Finance Formula Net Future Value

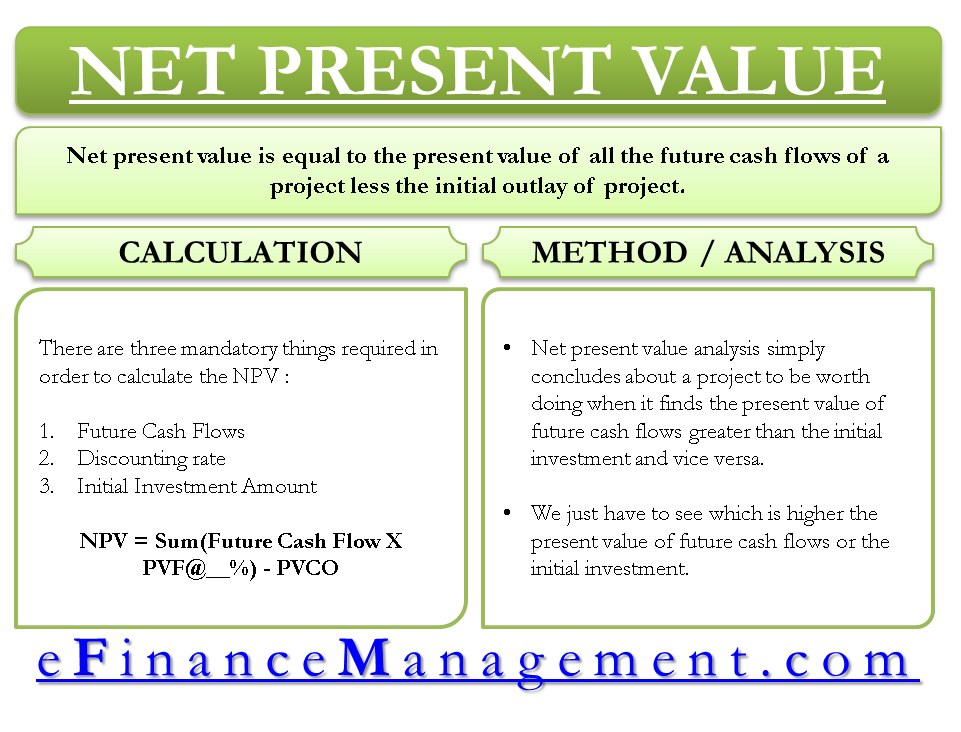

Net present value NPV is a financial metric that seeks to capture the total value of a potential investment opportunity. Formula How NFV is calculated.

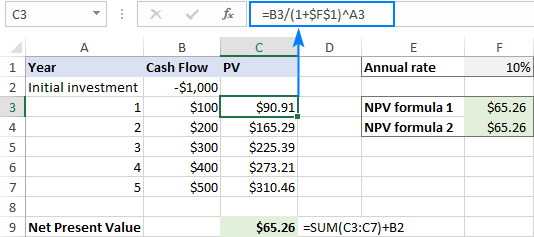

Calculate Npv In Excel Net Present Value Formula

Calculate Npv In Excel Net Present Value Formula

With four of the above five components in-hand the financial calculator can easily determine the missing factor.

Finance formula net future value. FV is the Future Value of the sum PV is the Present Value of the sum r is the rate taken for calculation by factoring everything in it n is the number of years Example of Future Value Formula. Solve for Future Value Now you are ready to command the calculator to solve for future value. Example of Annuity Payment Using Future Value Formula An example of the annuity payment formula using future value would be an individual who would like to calculate the amount they would need to save per year to have a balance of 5000 after 5 years.

However a cursory ability to run the. The idea behind NPV is to project all of the future cash inflows and. It is a negative value for the same reason as the payment amounts.

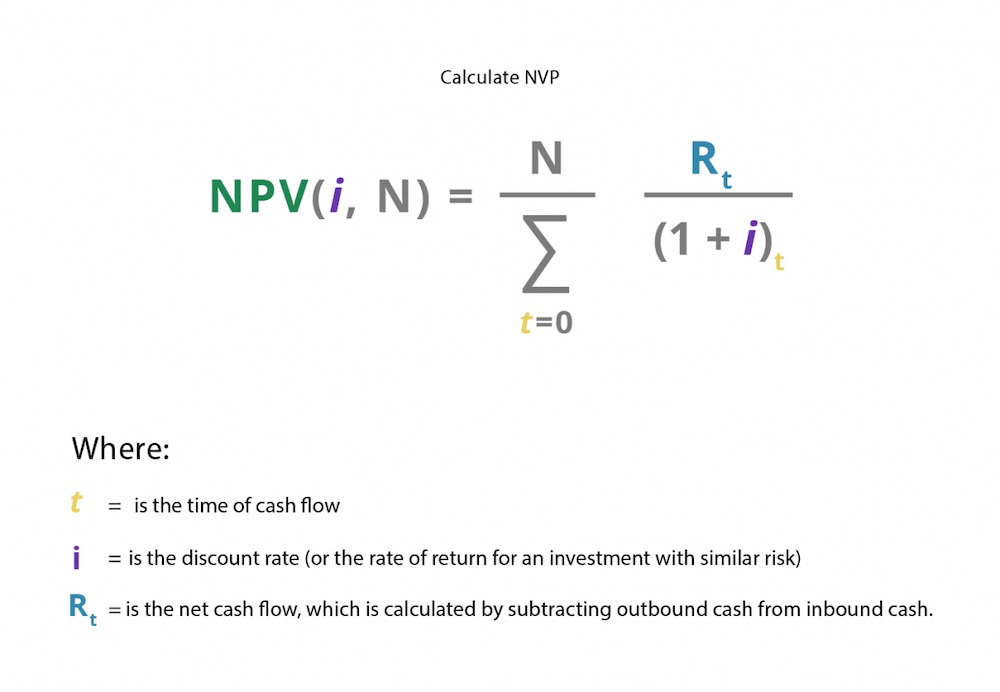

N number of periods. The future value formula changes slightly depending on which calculation is carried out. At its core it combines a number of different future value calculations added together.

The formula for Future Value FV is. The future value factor is generally found on a table which is used to simplify calculations for amounts greater than one dollar see example below. A PMT 1 rn nt - 1 rn The formula above assumes that deposits are made at the end of each period month year etc.

The objective of this FV equation is to determine the future value of a prospective investment and whether the returns yield sufficient returns to factor in the time value of money. The future value of an annuity formula assumes that 1. Each year is a separate future value calculation that are added together.

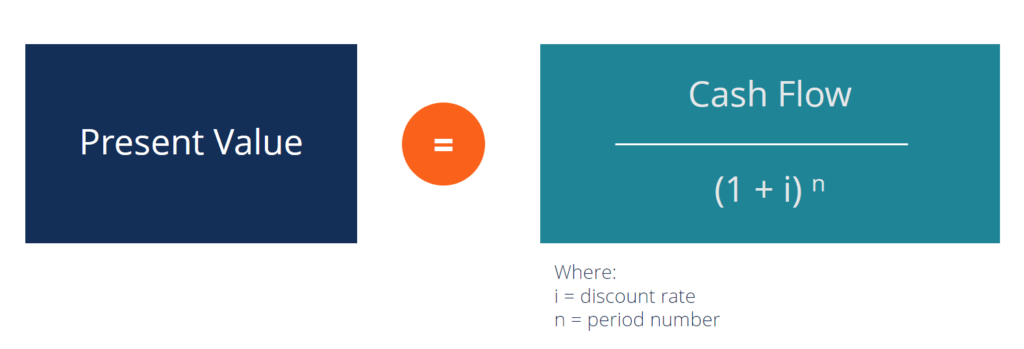

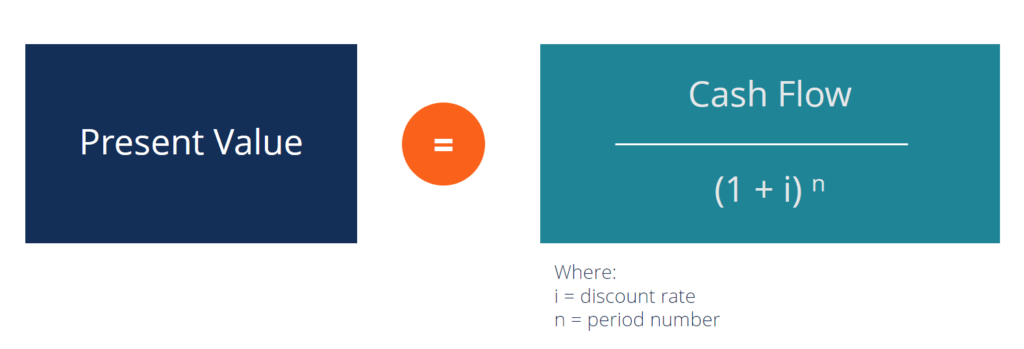

The Future Value FV formula assumes a constant rate of growth and a single upfront payment left untouched for the duration of the investment. From acid-base calculations in general chemistry to memorizing Winters Formula for USMLE Step 1 and the clinical wards many physicians dread math. Present Value can be converted into future value by multiplying the present value times 1r n.

The FV calculation can be done one of two ways. The future value calculator can be used to calculate the future value FV of an investment with given inputs of compounding periods N interestyield rate IY starting amount and periodic depositannuity payment per period PMT. The future value of an annuity formula is used to calculate what the value at a future date would be for a series of periodic payments.

But you can also calculate future value FV and present value PV by hand. Net Future Value NFV is the value in the future of a series of financial streams. By multiplying the 2nd portion of the PV of growing annuity formula above by 1r n the formula would show as.

Your answer should be exactly 1631547. Future Value FV is a formula used in finance to calculate the value of a cash flow at a later date than originally received. Future Value Present Value 1 Interest Rate x Number of Years Lets say Bob invests 1000 for five years with an interest rate of 10.

The rate does not change 2. Net present value or NPV is used to calculate todays value of a future stream of payments. To calculate FV simply press the CPT key and then FV.

Future value of a series formula Formula 1. Future Value with Simple Interest. F V C 0 1 r n.

The Future Value formula gives us the future value of the money for the principle or cash flow at the given period. This is the most commonly used FV formula which accounts for compounding interest on the new balance for each period. Future value with simple interest uses the following formula.

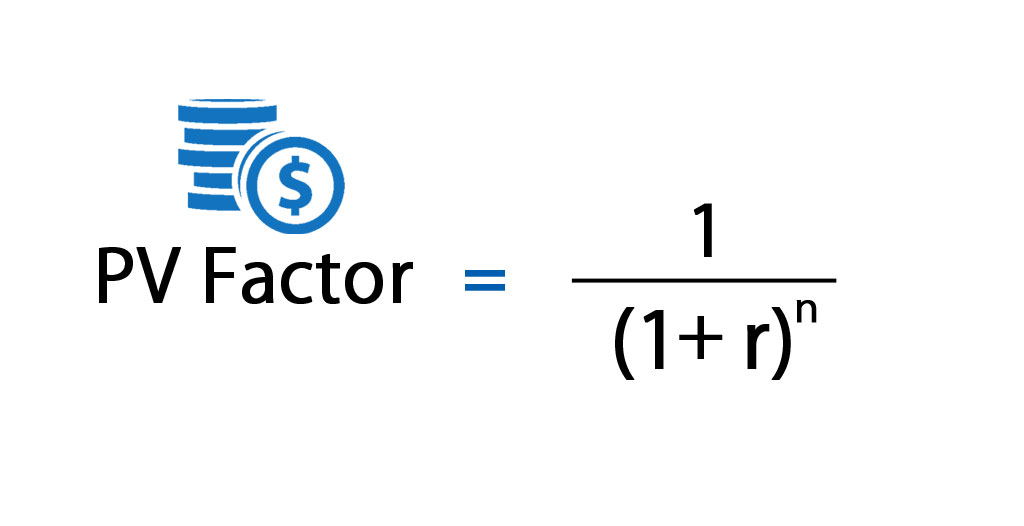

Physicians are notoriously averse to math. The future value factor formula is based on the concept of time value of money. If the NPV of a project or investment is positive it means that the discounted present value of all.

The first payment is one period away 3. The formula for the future value factor is used to calculate the future value of an amount per dollar of its present value. Future Value Present Value x 1 Rate of Return Number of Periods.

The periodic payment does not change. This idea that an amount today is worth a different amount than at a future time is based on the time value of money. FV C_ 0 times 1 r n FV C0.

C 0 Cash flow at the initial point present value r rate of return. Finally enter the present value amount -10000 and press the PV key. For this example it is assumed that the effective rate per year would be 3.

The future value formula is. There are even medical calculator websites and apps that help you do basic calculations that we encounter in day-to-day medicine.

How To Use The Excel Npv Function Exceljet

How To Use The Excel Npv Function Exceljet

Npv Formula Learn How Net Present Value Really Works Examples

Npv Formula Learn How Net Present Value Really Works Examples

Excel Formula Npv Formula For Net Present Value Exceljet

Excel Formula Npv Formula For Net Present Value Exceljet

What Is Net Present Value Npv In Project Management

What Is Net Present Value Npv In Project Management

Present Value Factor Formula Calculator Excel Template

Present Value Factor Formula Calculator Excel Template

Net Present Value Definition Example Investinganswers

Net Present Value Definition Example Investinganswers

Net Present Value Npv Meaning Formula Calculate Example Analysis

Net Present Value Npv Meaning Formula Calculate Example Analysis

What Is The Formula For Calculating Net Present Value Npv In Excel

Using The Net Present Value Npv In Financial Analysis By Dobromir Dikov Fcca Magnimetrics Medium

Using The Net Present Value Npv In Financial Analysis By Dobromir Dikov Fcca Magnimetrics Medium

Time Value Of Money How To Calculate The Pv And Fv Of Money

Time Value Of Money How To Calculate The Pv And Fv Of Money

Post a Comment for "Finance Formula Net Future Value"