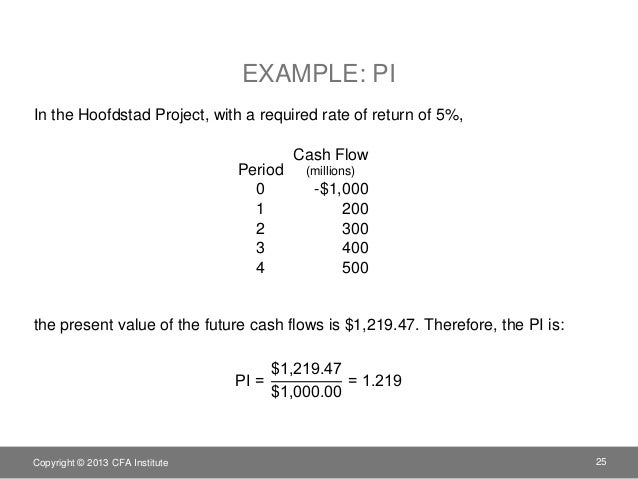

The PI is calculated by dividing the present value of future expected cash flows by the initial investment. Under capital rationing PI method is suitable because PI method indicates relative figure ie. The PV of future cash flows does not include the initial investment.

So based on the above formula. Letting r denote the real interest rate i denote the nominal interest rate and let π denote the inflation rate a linear approximation but the Fisher equation is often written as an equality. To learn more launch our free Excel crash course now.

Relevance and Uses of Profitability Index Formula. All acronyms 703 Airports Locations 1 Business Finance 38. The equation is as follows.

The profitability index formula is used calculate the profitability of a project based on its future discounted returns relative to the initial investment. Ratio instead of absolute figure. The profitability index equals the present value of a projects future cash flows divided by the initial cash investment.

Profitability Index PV of future cash flows Initial investment. Possible PI meaning as an acronym abbreviation shorthand or slang term vary from category to category. Formula The profitability index can be calculated by dividing the present value of expected cash flows PV by the initial cost of a project CF 0.

The profitability index PI refers to the ratio of discounted benefits over the discounted costs. Profitability Index Method Formula. PI index formula Let us start with a discussion of the pi index formula.

Abs is short for absolute value. The ratio is calculated as follows. What does PI mean.

The formula for Profitability Index is simple and it is calculated by dividing the present value of all the future cash flows of the project by the initial investment in the project. Arcsin refers to the inverse sine in radians. The formula for the PI is as follows.

Profitability index PV of future cash flows Initial invest. PI Formula 1 Net Present Value Initial Investment Required PI 1 Present Value of Future Cash Flow Present Value of Cash Outflow Initial Investment Required PI 1 US 130 million US 100 million US 100 million. Profitability Index Method Formula.

Home Finance Capital Budgeting Profitability Index Profitability Index It is calculated by dividing the present value of all cash inflows by the initial investment. For PI we have found 500 definitions.

Profitability Index Chartered Financial Analyst Investing Financial Modeling

Profitability Index Chartered Financial Analyst Investing Financial Modeling

Financial Management Principles And Applications 11ed Chapter 13

Financial Management Principles And Applications 11ed Chapter 13

Profitability Index Vs Net Present Value Which One Is Better

Profitability Index Vs Net Present Value Which One Is Better

Cfa Corporate Finance Chapter2

Cfa Corporate Finance Chapter2

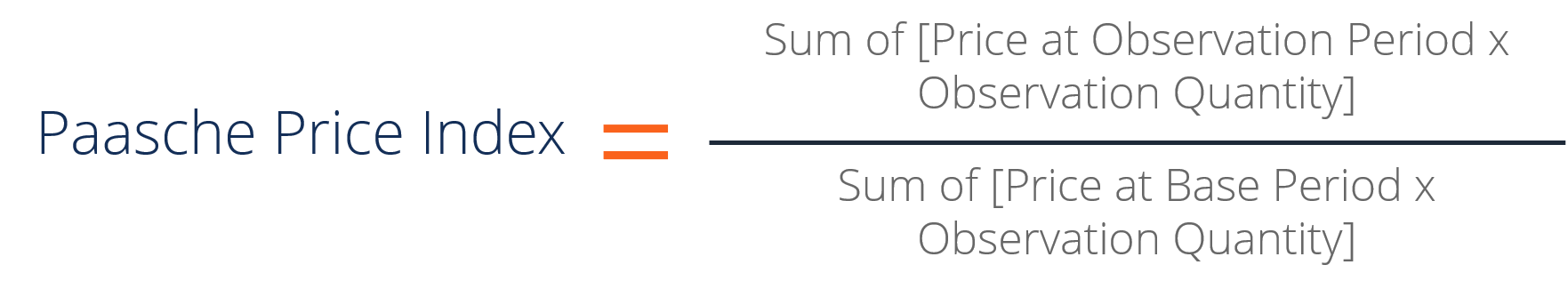

Paasche Price Index Overview Formula And Example

Paasche Price Index Overview Formula And Example

Profitability Index Meaning Example How To Interpret

Profitability Index Meaning Example How To Interpret

Profitability Index Formula Calculator Excel Template

Profitability Index Formula Calculator Excel Template

Cfa Level 1 Profitability Index Explained In 60 Seconds Soleadea

Cfa Level 1 Profitability Index Explained In 60 Seconds Soleadea

Post a Comment for "Pi Finance Formula"