Finance Charge Balance Formula

Finance Charge Formula outstanding amount interest rate no of days 365 How to Calculate Finance Charge. Finance Charge 500 175 500 00175 875 Last find the new balance.

Pin By Stacy Timm On Work Bookkeeping Business Accounting Accounting Jobs

Pin By Stacy Timm On Work Bookkeeping Business Accounting Accounting Jobs

The daily balance method sums your finance charge for each day of the month.

Finance charge balance formula. A customer may qualify for two similar. Average Daily Balance A D x I P. I The interest charge for the period.

If the interest compounds monthly then a lenders finance charge formula for the average daily balance will look like this. Finance charge 6026. For example if the APR is 18 with 12 billing cycles the monthly rate would be 15.

C This is the present value of lease payments minus the amount of the principal reduction. The new balance is what Don will have to pay if he wants a zero balance. There is no single formula for the determination of what interest rate to charge.

For this example the original balance which can also be referred to as initial cash flow or present value would be 1000 r would be 0055 and n would be 12 months. That produces the finance charges for the first month which is 23333. To do this calculation yourself you need to know your exact credit card balance every day of the billing cycle.

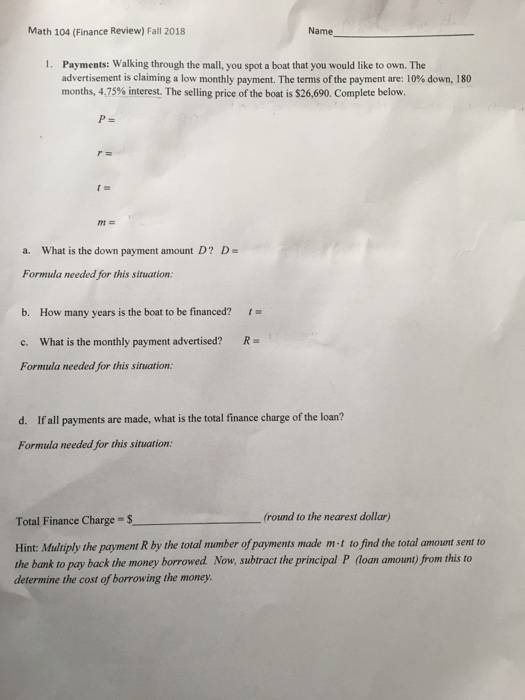

Finance Charge Unpaid Balance Periodic Rate New Balance Unpaid Balance Finance Charge New Purchases States regulate the maximum annual interest rate a credit card company may charge. To calculate the regular payment amount you divide the total amount to be repaid by the number of months or weeks of the loan. The original balance on the account is 1000.

New charges made during the billing cycle are not factored into the adjusted balance. In this video I go over how to calculate a fiinance charge on a credit card using the unpaid balance method. The finance charge would be the 15 of the average daily balance.

It can have the form of a flat fee or the form of a borrowing percentage. Finance Charge F P r 100 T B F P Where P Current Balance Owed r Annual Percentage Rate APR T Billing Cycle Length B New Balance You Owe. Calculate the finance charges for the first month by multiplying the annual percentage rate of 8 percent 08 by the balance of 35000.

Next find the finance charge using the formula. Finance charge adalah Tingkat Persentase Tahunan Annual Percentage Rate atau APR yang disesuaikan untuk jumlah banyaknya siklus penagihan dalam satu tahun dikali saldo harian rata-rata. Divide the result 2800 by the number of months in a year 12.

To convert the loan period T from years to months you multiply it by 12. Maka finance charge adalah 15 dikali saldo harian rata-rata. The Adjusted Balance Method Calculation The adjusted balance method of calculating your finance charge uses the previous balance from the end of your last billing cycle and subtracts any payments and credits made during the current billing cycle.

The closing balance for the current period will be the opening balance for the next period. The finance charge is the APR Annual Percentage Rate adjusted for the number of billing cycles in a year times the average daily balance. Suppose we have a bill of 350 for the month of December 2019 and the last payable date for the same is 6 th January 2020.

Then multiply each days balance by the daily rate APR365. P The principal reduction is the lease payment less the interest charge. Add up each days finance charge to get the monthly finance charge.

Finance charges can vary from product to product or lender to lender. To convert T to weeks you multiply by 52 since there are 52 weeks in a year. New balance owed 456026.

Finance Charge Unpaid Balance Monthly Periodic Rate Write the monthly periodic rate as a decimal so 175 00175. For example following is how we calculate the finance charge for a loan of 1000 with a 18 APR and a billing cyles of 25 days. Sebagai contoh jika APR 18 dengan 12 siklus penagihan suku bulanannya adalah 155.

Putting this into the formula we would have. The second option is most often used within US. Finance ChargeF P r 100 T B F P Where P Current Balance Owed r Annual Percentage Rate APR T Billing Cycle Length B New Balance You Owe Related Calculator.

What is finance charge. Finance Charge Current Balance Periodic rate where Periodic Rate APR billing cycle length number of billing cycles in the period. In finance theory while it represents a fee charged for the use of credit card balance or for the extension of existing loan debt of credit.

Find The Finance Charge On An Unpaid Balance Calculator Financeviewer

Find The Finance Charge On An Unpaid Balance Calculator Financeviewer

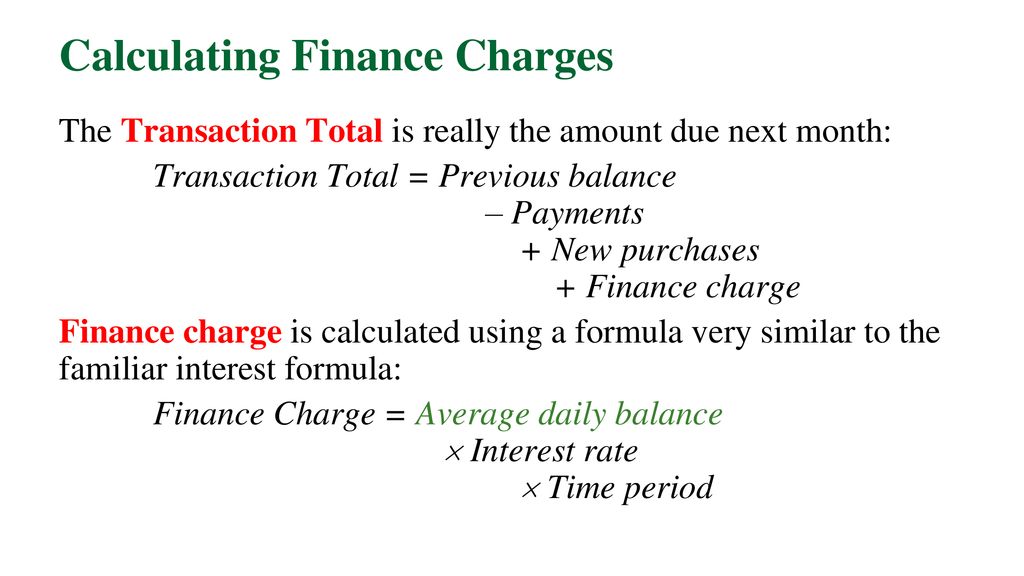

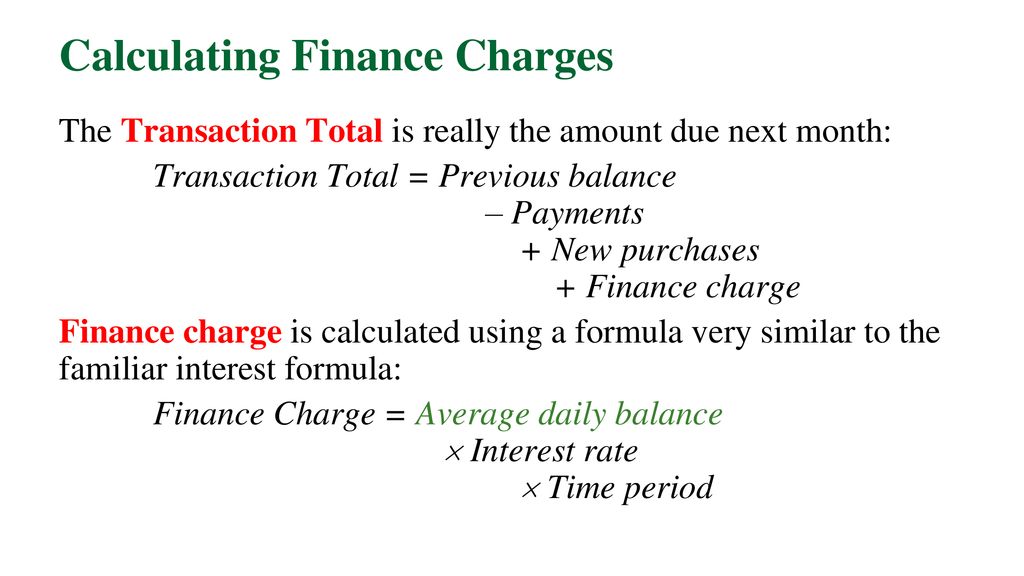

Real World Lessons That Put Math To Work Ppt Download

Real World Lessons That Put Math To Work Ppt Download

How To Calculate Finance Charge Howtofinance

How To Calculate Finance Charge Howtofinance

Modeling Interest During Construction Idc Excel Project Finance Project Finance Excel Finance

Modeling Interest During Construction Idc Excel Project Finance Project Finance Excel Finance

Finance Charge Definition Example Investinganswers

Finance Charge Definition Example Investinganswers

Cara Menghitung Finance Charge Pada Saldo Kartu Kredit 6 Langkah

Cara Menghitung Finance Charge Pada Saldo Kartu Kredit 6 Langkah

Credit Card Unpaid Balance Method

Finance Interest Charge Dbs Singapore

Finance Interest Charge Dbs Singapore

How To Calculate Finance Charge Financeviewer

How To Calculate Finance Charge Financeviewer

8 Simple But Important Things To Remember About Credit Card Statement Credit Card Statement Https Www Cardsvi Credit Card Statement Visa Card Good Credit

8 Simple But Important Things To Remember About Credit Card Statement Credit Card Statement Https Www Cardsvi Credit Card Statement Visa Card Good Credit

Post a Comment for "Finance Charge Balance Formula"