Finance Charge Formula Car Loan

This is called the principal. There is no single formula that can determine the exact finance charges of your car loan.

Download Personal Loan Agreement Template Pdf Rtf Word Doc Wikidownload Personal Loans Contract Template Loan Application

Download Personal Loan Agreement Template Pdf Rtf Word Doc Wikidownload Personal Loans Contract Template Loan Application

Let us take the example of a car loan.

Finance charge formula car loan. This should give you the Total Amount of Finance Charges that you can expect to pay. Calculating finance charge on auto loans I think you need to find out how they calculate the daily interest rate from the annual rate. To do this calculation yourself you need to know your exact credit card balance every day of the billing cycle.

Heres the formula used to calculate the finance charge using this method. Divide the result 2800 by the number of months in a year 12. That produces the finance charges for the first month which is 23333.

Finance charges can vary from product to product or lender to lender. In this example the five-year loan would be multiplied by 12 to give you 60 months. There is no single formula for the determination of what interest rate to charge.

Determine your total finance charges. The daily balance method sums your finance charge for each day of the month. So the charge is levied upon after 6 th January 2020 on a daily basis till the time one does not clear the dues.

One common approach cardholders use for calculating finance charges is known as the average daily balance method. This formula is conceptually the same with only the PVIFA replacing the variables in the formula that PVIFA is comprised of. Step 2 Divide the annual interest rate by 12 the number of payments you will make per year.

The better way to avoid the financial charges is by not carrying a balance. Finance Charge Formula outstanding amount interest rate no of days 365. Calculating simple finance charges is easy once you have done some practice with the formulas.

Determine the principle amount. So in our example this would be. New balance you owe B CBO A Where.

Typically most car loan computations only factor in your principal interest rate loan term down payment or balloon payment and repayment frequency. Calculating the Car Loan Finance Charges. - If Days then BCL 365 - If Weeks then BCL 52 - If Months then BCL 12.

BCL Billing cycle length corresponding index. CBO Current Balance owed. The first step is to clarify the amount that you are being financed for.

The formula is as follows. Car loans mortgages and other property loans are also calculated in the same way. The finance charge that is associated with your car loan is directly contingent upon three variables.

Average Daily Balance x Annual Percentage Rate x Number of Days in Billing Cycle 365. Calculate the finance charges for the first month by multiplying the annual percentage rate of 8 percent 08 by the balance of 35000. Step 1 Calculate the loan duration in months by multiplying the number of years and 12.

Plug that number into the total finance charges formula. The following are the steps to take to calculate the finance charge on your vehicle loan. Alternative Loan Payment Formula The payment on a loan can also be calculated by dividing the original loan amount PV by the present value interest factor of an annuity based on the term and interest rate of the loan.

Finance charge A CBO APR 001 VBCBCL. Determine the number of payments you will make on your car loan by multiplying the number of years in the term of the loan by 12. A daily rate of 0046209 liquidates the loan at 54 months with interest computed daily starting from the contract date and payments made on the same day of the month as the first payment date but the interest totals 728729 not 729350.

To determine how much you can expect to pay in finance charges over the life of the loan multiply the Monthly Payment Amount by the Number of Payments minus the Amount Borrowed. Modifying any or all of these variables will change the amount of finance charges you will pay for the loan. 409 x 60 - 20000 Total amount of finance charges.

Monthly Payment Amount x Number of Payments Amount Borrowed Total Amount of Finance Charges. Weekly payment amount total repayments divided by loan period T in weeks. In this case 1860 divided by 104 weeks equals 1788 per week.

For example following is how we calculate the finance charge for a loan of 1000 with a 18 APR and a billing cyles of 25 days. A customer may qualify for two similar. For example a five-year car loan has 60 monthly payments.

APR Annual percentage rate. How to Calculate Finance Charge. Add up each days finance charge to get the monthly finance charge.

Then multiply each days balance by the daily rate APR365. Finance Charge Current Balance Periodic rate where Periodic Rate APR billing cycle length number of billing cycles in the period. Here is a finance charge formula to calculate your charges.

Finance charges are a type of compensation that allows the lender to make a profit for giving the funds or extending credit to a borrower. As an example calculate the finance charge for a 25000 car loan given with APR of 60 percent for five years. Loan amount interest rate and loan term.

The algorithm of this finance charge calculator uses the standard equations explained. 24540 - 20000 Total amount of finance charges. Finance charges applied to a car loan are the actual charges for the cost of borrowing the money needed to purchase your car.

Suppose we have a bill of 350 for the month of December 2019 and the last payable date for the same is 6 th January 2020.

Can You Get A Car Loan With No Credit Student Car Car Loans Student Driver

Can You Get A Car Loan With No Credit Student Car Car Loans Student Driver

How To Calculate Annual Percentage Rate Investing Calculator Borrow Money

How To Calculate Annual Percentage Rate Investing Calculator Borrow Money

Things To Check Before Applying For A Car Loan Take Indiabulls Dhani Car Loan For Your Purchase Car Finance Car Loans Best Payday Loans

Things To Check Before Applying For A Car Loan Take Indiabulls Dhani Car Loan For Your Purchase Car Finance Car Loans Best Payday Loans

Sbi Car Loan 7 70 Calculate Emi Check Eligibility Apply Online

Sbi Car Loan 7 70 Calculate Emi Check Eligibility Apply Online

18 Ways On How To Prepare For Car Finance Calculator Car Finance Calculator Car Finance Car Loan Calculator Compare Car Insurance

18 Ways On How To Prepare For Car Finance Calculator Car Finance Calculator Car Finance Car Loan Calculator Compare Car Insurance

The Hdfc Car Loans Have Revolutionised The Entire Market Due To The Low Interest Rates Charged By The Bank The Hdfc Car Loa Car Loans Loan Loan Interest Rates

The Hdfc Car Loans Have Revolutionised The Entire Market Due To The Low Interest Rates Charged By The Bank The Hdfc Car Loa Car Loans Loan Loan Interest Rates

J K Bank Car Loan 8 35 Emi Calculator Check Eligility

J K Bank Car Loan 8 35 Emi Calculator Check Eligility

Pin By Pakwheels Com On Tips Random Pakwheels Car Loans Car Loan Calculator How To Apply

Pin By Pakwheels Com On Tips Random Pakwheels Car Loans Car Loan Calculator How To Apply

Blog Complete Auto Loans Car Finance Car Loans Loan Lenders

Blog Complete Auto Loans Car Finance Car Loans Loan Lenders

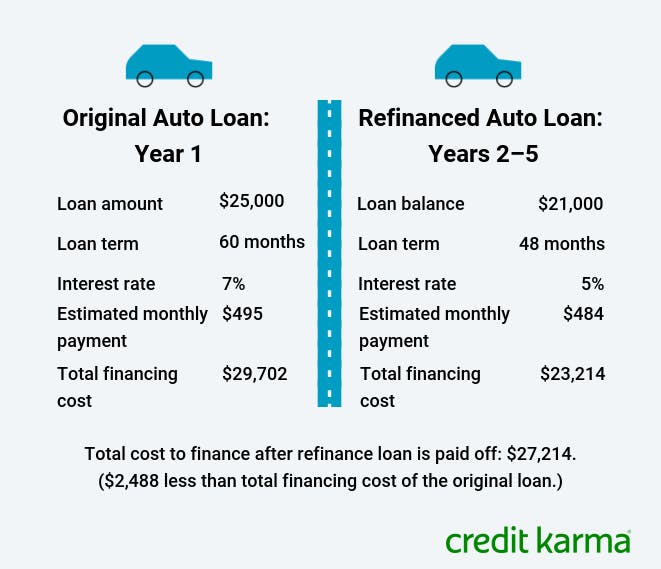

When Does Refinancing A Car Loan Make Sense Credit Karma

When Does Refinancing A Car Loan Make Sense Credit Karma

Post a Comment for "Finance Charge Formula Car Loan"